Antwort Is it risky to Stake? Weitere Antworten – Can you lose staked crypto

Participants trying to earn a chance to validate new transactions offer to lock up sums of cryptocurrency in staking as a form of insurance. If they improperly validate flawed or fraudulent data, they may lose some or all of their stake as a penalty.There are several drawbacks to cryptocurrency staking: Your assets have limited or no liquidity during the staking lockup period. Staking rewards (as well as staked tokens) can lose value when prices are volatile. Your cryptocurrency can be slashed (partially confiscated) for violating network protocols.It only makes sense to buy a crypto for staking if you also believe it's a good long-term investment. The proof-of-stake model has been beneficial for both cryptocurrencies and crypto investors. Cryptocurrencies can use proof of stake to process large numbers of transactions at minimal costs.

Which coin is best to stake : The best crypto to stake for you will correspond to your risk tolerance as much as potential yields.

- eTukTuk. APY: Over 30,000%

- Bitcoin Minetrix (BTCMTX) APY: Above 500%

- Cardano (ADA) Staking Rewards: Flexible staking rewards.

- Doge Uprising (DUP)

- Ethereum (ETH)

- Meme Kombat (MK)

- Tether (USDT)

- TG.

Can I lose my ETH if I stake it

The Ethereum Proof-of-Stake system works like many others on the surface. To become a validator, you must stake 32ETH and the funds act as collateral. If you attempt to undermine the system or fail to validate accurately and reliably, you risk losing their staked ETH investment.

Can staked crypto be stolen : It's important to compare the fees different validators charge before deciding where to stake your crypto assets. Loss or theft is a significant risk when it comes to crypto staking. This risk involves the potential for your digital assets to be stolen or lost due to various factors.

Clearly, staking Ethereum is a great way to earn some passive income on the side of your crypto investments. It's relatively low-risk and easy, but your yields (results) can vary quite a lot, depending on what kind of staking strategy you use.

As is true of any investments that result in yield, there is always the potential risk of losing the digital assets that you stake. This could happen for a number of reasons. Market Risks: Despite USDT's stability, the broader cryptocurrency market is volatile, and external factors can impact the staking ecosystem.

Is staking better than holding

Hodling does not increase the number of tokens a person is holding. Staking, apart from blocking the tokens, also rewards the user for validation and other purposes the tokens are staked for. So, the number of tokens increases in staking.Either way, the benefits are clear. Staking Ethereum is worth it, with potential interest earnings of up to 30% in the best cases. And that's all passive income, so you barely have to do anything to earn it. It's one of the easiest paths to “free money” in cryptocurrency.You are depositing your cryptocurrency with a blockchain, much like depositing your dollars with a bank. And, in exchange for doing so, you are paid a specified reward rate, usually expressed in terms of an annual percentage yield (APY). For most cryptos, these APYs range from 2% to 10%.

What are the best staking platforms in 2024

| Platform | Cryptocurrencies available | Additional Benefits |

|---|---|---|

| Coinbase | 15 | Only for Coinbase One members |

| KuCoin | 40+ | Higher APR for dual investment products |

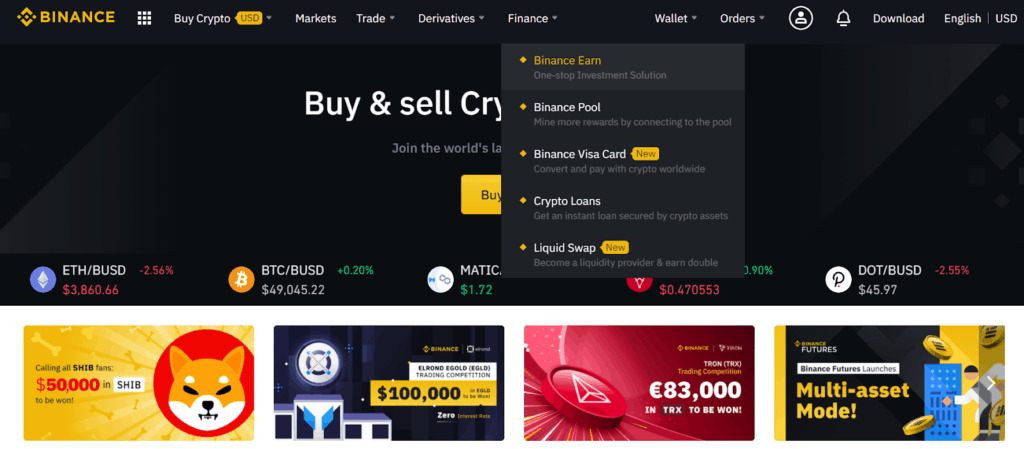

| Binance | 60+ | Auto-invest plans & principal protected options |

| Crypto.com | 10+ | Additional rewards for CRO holders |

Is staking my ETH risky : By staking Ethereum, individuals can earn passive income, estimated at an annual return of around 5-10%. However, staking Ethereum also involves risks, including market volatility and technical challenges. Therefore, it's important to consider these factors before deciding to stake your Ethereum.

How much will 1 Ethereum be worth in 2030 : Ethereum (ETH) Price Prediction 2030

According to your price prediction input for Ethereum, the value of ETH may increase by +5% and reach $ 4,172.69 by 2030.

Can I lose my Ethereum if I stake it

Yes, you really can lose all your ETH if you stake with Geth.

Staking is a way to earn rewards (cryptocurrency) while helping strengthen the security of the blockchain network. You can unstake your crypto at any time, and your crypto is always yours.Also, because USDT is pegged to the dollar, price volatility shouldn't have a significant impact on its value. Overall, utilizing USDT should be rather secure as long as you follow some simple safety steps ( like only using exchanges and wallets that you trust).

Is it safe to leave money in USDT : USDT is generally considered safe for investment, especially as a means to hedge against the volatility of other cryptocurrencies. However, like any investment, it comes with risks, and it's essential to consider Tether's efforts to maintain transparency and regulatory compliance.

:max_bytes(150000):strip_icc()/Term-Definitions_Proof_Of_Stake_V1-2fe2af764d9c404e8c387224e4f69f60.jpg)