Antwort How many merchants are using Global Payments? Weitere Antworten – How many clients does Global Payments have

We make taking payments easy—in person, online or on the go. Our point-of-sale technology and software solutions help you run and grow your business, whatever your sector, size or ambition. That's why we're trusted by over 4.6 million companies across 100+ verticals around the world.Global Payments has market share of 0.06% in payments-processing market. Global Payments competes with 210 competitor tools in payments-processing category. The top alternatives for Global Payments payments-processing tool are Shopify Pay with 57.75%, Klarna with 7.13%, Amazon Payments with 6.72% market share.Introduction. Background. The Global Payments Merchant Portal is an extensive online data management platform, desiged to make it simple to find the information that helps you to better understand your customers and make informed business decisions.

How many people work for Global Payments : 24,000 employees

With over 24,000 employees in 32 countries, Global Payments is trusted by over 2 million businesses worldwide.

How big is the global payment processing market

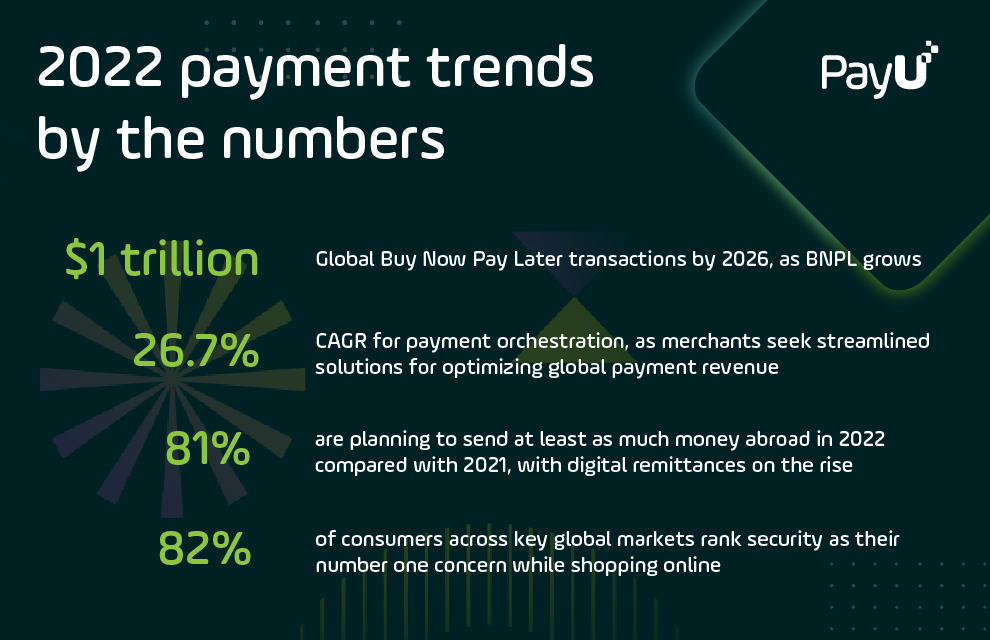

The global market for Payment Processing Solutions estimated at US$58.5 Billion in the year 2022, is projected to reach a revised size of US$161.9 Billion by 2030, growing at a CAGR of 13.6% over the analysis period 2022-2030.

How big is the global real-time payments market : The global real-time payments market size was estimated at USD 17.57 billion in 2022 and is expected to reach USD 23.02 billion in 2023.

In 2023, the Payments Market size was estimated at USD 2.54 trillion. The report covers the Payments Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Payments Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

The global payment processing solutions market size was estimated at USD 100 billion in 2022 and is expected to surpass around USD 632.18 billion by 2032 with a remarkable CAGR of 20.3% from 2023 to 2032.

Is Global Payments a fintech

Global Payments Inc. is an American multinational financial technology company that provides payment technology and services to merchants, issuers and consumers.Cameron M. Bready (Jun 1, 2023–)Global Payments / CEO

Cameron Bready – president, chief executive officer and member of the board of directors of Global Payments – is an experienced global business leader who has served in a variety of top leadership roles at public companies over his nearly 30-year career.The global real-time payments market size was estimated at USD 17.57 billion in 2022 and is expected to reach USD 23.02 billion in 2023.

Transaction banking is a $536 billion market globally today and is expected to grow at an annual rate of 6.6%, becoming a $738 billion market by 2027.

Is Global Payments a real company : As a Fortune 500 financial and payments technology company, we lead the industry in innovation, scale and service. And our expertise is your advantage.

Who is the CEO of Global Payments : Cameron M. Bready (Jun 1, 2023–)Global Payments / CEO

Cameron Bready – president, chief executive officer and member of the board of directors of Global Payments – is an experienced global business leader who has served in a variety of top leadership roles at public companies over his nearly 30-year career.

Is the CEO of Global Payments leaving

Payments technology firm Global Payments has named a new chief executive. Jeff Sloan, who has held the CEO post for nearly 10 years, announced his departure Monday (May 1), with Chief Operating Officer Cameron M. Bready set to take his place.

In the Payments Processing market, Moneris has a 0.35% market share in comparison to Global Payments's 0.06%. Since it has a better market share coverage, Moneris holds the 21st spot in 6sense's Market Share Ranking Index for the Payments Processing category, while Global Payments holds the 63rd spot.Cameron Bready

Cameron Bready – president, chief executive officer and member of the board of directors of Global Payments – is an experienced global business leader who has served in a variety of top leadership roles at public companies over his nearly 30-year career.

Why did Jeff Sloane leave Global Payments : “Good reason” for resignation is defined under the 'Amended and Restated Employment Agreement' – with one of the reasons being a 'reduction by the company in Executive's Bonus Target'. This makes it so Jeff is eligible to receive $34.4M in 'post-employment payments' versus leaving 'without good reason.