Antwort How many trading markets are there? Weitere Antworten – How many different markets are there to trade

The main markets are stocks (equities), bonds, forex (currency), options and derivatives, and physical assets. Furthermore, within each of these types of markets, there can be even more specialty markets.This article will explore the various types of trading in the stock market, including intraday trading, scalping, swing trading, position trading, momentum trading. By familiarising yourself with these trading approaches, you can make informed decisions and develop a trading strategy that suits your investment goals.The foreign exchange or forex market is the largest financial market in the world – larger even than the stock market, with a daily volume of $6.6 trillion, according to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets.

How many stock traders are there in the world : According to “The Modern Trader ” report, released by Broker Notes, there are 9.6 million traders worldwide. Basically, 1 out of 781 people on the planet trade online. You might assume that they would live in big cities near financial centres, such as New York, London, Hong Kong, etc., but you are mistaken.

What are the 4 main markets

Economic market structures can be grouped into four categories: perfect competition, monopolistic competition, oligopoly, and monopoly.

What are the 3 major markets : In the United States, the three leading stock indexes are the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite.

Of the different types of trading, long-term trading is the safest.

Still, there are many risks that a trader must be aware of and how to minimize or mitigate those risks. Because forex trading operates with a relatively high degree of leverage, the potential risks are magnified compared to other markets.

What is the 3 strongest currency

List of Highest Currencies in the World 2024

| Currency | Symbol | INR Value In Rs (As on May 2024) |

|---|---|---|

| Kuwaiti Dinar | 1 KWD | 271.43 |

| Bahraini Dinar | 1 BHD | 221.42 |

| Omani Rial | 1 OMR | 216.86 |

| Jordanian Dinar | 1 JOD | 117.91 |

Top 10 Traders In India 2024:-

| Rank | Trader Name |

|---|---|

| 1 | Premji and Associates |

| 2 | Radhakrishnan Damani |

| 3 | Rakesh Jhunjhunwala |

| 4 | Raamdeo Agrawal |

Because the investment amount is not fixed, they invest most of their money in the stock market. Due to which they do not have enough money even for emergency times. And when they need money, that's when the market is going downhill. Due to which they have to withdraw money from the market by making losses.

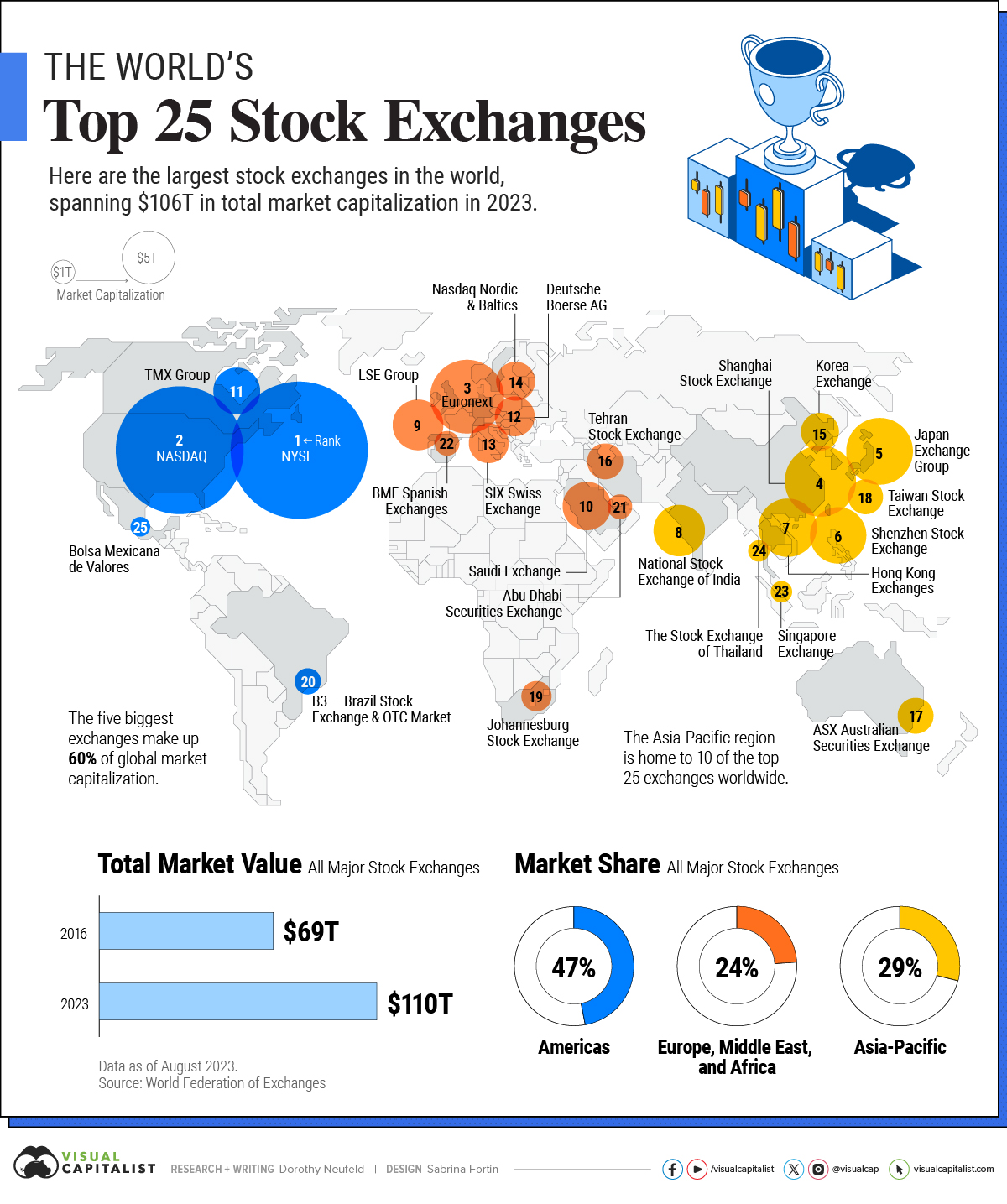

The New York Stock Exchange (NYSE), the Nasdaq Stock Market, and the Chicago Stock Exchange are the three largest stock exchanges in the United States.

What are the most common markets : Aside from the two most common markets—physical and virtual—there are other kinds of markets where parties can gather to execute their transactions.

What are 4 types of market : Economic market structures can be grouped into four categories: perfect competition, monopolistic competition, oligopoly, and monopoly.

Who is the no. 1 share market in the world

New York Stock Exchange (NYSE)

New York Stock Exchange (NYSE) is the world's largest stock exchange located at 11 Wall Street, New York City, USA. NYSE has a market capitalisation of $26.2 trillion (world's biggest stock exchange) and has more than 2400 companies listed.

The 10 Riskiest Investments

- Options. An option allows a trader to hold a leveraged position in an asset at a lower cost than buying shares of the asset.

- Futures.

- Oil and Gas Exploratory Drilling.

- Limited Partnerships.

- Penny Stocks.

- Alternative Investments.

- High-Yield Bonds.

- Leveraged ETFs.

Examples include stocks of volatile companies, cryptocurrencies, startup investments, future contracts, forex trading and investing in emerging markets. In this article, let us learn about the high-risk and high-return investments in India. Why we need your mobile number

What is the 1% risk per trade : The 1% risk rule means not risking more than 1% of account capital on a single trade. It doesn't mean only putting 1% of your capital into a trade. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position.

:max_bytes(150000):strip_icc()/Term-m-market-cap-to-gdp_Final-40e2dec31d644c0d8ddd418a3e7efcbc.png)