Antwort How much money do you need to open a bank account in the Cayman Islands? Weitere Antworten – Who can open a bank account in the Cayman Islands

Legal basis. The Cayman Islands does not restrict foreigners from opening bank accounts. The islands' banking system is set up to serve international customers, including residents and non-residents.Account holders in the Cayman Islands are protected by strict bank secrecy laws, which provide an excellent level of privacy and security. Confidentiality can help protect assets by making it more difficult for creditors or other parties to identify and seize them.Offshore banking refers to conducting banking services with a financial institution located outside one's home country. Opening an offshore bank account can cost anywhere between $100 to $1,000 (or more for premium services). The actual cost will depend on the bank you open an account with.

Which country has best banking system :

| Global Top 100 | ||

|---|---|---|

| Rank | Name | Domicile |

| 1 | KfW | GERMANY |

| 2 | Zuercher Kantonalbank | SWITZERLAND |

| 3 | BNG Bank | NETHERLANDS |

How much does it cost to open an account in the Cayman Islands

As mentioned earlier, if you're opening an offshore investment account, the minimum initial deposit is $500,000. But if you're opening an offshore savings account or personal account, the minimum initial deposit is typically $1,000 for non-residents, and $,5,000 for CD's.

Do Cayman Islands banks report to the IRS : US Citizens Using Cayman Island Bank Account

The Foreign Account Tax Compliance Act (FATCA) is a US federal law that requires foreign financial institutions, including banks in the Cayman Islands, to report information about their US account holders to the Internal Revenue Service (IRS).

There is great stability which has attracted the best banks and encouraged businesses to incorporate locally. It's also a highly liveable place with beautiful scenery and world-class lifestyle options. The Cayman Islands know how to cater to the high net worth population.

However, it might be challenging for you to open a business bank account in such countries as a foreigner. That is why we recommend opening a bank account in Hong Kong or Singapore. Their processes are much simpler than those in other jurisdictions, thus they have a positive reputation.

Is it worth having an offshore account

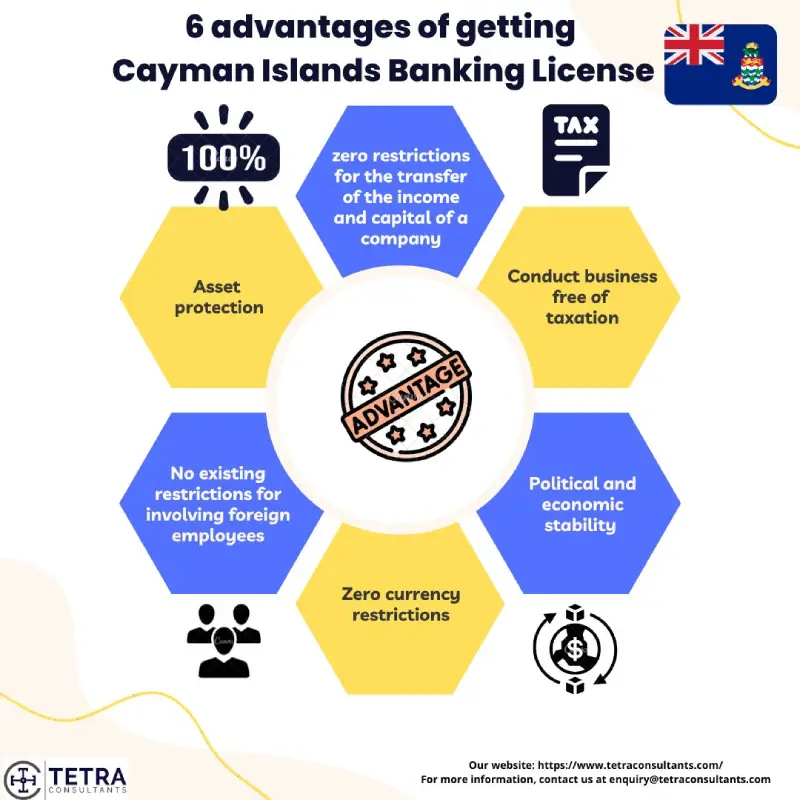

Depending on your situation, offshore investing may offer you many advantages including tax benefits, asset protection, and privacy. Disadvantages include increasing regulatory scrutiny on a global scale and high costs associated with offshore accounts.Switzerland

It's a well-known tax haven country quite famous among investors for its money and privacy. Switzerland not only is known for its privacy but also for its marvellous banking systems. Switzerland banks own more than 7 trillion dollars per year only of offshore bank accounts owned by foreigners.Biggest Banks in the World 2024

- Industrial and Commercial Bank of China (ICBC) Total Assets: $6.118 Trillion.

- Wells Fargo. Total Assets: $1.886 Trillion.

- HSBC. Total Assets: $2.989 Trillion.

- Morgan Stanley. Total Assets: $1.199 Trillion.

- China Construction Bank (CCB) Total Assets: $5.376 Trillion.

Setting an offshore account in the Cayman Islands (or in any other foreign country for that matter) is legal unless you are planning tax evasion. Note that offshore banking is also not tax exempt.

How much does it cost to become a citizen of the Cayman Islands : After five years as a BOTC Citizen, you can then apply to become Caymanian. You need to invest at least US$2.4 million in developed real estate and possess sufficient financial resources to maintain yourselves and your dependents, as well.

Is Grand Cayman still a tax haven : The Cayman Islands don't have a corporate tax and act as a haven for multinational corporations to shield some or all of their incomes from taxation. The Cayman Islands do not impose taxes on residents and are considered tax-neutral.

Why do people put money in Grand Cayman banks

Offshore banking in the Cayman Islands can offer a range of benefits to individuals and businesses. It can protect their assets, maximize returns, and take advantage of a stable and well-regulated financial system.

Having an offshore bank account in the Cayman Islands is not illegal, but if your intent is to hide money there, that's another story. When we talk about the Cayman Islands, two things usually come to mind: a tropical vacation paradise and a premier haven for investments and private and offshore banking.The Cayman Islands is the third worst tax haven for corporate tax avoidance and the world's worst tax haven in terms of financial secrecy according to the Tax Justice Network. Yesterday Oxfam showed how the EU tax haven blacklist is undermining attempts to stop government bailouts going to corporate tax dodgers.

Why do people put money in offshore accounts : Offshore banking is the practice of keeping money in a bank account located in a different country than the account holder's home country. Reasons people may choose offshore bank accounts include the potential for tax benefits, asset protection, convenience, security, privacy, and higher interest rates.