Antwort Is e wallet better than cash? Weitere Antworten – Which one is better, e-wallet or physical money

Digital transactions are more secure than cash transactions, as there is no risk of theft or loss of physical currency. Digital transactions can also be traced and monitored, which can help prevent fraudulent activities.8 Advantages of E-Wallet: Why Digital Wallets Are the Future

- Convenience.

- Security.

- Efficiency.

- Mobility.

- Trackable Expenses.

- Rewards and Cashback.

- Global Accessibility.

- Environmental Impact.

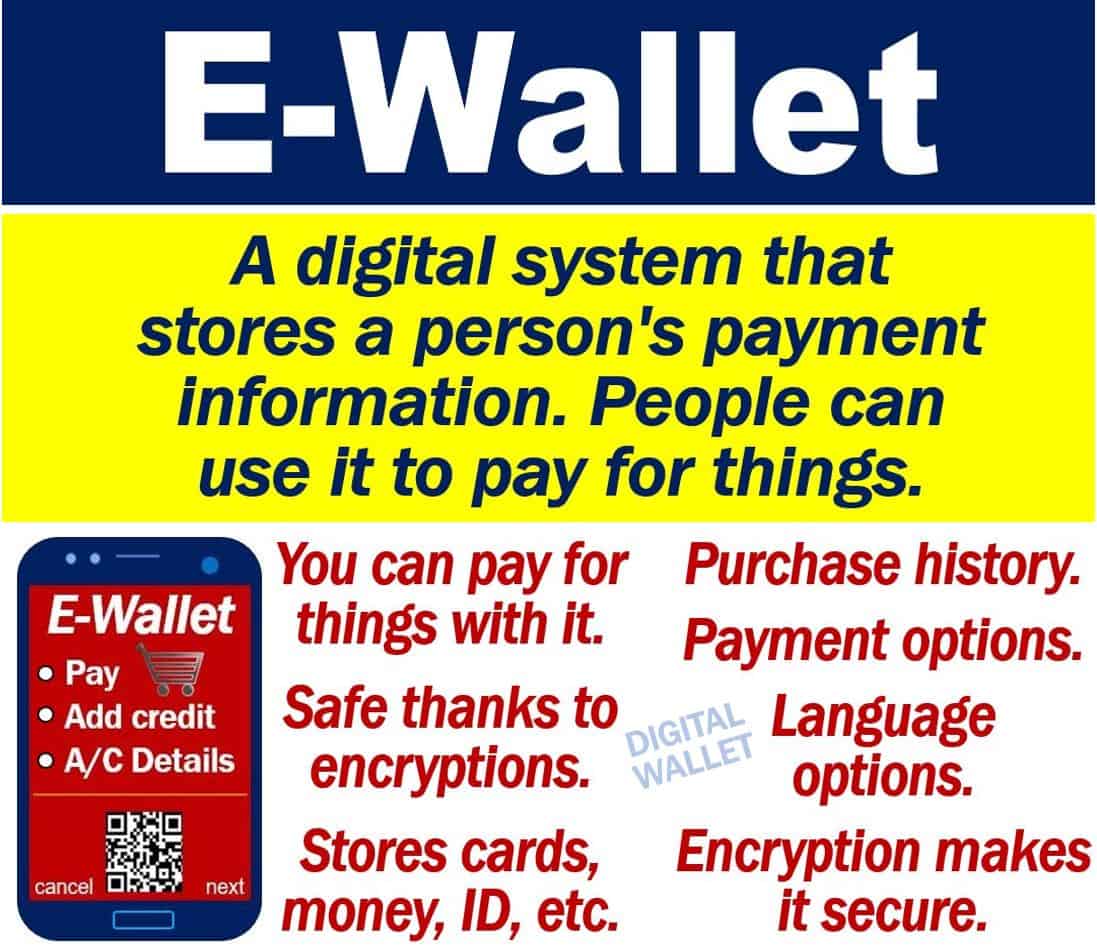

eWallets are digital versions of traditional wallets, accessible across various devices, whereas Mobile Wallets are specifically tailored for mobile devices, emphasizing features like contactless payments and optimized user experiences on smartphones or tablets.

What is the difference between e-wallet and digital wallet : Are e-wallets and digital wallets the same Yes, the terms “e-wallet” and “digital wallet” are often used interchangeably and refer to the same concept. Both terms describe a virtual wallet that allows users to store and manage their payment information digitally.

What are the disadvantages of e-wallet

When using a digital wallet for payments, transaction data may be tracked, leading to privacy concerns about the security of personal information stored digitally. The idea that third parties could track and analyze your financial behavior is a significant privacy concern for many users.

What are the disadvantages of eWallet : In comparison to traditional cash and card payments, digital wallets provide several advantages, including convenience, speed, and security. However, there are risks to transferring money to a digital wallet, such as security and fraud, technical issues, limited acceptance, and hidden fees.

Theft, Fraud, and Loss: The biggest threat to your digital wallet (and your financial data) might be the physical loss or theft of your phone itself. Primarily, we recommend always keeping your phone out of sight and on your person, especially when you're on the move.

Age Range People aged 20 to 30 have the largest percentage of E-Wallet users at 53.3%, those under 20 have a percentage of 33.3%, and users in the range aged 40 to 50 year has a percentage of 13.3%. This research aims to find out the role of E-Wallet as a payment instrument in the millennial era.

Is e-wallet app safe

Digital wallets often provide enhanced security through information encryption, making them safer. However, if an unauthorized individual were to gain access your device, they could potentially access your digital wallet, putting your personal information and financial assets at risk.In general, digital wallets are considered much safer than using physical credit cards, which can be more easily lost or stolen.Cons of a digital wallet:

- Not all merchants accept them yet, so you may still have to bring your card with you to certain places.

- It relies on your device and battery life; your device can also be lost or stolen (another great reason to password-protect your phone!)

Risks of Digital Wallets

Mobile wallet providers may be tempted to collect more data than they need or even sell your information without your knowledge or consent. This could lead to identity theft and financial fraud, as well as other problems that come with having no consumer protection in place.

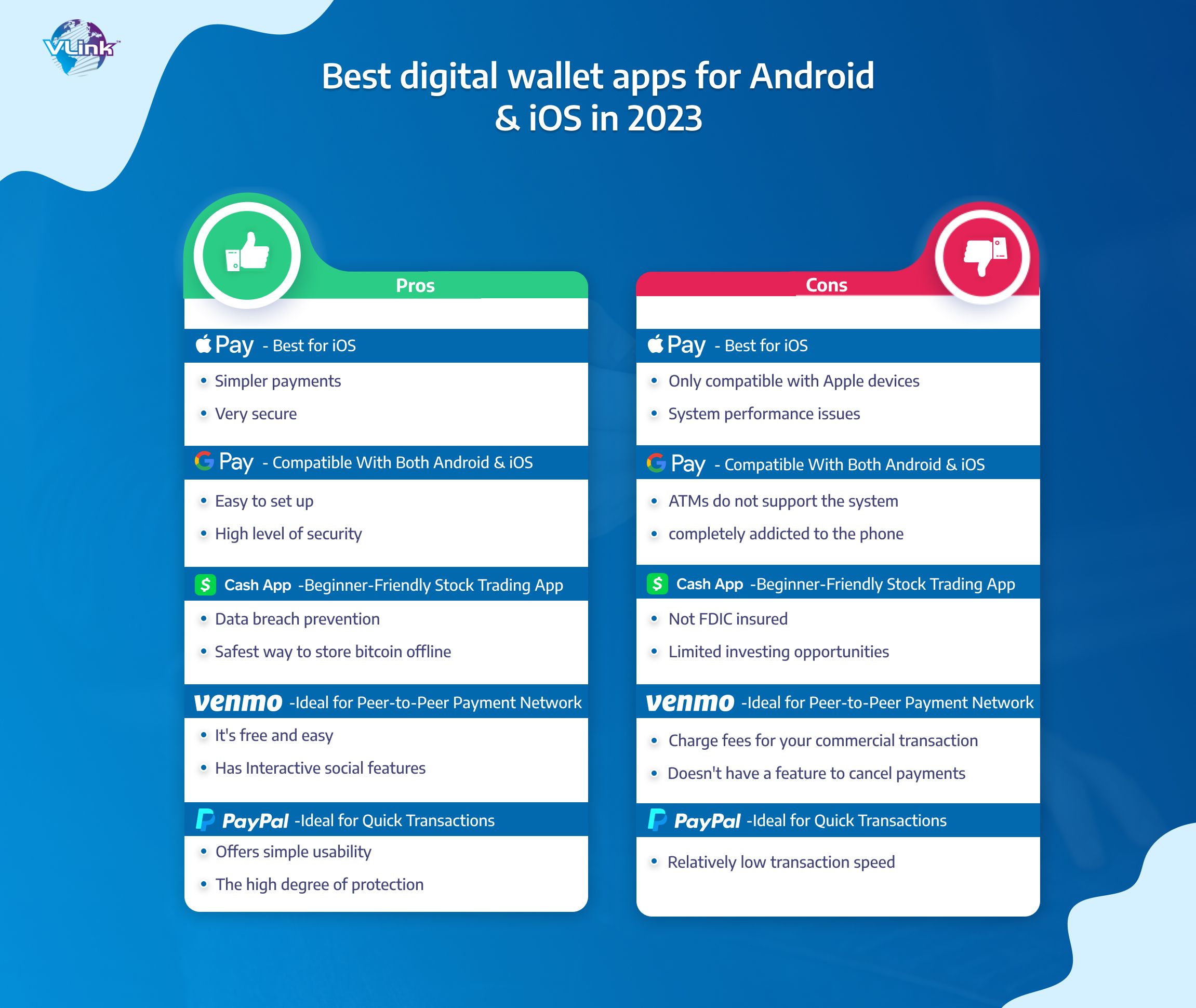

What are the pros and cons of e-wallets : Digital wallets provide a number of advantages, including convenience, security, accessibility, and rewards. However, they also have some drawbacks, such as limited acceptance, technical difficulties, security concerns, and dependency on technology.

Is it safe to use e-wallet : In general, digital wallets are considered much safer than using physical credit cards, which can be more easily lost or stolen.

Is PayPal an eWallet

PayPal is both an eWallet and a digital wallet because you can store funds directly on the platform, but you can also access a bank account through the app, pay with a QR code, use BNPL, or connect to a crypto account.

At the first level, each transaction made using a digital wallet is protected through a technology called tokenization. This process encodes your debit and credit card details so the numbers are never shared with a merchant. So if a retailer gets hacked, your credit or debit card number won't be compromised.About 80% of Gen Zers — the oldest of whom turn 27 this year — use digital wallets, such as Apple Pay and Google Pay, as do about two-thirds of millennials — which the study defines as people in their late 20s to mid 30s — according to a recent survey by the financial research firm Pymnts Intelligence.

Can an eWallet be hacked : “If you use an unreliable public network for transactions or do not follow good password security, the information in the digital wallet could be compromised,” cautions Salter. “And if you lose your mobile device, without proper password protection a hacker might be able to access the stored information.”