Antwort How much does it cost to withdraw money from HSBC abroad? Weitere Antworten – Does HSBC charge for cash withdrawals abroad

Cash fee

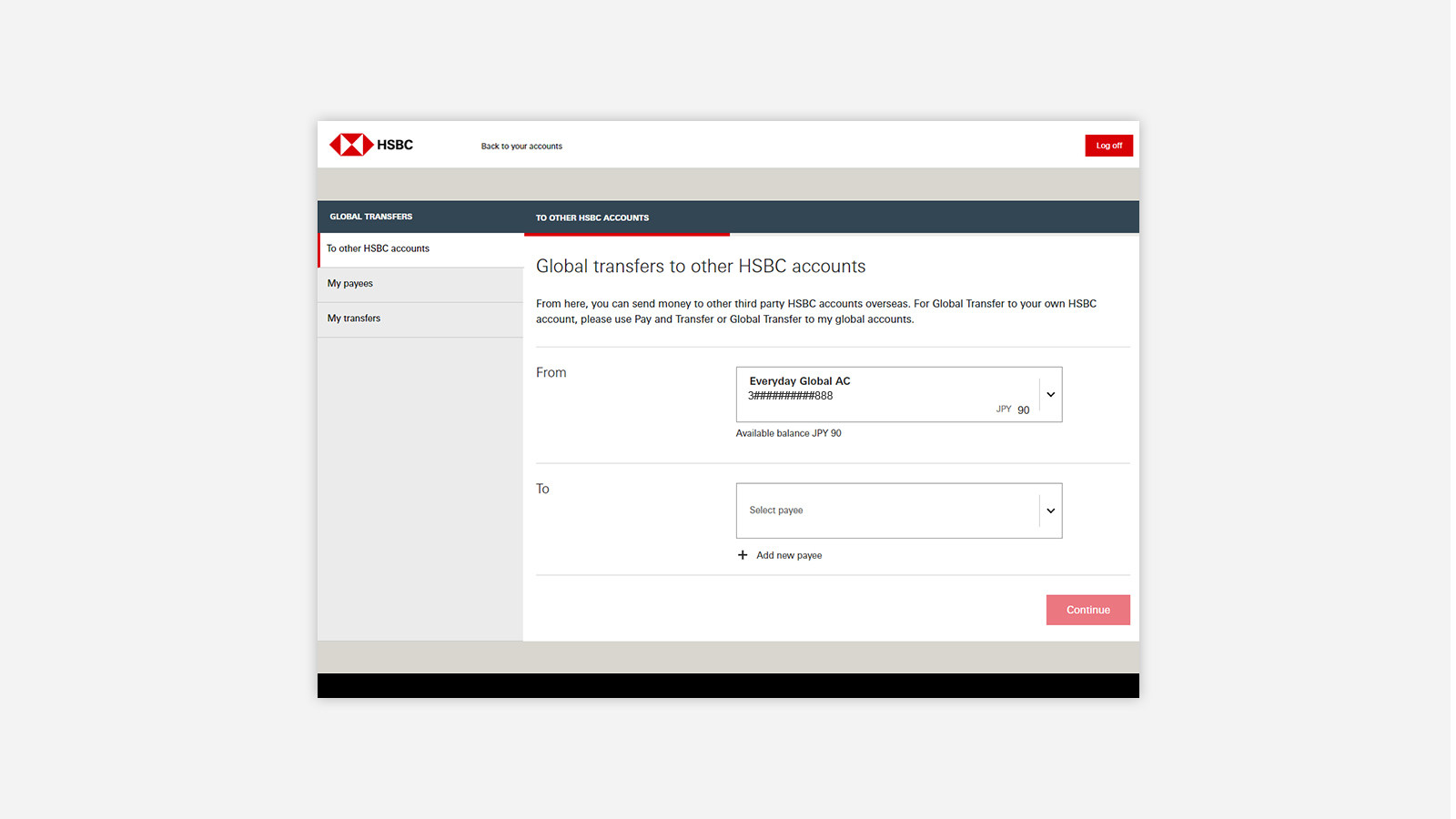

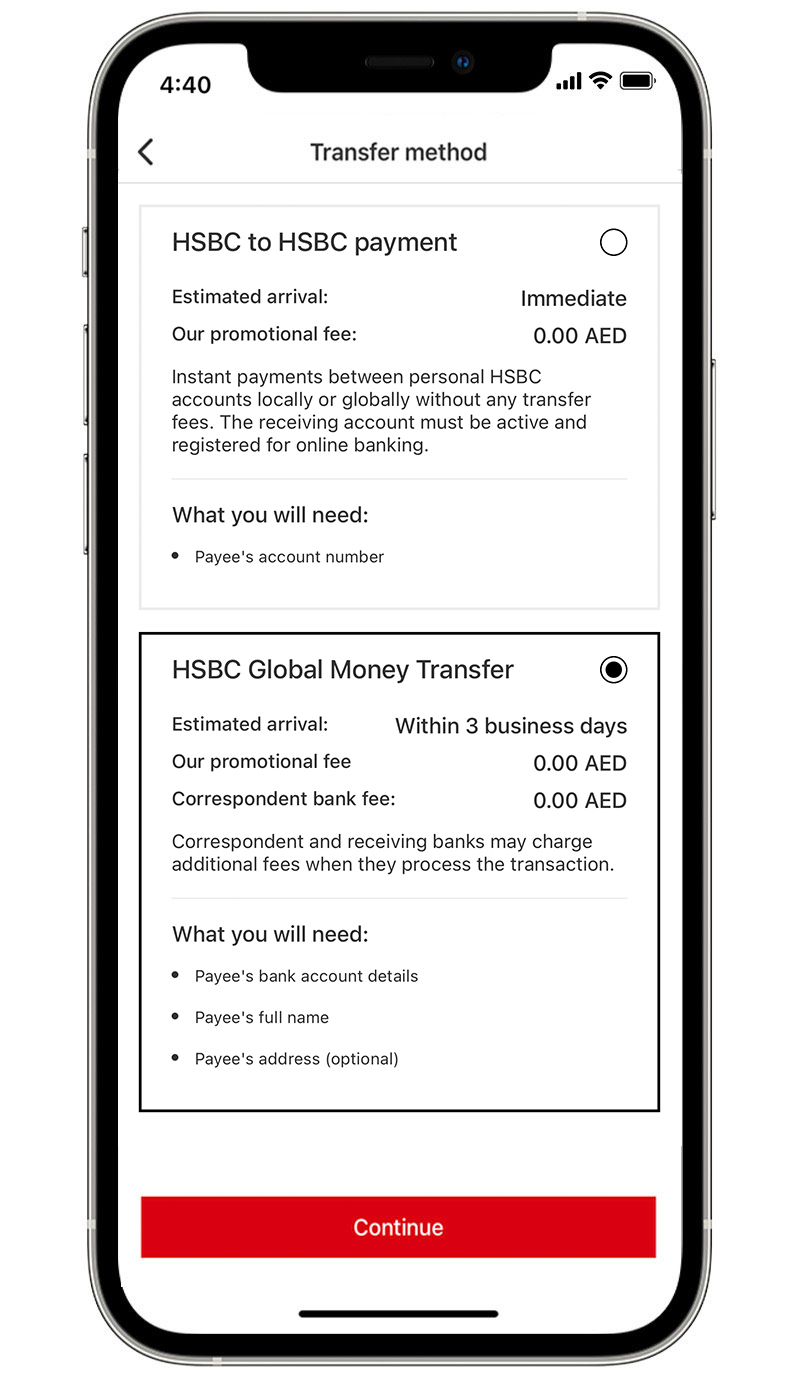

There's no cash fee either for using your debit card to withdraw money from a cash machine outside the UK if you're an HSBC Premier customer. For other HSBC accounts there's a cash fee of 2% (minimum £1.75, maximum £5) on withdrawals using a debit card. With a credit card the cash fee is 2.99% (minimum £3).No ATM or transaction fees to access the local currency in Australia or anywhere in the world – some ATM providers and merchants may charge a separate fee. Withdraw your money in the local currency via thousands of HSBC ATMs globally.Will I be charged anything extra if I use my credit card overseas A service fee amounting to 2.50% of the converted sum plus reimbursement of the assessment fee charged by Visa/MasterCard to HSBC equivalent to 1% of the converted sum, will be charged for overseas transactions.

Can I use my HSBC ATM card abroad : You can use your HSBC Global Private Banking Mastercard® Debit Card / HSBC Jade Mastercard® Debit Card to withdraw cash overseas at any HSBC Group ATM, or at ATMs carrying the Mastercard or Cirrus logo, for free and at the HSBC preferential rate.

How much will I be charged to withdraw money abroad

A 2.99%

Visa exchange rate

This is the exchange rate used by Visa to convert the transaction into sterling on the day Visa processes the transaction. This might not be the same day when the transaction took place. A 2.99% fee charged by us for using your debit card abroad when making purchases, withdrawing cash or for refunds.

How can I avoid cash withdrawal fees abroad : How to Avoid ATM Fees When Traveling Abroad

- Use an ATM in Your Bank's International Network.

- Use Your Debit Card to Get Cash Back at a Store.

- Don't Use the ATM's Conversion Offer.

- Use a Bank That Doesn't Charge International ATM Fees.

- Use a Bank That Refunds ATM Fees.

- Use a Credit Card Without a Foreign Transaction Fee.

For cash withdrawals on your debit card outside the UK in a foreign currency, we will charge you a 2.75% fee (which will show on your statement as 'non-sterling transaction fee'). Please be aware that some cash machine operators may also apply a direct charge for withdrawals from their cash machines.

How to avoid fees when using ATMs in Europe

- Find a bank account that doesn't charge them. Some banks—particularly digital-only ones—offer a number of free withdrawals every month.

- Stick to bank-owned ATMs.

- Be tactical with withdrawals.

- Pay by debit card where you can.

How to avoid foreign transaction fees

The following steps will help you avoid foreign transaction fees:

- Open a Credit Card Without a Foreign Transaction Fee.

- Open a Bank Account Without a Foreign Transaction Fee.

- Exchange Currency Before Traveling.

- Avoid Foreign ATMs.

- Ask Your Bank About Foreign Partners.

Fee free ATMs : ATM access in Australia at HSBC ATMs and any other banks offering fee free ATM access. Plus, you can access your money at overseas ATMs where Visa is accepted.Withdrawing cash on a specialist overseas credit card when you're on holiday overseas can actually be a good MoneySaving thing to do, as it's often a cheap way to get cash. But you shouldn't just withdraw cash overseas on any credit card – most will charge you a fortune for it.

The best debit cards to take abroad

- First Direct. When you were abroad, First Direct used to charge a 2.75% conversion fee every time you used your card to buy something or withdraw cash.

- Starling Bank. The Starling Bank current account is free.

- Chase.

- Monzo.

- Virgin Money.

- Kroo Bank.

- Cumberland Building Society.

Will I get charged for withdrawing money abroad : There may be additional charges from cash machines or banks when you withdraw money abroad or in a foreign currency. Check before you make the transaction.

Is there a fee to withdraw money internationally : Foreign transaction fees are charged by your bank for currency conversion. If your bank charges foreign transaction fees — and many do — you'll pay a percentage of the total withdrawal amount, usually 1% to 3%, for using your card at a foreign ATM (or anywhere else abroad).

What is the ATM fee in Europe

Countries with the highest ATM fees in Europe

| Countries | % in ATM Fees |

|---|---|

| Iceland | 4.60% |

| Turkey | 3.59% |

| Albania | 1.31% |

| Austria | 1.23% |

If you have a debit card, you can withdraw money from any HSBC cash machine with no transaction fee. Your daily cash withdrawal limit depends on the type of current account you hold and whether you've asked for the limit to be reduced.How to avoid fees when using ATMs in Europe

- Find a bank account that doesn't charge them. Some banks—particularly digital-only ones—offer a number of free withdrawals every month.

- Stick to bank-owned ATMs.

- Be tactical with withdrawals.

- Pay by debit card where you can.

Do I get charged for using my debit card abroad : Visa exchange rate

This might not be the same day when the transaction took place. A 2.99% fee charged by us for using your debit card abroad when making purchases, withdrawing cash or for refunds.