Antwort How much is shipping to Turkey? Weitere Antworten – How much would it cost to ship something to Turkey

Country Conditions for Mailing – Turkey

| Weight not over (lbs.) | Parcel Post Rate |

|---|---|

| 1 | $16.75 |

| 2 | 19.50 |

| 3 | 22.65 |

| 4 | 25.30 |

Send a Cheap Parcel to Turkey

| Weight of parcel being delivered to Turkey | Worldwide Air Prices |

|---|---|

| 1kg | £37.32* Book |

| 5kg | £57.80* Book |

| 10kg | £83.40* Book |

| 25kg | £160.20* Book |

The cost of shipping for a 20 ft container between Turkey and the UK is approximately £2,066 – £2,285. 40ft container: These have an internal capacity of 66 cbm. The cost of shipping for a 20 ft container is approximately £3,926 – £4,341.

Is DHL shipping to Turkey : DHL Express – Fast. Door-to-Door. Courier Delivered – Turkey.

How can I ship to Turkey

Interparcel can guarantee some of the cheapest and fastest delivery services to Turkey. This is thanks to our negotiations with leading courier companies, including UPS, TNT, FedEx and DHL eCommerce.

What is the import fee in Turkey : Import Taxes in Turkey

VAT on imported goods to Turkey is imposed at the same rates applicable to the domestic supply of goods, that is, 20% (increased in July 2023), with the exception of some goods which are eligible for reduced VAT rates of 1% or 8%, and a few other transactions, which are exempt.

Turkey can surprise expats with fairly moderate prices. The cost of living in the country varies depending on the region. It is most expensive to live in big cities and business centers. However, Istanbul, although recognized as the most expensive city in Turkey, is much cheaper than London or New York.

How long does it take to ship to Turkey Delivery times from the the US to Turkey can vary between 6-7 business days for a standard or express service to 14-21 for an economy service. Generally you'll pay less for services with longer delivery times.

How can I send items to Turkey

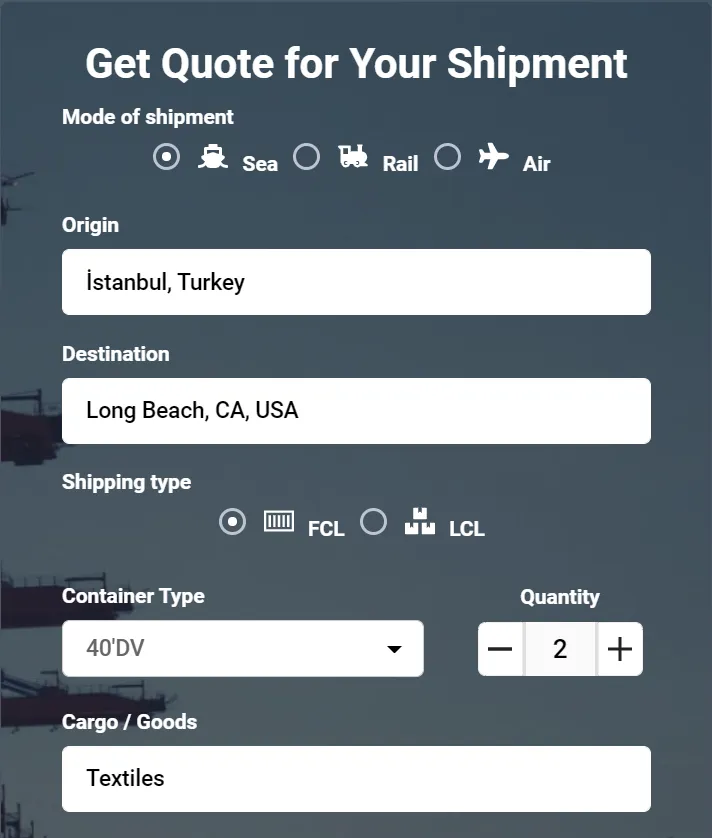

Parcelforce is a popular choice for those with a parcel to post to Turkey as we offer a choice of service. You can book online and drop off at your local Post Office or Parcelforce depot, or you can get a courier collection booked in.Best Shipping Option from Shipping to Turkey from USA

| Service | Delivery Time | |

|---|---|---|

| UPS | Worldwide Saver | 2 to 5 business days |

| USPS | Priority Mail Express International | 3 to 5 business days |

| USPS | Priority Mail International | 6 to 10 business days |

| DHL | Global Express | 6 to 7 business days |

There are a number of different charges associated with these services, including shipping and handling, the fees charged by the service for clearing the merchandise through CBP, as well as any Customs duty and processing fees that may be owed on your importation.

Total Trade

| Total Exports (2021) | $225,214,458,038 |

|---|---|

| Total Imports (2021) | $271,425,552,445 |

| Trade Balance (2021) | ($46,211,094,407) |

| Exports of goods and services (% of GDP) (2022) | 37.89% |

| Imports of goods and services (% of GDP) (2022) | 42.6% |

Is 10,000 lira enough for a week : However if you are an ordinary tourist you will spend 22 dollars a day (300 Turkish Liras) in Turkey so.. if you are not alone it means a double (600 Turkish Liras) …. 10000/ 600 = 16 days. Yeah. It is enough money for an ordinary couple to spend 15 days in Turkey.

Why is Turkey so cheap : First, the Turkish government offers discounts and incentives to attract international tourists. Additionally, the cost of living in Turkey is generally lower than in other countries, making it cheaper for tourists to purchase goods and services.

Do you pay import duty on Turkey goods

Yes, you will still need to pay duties and taxes when importing goods – however, you may be entitled to claim the charges back when you leave, depending on the country and your circumstances.

Some of the import costs within the supply chain include the cost of the products, currency conversion costs, international freight & logistics charges, import charges, port charges, tariffs, harbor fees, handling fees, customs clearance fees, import and export duties & taxes, payment processing fee and local delivery, …Q- How to calculate customs duty in India

- Basic Customs Duty – 20% of Rs.50,000 = 10,000.

- Additional CVD – 12% of (50,000+10,000) = Rs.7200.

- Education cess – 2% of (10,000+7200) = Rs.244.

- Total customs duty payable = 10,000+7200+244 = Rs.17,444.

What is the import fee for Turkey : Import Taxes in Turkey

VAT on imported goods to Turkey is imposed at the same rates applicable to the domestic supply of goods, that is, 20% (increased in July 2023), with the exception of some goods which are eligible for reduced VAT rates of 1% or 8%, and a few other transactions, which are exempt.