Antwort How to do online payment? Weitere Antworten – What are the steps for online payment

Login into bank website using the net banking user id and password. Select the payment details and make the payment. On successful transaction e-challan will be generated.Online payments can be made via electronic bank transfer, debit or credit card payments, digital wallet transactions, and more. The online transaction process should always be secure and password protected, safeguarding the customer's payment information.How to Start Accepting Online Payments

- Choose a Payment Processing Software.

- Set up Your Online Storefront.

- Set up Online Payment Forms.

- Embed a “Buy Now” Button on Your Website.

- Add Mobile Payment Processing.

How to do online payment from bank account : Now click the menu. Button. Then click pay or transfer. Now you'll enter the payment. Details click from choose the account you'd like to make the payment.

Is online payment easy

The advantages of online payments include fast speed, a simple onboarding process, ease of use, automated payments, discount offers, and lower transaction costs.

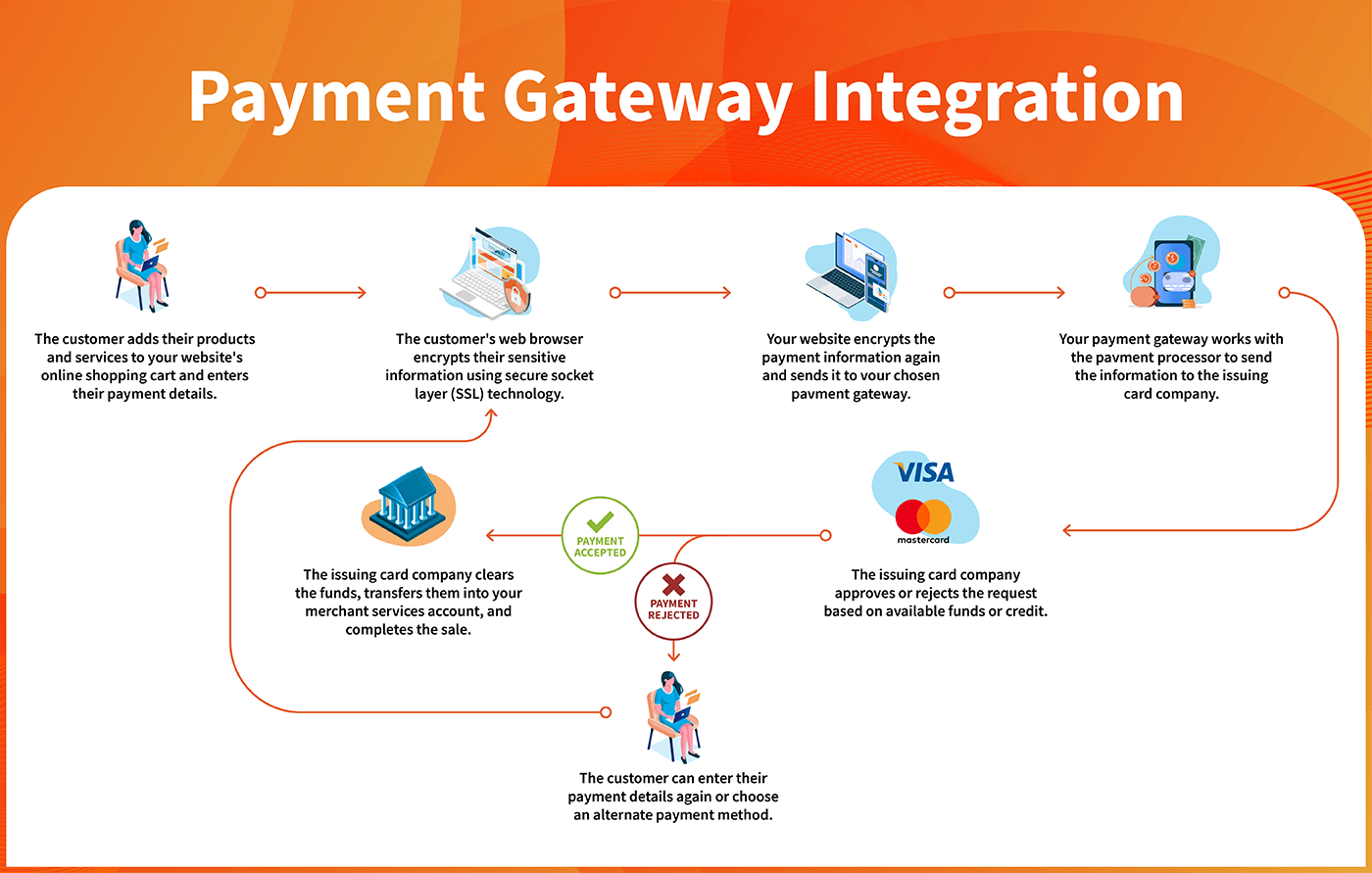

How does online pay work : Using secure communication methods and tokenization, payment gateways communicate between your online store/website and your bank. Customer data is collected, validated, approved, and then the payment is accepted, debiting your customer's account.

Bank payment is cheaper and more reliable, while cards offer quicker payments but are significantly more expensive and less reliable.

- Online Payment Options.

- 1) ACH Debit.

- 2) Credit (or debit) card.

- Top online payment methods.

- Adyen.

- GoCardless.

- Google Pay.

- Apple Pay.

4 ways to accept online payments

- Online payment service provider. If you run a service-based business or sell products online, an online payment service provider might be the most common way you get paid by customers or clients.

- Bacs transfer.

- Mobile payments.

- Invoicing and billing.

How do I start a digital payment

Here at takepayments, helping businesses thrive is our bread and butter, so buckle in for our 10 top tips when starting your digital payments journey.

- Evaluate your business.

- Plan for growth.

- Research your options.

- Identify the right fit.

- Set up a merchant account.

- Research providers.

- Build a website.

- SEO.

To send money via Virtual Payment Address using your UPI app, follow these simple steps:

- STEP 1: Log in to your UPI-enabled app.

- STEP 2: Select 'Fund Transfer through UPI'.

- STEP 3: Enter the beneficiary's VPA, amount, and remarks (if required).

- STEP 4: Choose the VPA linked with your desired bank account.

Credit or Debit Card: The buyer has to send his debit card or credit card details to the seller, and a particular amount will be deducted from his/her account. Digital Cash: Digital Cash is a form of electronic currency that exists only in cyberspace and has no real physical properties.

2. How to transfer money from the bank account to another bank account online

- Open your bank's website.

- Log in to your credit card account.

- Select the transfer option.

- Enter the amount you want to transfer.

- Enter the required details mentioned in the form.

- Follow the prompts to complete transactions.

Is online payment risky : Most online payments are done with the help of credit/debit cards, ATM cards, or identity cards. So if you lose any of these, automatically, your online payment accounts that are linked to your cards will be at risk too.

Which method is best for online payment : Top 4 Secure Online Payment Methods

- Credit Cards. Credit cards are widely used for online payments due to their convenience and strong security measures.

- Debit Cards. Debit cards offer the convenience of card payments without the need for credit.

- ACH & SWIFT transfers.

- Digital Wallets.

How to pay from online

Here is a quick guide to the main ones.

- Debit card. If merchants can take payment by credit card, they can also take payment by debit card.

- Direct debit. Direct debit used to be for recurring payments only.

- Open banking services.

- Payment Apps (E-Wallets)

- Gift cards.

- Reward points.

- Bank transfer.

- Cryptocurrency.

STEP I: Login to your bank's internet banking portal with your credentials. STEP II: Go to the 'Value Added Services' or the 'Cards' section, depending on your bank's website, and choose 'debit card ON/OFF'. STEP III: Choose the card you want to enable from a list of all your linked debit cards.You can send money without a fee by using P2P payment apps such as Cash App, Google Pay, PayPal, Venmo and Zelle. Note that you may have to pay a fee if you fund your transfer with a credit card, and the recipient may have to pay a fee if they choose to receive the money instantly in their bank account or debit card.

How does e-payment work : Electronic payment, also known as e-payment, refers to the process of conducting financial transactions electronically, wherein money is transferred from one party to another through digital channels, eliminating the need for physical cash or paper-based instruments.