Antwort How is swap rate calculated? Weitere Antworten – How are swap rates determined

The swap rate will be determined at the start of the swap and will remain constant for each payment. In contrast, while the variable interest rate will be defined at the start of the swap (e.g., equal to LIBOR plus 100 bps), the rate will likely change each time a payment is determined.The swap pricing equation, which sets r FIX for the implied fixed bond in an interest rate swap, is: rFIX=1−PVn(1)∑ni=1PVi(1) r F I X = 1 − PV n ( 1 ) ∑ i = 1 n PV i ( 1 ) .So these this is our table or series of cash flows for the fixed rate bond side of this swap. Then the present value of each one will just be equal to the cash flow for that period divided. By 1 plus

What is the swap rate in trading : The “swap rate” is the fixed interest rate that the receiver demands in exchange for the uncertainty of having to pay the short-term LIBOR (floating) rate over time. At any given time, the market's forecast of what LIBOR will be in the future is reflected in the forward LIBOR curve.

How do you calculate swaps

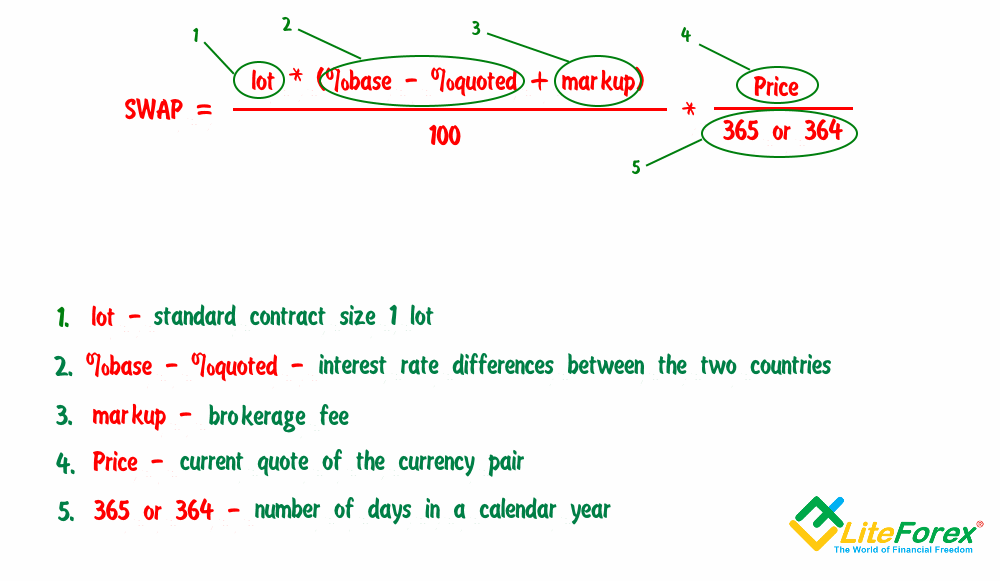

Using the formula:

- Swap rate = (Contract x [Interest rate differential. + Broker's mark-up] /100) x (Price/Number of. days per year)

- Swap Short = (100,000 x [0.75 + 0.25] /100) x (1.2500/365)

- Swap Short = USD 3.42.

Where do swap rates come from : Generally, swap rates are determined by market forces such as supply and demand, as well as expectations of future interest rate movements. Swap rates are influenced by factors such as prevailing interest rates, credit risk, liquidity conditions, and market participants' expectations.

For forex, here's the formula to calculate swap:

- Swap = (Pip Value * Swap Rate * Number of Nights) / 10.

- Pip value: $1.

- Swap (long) rate: -3.3154.

- Swap fee: (1* -3.3154 * 1) / 10 = -$0.33.

Now let's take a closer look at how the total swap value is calculated on Forex trading for a sell trade in the EURUSD currency pair. SWAP (short positions) = (Lot * (quote currency rate – base currency rate – markup) / 100) * current quote / number of days in a year.

What is the 3 month Euribor swap rate

Current 1 Month, 3 Month, and 6 Month EURIBOR

| Index | Rate |

|---|---|

| One Month | 3.856% |

| Three Month | 3.818% |

| Six Month | 3.789% |

For forex, here's the formula to calculate swap:

- Swap = (Pip Value * Swap Rate * Number of Nights) / 10.

- Pip value: $1.

- Swap (long) rate: -3.3154.

- Swap fee: (1* -3.3154 * 1) / 10 = -$0.33.

Swap Points are the fees charged by the intermediaries in an FX Swap and can be calculated as 'Swap Points = Spot Rate x Forward Rate'. Swap Points in FX Swaps are the difference between the forward rate and the spot rate of the exchange. They can be calculated by 'Swap Points = Forward Rate – Spot Rate'.

Calculating the Rate for Forex Calculating the Rate for Forex

- Swap rate = (Contract x [Interest rate differential. + Broker's mark-up] /100) x (Price/Number of. days per year)

- Swap Short = (100,000 x [0.75 + 0.25] /100) x (1.2500/365)

- Swap Short = USD 3.42.

How are swap points calculated : Computing Swap Points. The difference between the forward rate and the spot rate for a particular currency pair when expressed in pips is typically known as the swap points. These points are computed using an economic concept called Interest Rate Parity.

Is Euribor a swap rate : EURIBOR swaps are commonly used by real estate borrowers to hedge floating-rate EUR debt, structured to pay this fixed rate quarterly versus receiving 3-month EURIBOR quarterly, on an Actual/360 basis without amortization. Often used as a reference rate for fixed-rate debt.

How is 3-month Euribor calculated

The Euribor is calculated by eliminating the highest 15% and the lowest 15% of the interest rates submitted and calculating the arithmetic mean of the remaining values.

The swap fee varies depending on:

- The type of position – purchase or sale.

- The instrument.

- The number of days the position is open.

- The nominal value of the position.

Using the formula:

- Swap rate = (Contract x [Interest rate differential. + Broker's mark-up] /100) x (Price/Number of. days per year)

- Swap Short = (100,000 x [0.75 + 0.25] /100) x (1.2500/365)

- Swap Short = USD 3.42.

How is FX swap calculated : They are calculated by 'Swap Points = Spot Rate – Forward Rate'. Swap Points in FX Swaps are the difference between the forward rate and the spot rate of the exchange.