Antwort How much do banks charge to transfer money abroad? Weitere Antworten – How much do banks charge to transfer money internationally

Foreign exchange (FX) charges

| Currency amount | Charges |

|---|---|

| Up to INR100,000 | 1% of gross amount exchanged, with a minimum amount of INR250 |

| From INR100,000 to INR1,000,000 | INR1,000 plus 0.5% of gross amount exchanged |

| Above INR1,000,000 | INR5,500 plus 0.1% of gross amount exchanged, with a maximum of INR60,000 |

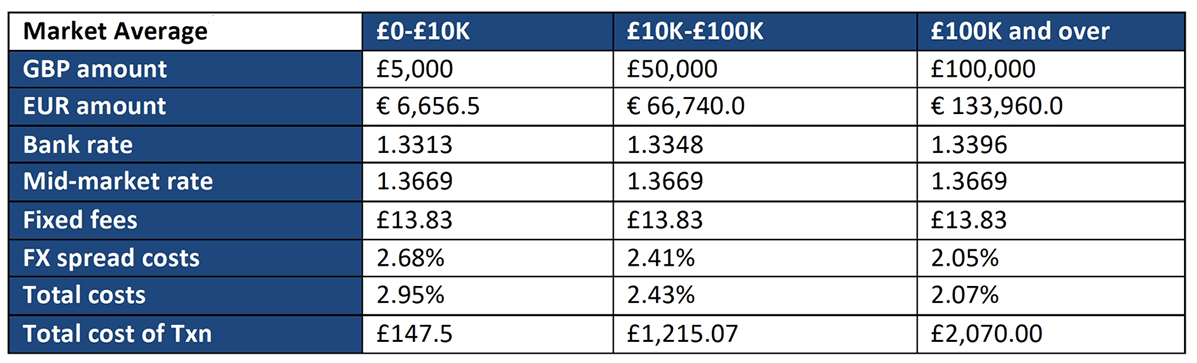

When you send money abroad, it is expected that your bank charges a transfer fee. The fee can vary based on your bank, the amount you're transferring, and where it's going. Some banks have a fixed cost, while others charge a percentage of the transfer amount.Exchange fee

Other than the bank accounts that send and receive the money, also known as the originator and beneficiary banks, there can be up to 3 intermediary banks in between. Each bank often has its own international money transfer charges, which can be anywhere between USD 10 to USD 30.

How much does a bank to bank transfer cost internationally : How much do international bank transfers cost Every bank is different, but in general you can expect them to take as much as 3-4% of your total transfer as a fee when you send money internationally.

How do I avoid bank charges on international transfers

How to Avoid Wire Transfer Fees

- Select a bank or other financial institution that may reduce or waive wire transfer fees or offer lower costs than competitors.

- Contractually transfer the cost of wire transfer fees to the payee.

- Factor bank wire transfer costs into pricing.

Is there a fee to send money overseas : International transfer fees vary widely based on the value of your payment, where you're sending money to, and the specific bank or provider you pick. You may find that specialist services like Wise, OFX and WorldRemit offer more transparent fees and a better rate compared to a traditional bank.

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money.

HSBC Global Money Transfers lets you send money overseas faster and fee-free, with just a few taps on the HSBC Mobile Banking app.

Which bank is best for international transfers

This enables users to initiate transfers once their desired rate is reached.

- ICICI Bank Exchange Rates, Fees and Money2India Service.

- HDFC Exchange Rates and Transfer Fees.

- PNB Transfer Fees and Charges.

- SBI International Money Transfer Fees.

- Additional Fees.

- Fees of Axis Bank International Money Transfers.

Make Cross-Border Payments

Digital wallets are independent of banks and can hold funds in multiple currencies, with transparent exchange rates. Because of this, they can circumvent many of the fees and costs associated with wire transfers, making it even easier to send money abroad, all over the world.Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money.

Wire Transfer Fees

| Bank/Credit Union | Domestic Outbound | International Inbound |

|---|---|---|

| Nationwide Bank | $35 | Free |

| Navy Federal Credit Union | $14 | Free |

| Northpointe Bank | $25 | Not offered |

| PenFed Credit Union | $25 | Free |

How to avoid international transfer fees : Make Cross-Border Payments

Digital wallets are independent of banks and can hold funds in multiple currencies, with transparent exchange rates. Because of this, they can circumvent many of the fees and costs associated with wire transfers, making it even easier to send money abroad, all over the world.