Antwort How much can you global transfer HSBC daily? Weitere Antworten – What is the global transfer limit for HSBC

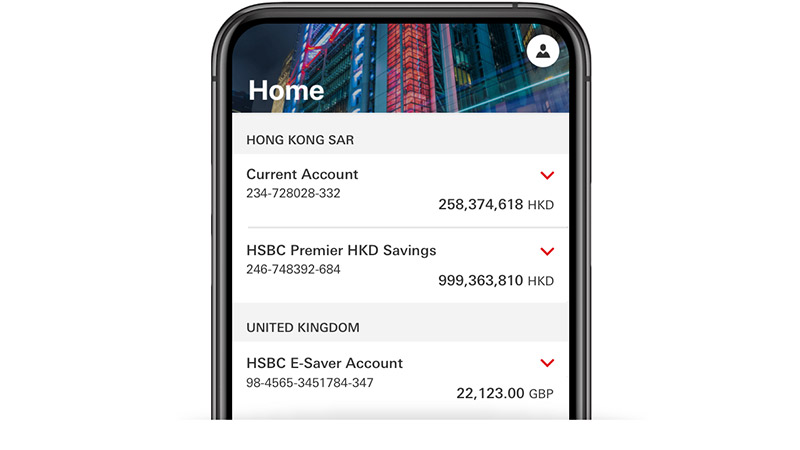

USD200,000

You can send up to USD200,000 (or currency equivalent) a day. Some countries may have local limit restrictions. Check with your destination country for limit information. Accounts eligible for Global Transfers include all HSBC deposit accounts, except for CDs.How much money can I transfer between banks If you're transferring money online to another one of your HSBC accounts, there is no limit to how much you can move. If you're paying bills or making payments to friends and family – there is a daily limit for online bank transfers of £25,000.Transactions are limited up to $2,500 per transaction, $5,000 daily (subject to change).

How to transfer more than 25,000 HSBC : You can send money up to your personal payment limit to friends and family or up to £25,000 for payments to a company via online and mobile banking. Payments above these limits will be sent as a CHAPS payment. If you're an HSBC customer, you can send a CHAPS payment in branch or by post.

What is the transaction limit for HSBC Everyday Global

Use your HSBC Everyday Global Visa Debit Card everywhere Visa is accepted anywhere in the world. Access your own money at ATMs and when making purchases in-store and online. In-store purchase – daily limit8 of $10,000 Select 'Credit' for instore purchases above $100 or tap for contactless purchases under $100.

What is the daily limit of HSBC transaction : Is there a payment limit for HSBC mobile banking The daily maximum that can be transferred to third parties is Rs. 30 lakh. You can learn more about your current maximum third party transfer limits by logging into Personal Internet Banking.

There is no limit or maximum amount for NEFT Transactions. However, each bank may have certain specified limits for their NEFT services. For example, HDFC Bank has an NEFT Transfer Limit of Rs. 25 Lakhs per day per customer ID if the transaction is done through online mode.

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

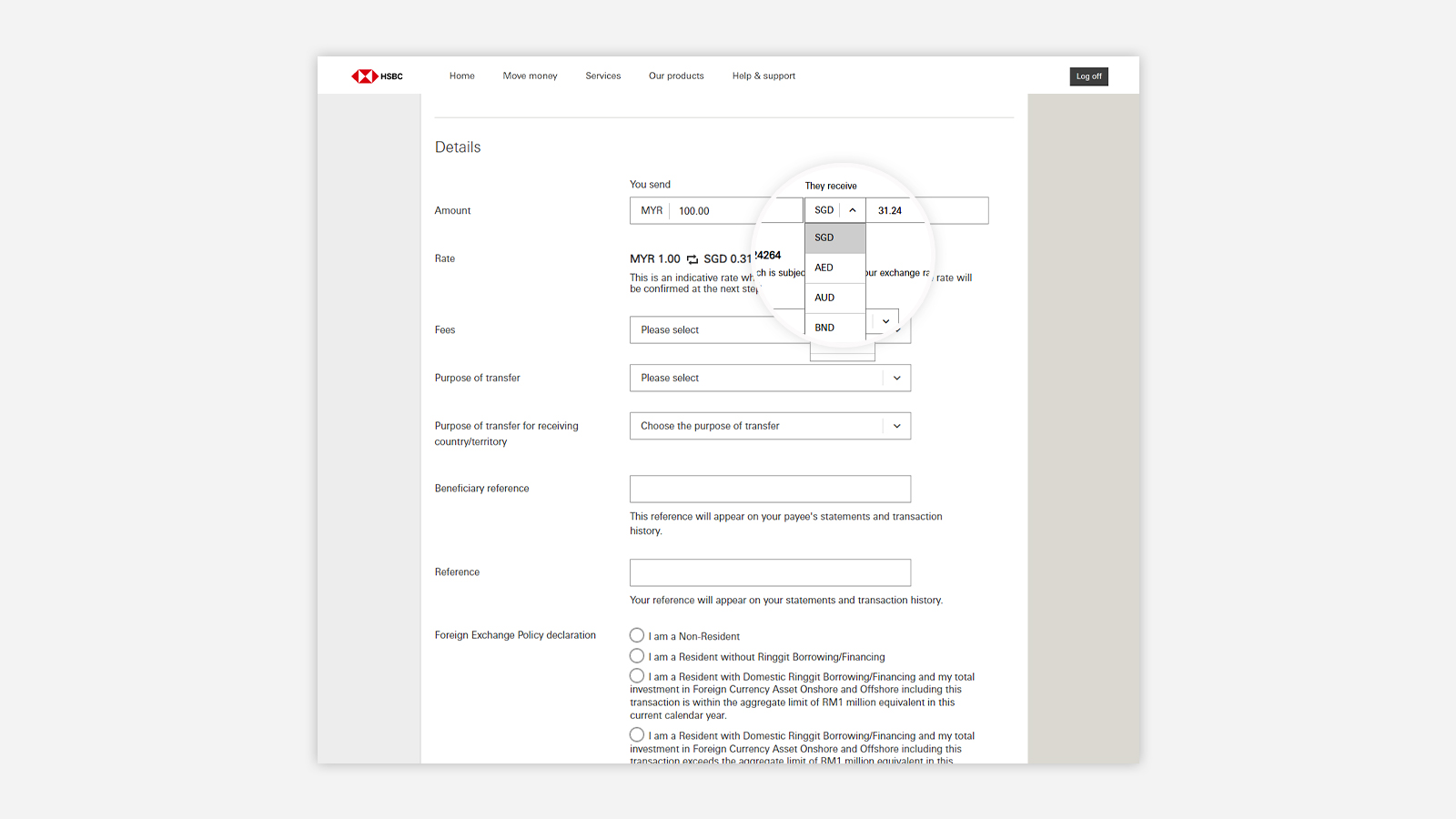

What is the transaction limit for HSBC Global Account

Where can I check the daily purchase limit and ATM cash withdrawal limit

| EGA Debit Card/-i type | Premier Everyday Global VISA Debit Card/-i |

|---|---|

| Daily ATM Cash Withdrawal Limit (RM) | 5,000 |

| Daily ATM Instant Transfer Limit (RM) | 30,000 |

| Daily ATM IBG Limit (RM) | 5,000 |

| Daily ATM JomPay Limit (RM) | 5,000 |

The default daily limit for an international funds transfer through NAB Internet Banking is $5,000.Online Transfer payments via Sterling Internet Banking

We'll process your payment during normal banking hours. Send from £1.01 up to £100,000 per day via Internet Banking. We won't charge you for transferring money overseas. However, correspondent and recipient bank charges may apply.

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

Can I wire transfer 1 million dollars : Is there a limit on wire transfers Broadly speaking, you can send as much money as you want in either a domestic or international wire transfer.

What is the daily limit for HSBC Everyday Global : Use your HSBC Everyday Global Visa Debit Card everywhere Visa is accepted anywhere in the world. Access your own money at ATMs and when making purchases in-store and online. In-store purchase – daily limit8 of $10,000 Select 'Credit' for instore purchases above $100 or tap for contactless purchases under $100.

What is the maximum amount you can transfer internationally

$10,000 USD

Transferring Large Sums of Money Internationally – FAQ

Any international money transfer exceeding $10,000 USD must be reported to the US government on a Foreign Bank Account Report per the Bank Secrecy Act. Many people wonder, “Do large bank transfers take longer than online services” Typically, the answer is yes.

Yes, you can transfer money from one bank to another. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. There are pros and cons to each method, and some come with transfer fees.Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

Can I transfer 2 million dollars : There isn't a law that limits the amount of money you can send or receive. However, financial institutions and money transfer providers often have daily transaction limits.