Antwort How is swap calculated? Weitere Antworten – What is the formula for swap points

Swap Points are the fees charged by the intermediaries in an FX Swap and can be calculated as 'Swap Points = Spot Rate x Forward Rate'. Swap Points in FX Swaps are the difference between the forward rate and the spot rate of the exchange. They can be calculated by 'Swap Points = Forward Rate – Spot Rate'.A foreign exchange swap (also known as an FX swap) is an agreement to simultaneously borrow one currency and lend another at an initial date, then exchanging the amounts at maturity.For example: XAU/USD has a Long swap of – 11.27. If you bought 2 lots, the swap charged would be 2 x – 11.27 equaling -22.54 USD, this total will be converted to your accounts base currency from USD.

What are swap charges : A swap, also known as “rollover fee”, is charged when you keep a position open overnight. A swap is the interest rate differential between the two currencies of the pair you are trading. It is calculated according to whether your position is long or short.

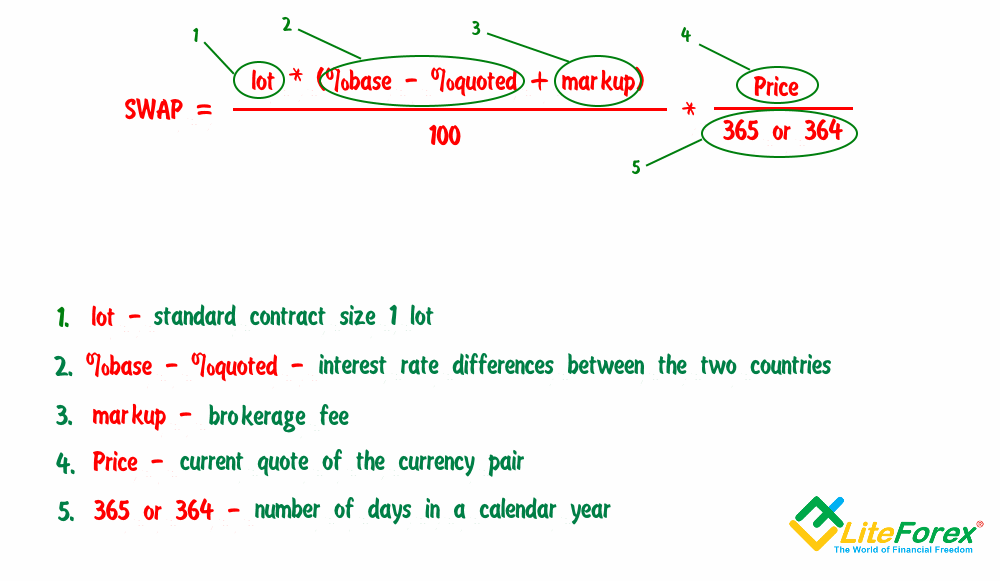

What is swap calculation

Swap rate = (Contract x [Interest rate differential + Broker's mark-up] /100) x (Price/Number of days per year) Swap Short = (100,000 x [0.75 + 0.25] /100) x (1.2500/365) Swap Short = USD 3.42.

How do you solve swaps : 2.8182 if we do this math we end up with 0.05 3605 and if we multiply by 100 that gives us 3.605 percent this is our fixed rate on the swap. Okay there it is so now we can look at our answers. Uh.

Now let's take a closer look at how the total swap value is calculated on Forex trading for a sell trade in the EURUSD currency pair. SWAP (short positions) = (Lot * (quote currency rate – base currency rate – markup) / 100) * current quote / number of days in a year.

A swap is an agreement for a financial exchange in which one of the two parties promises to make, with an established frequency, a series of payments, in exchange for receiving another set of payments from the other party. These flows normally respond to interest payments based on the nominal amount of the swap.

How to calculate a swap

Using the formula:

- Swap rate = (Contract x [Interest rate differential. – Broker's mark-up] /100) x (Price/Number of days. per year)

- Swap Long = (100,000 x [0.75 – 0.25] /100) x. (1.2500/365)

- Swap Long = USD 1.71.

Now let's take a closer look at how the total swap value is calculated on Forex trading for a sell trade in the EURUSD currency pair. SWAP (short positions) = (Lot * (quote currency rate – base currency rate – markup) / 100) * current quote / number of days in a year.Swap = (Pip Value * Swap Rate * Number of Nights) / 10

Note: FxPro calculates swap once for each day of the week that a position is rolled over, however, to account for weekends, a triple charge will take place on Wednesday for FX & metals, and on Friday for other instruments.

Generally, swap rates are determined by market forces such as supply and demand, as well as expectations of future interest rate movements. Swap rates are influenced by factors such as prevailing interest rates, credit risk, liquidity conditions, and market participants' expectations.

How do you calculate swap size : Swap space should be twice the size of RAM in case the RAM amount is below 2 GB. If RAM amounts to more than 2 GB, then swap space should be the size of RAM + 2 GB. For example, 6GB of swap for 4GB of RAM.

What is the formula for swap price : The swap pricing equation, which sets r FIX for the implied fixed bond in an interest rate swap, is: rFIX=1−PVn(1)∑ni=1PVi(1) r F I X = 1 − PV n ( 1 ) ∑ i = 1 n PV i ( 1 ) .

How to calculate swap calculator

Swap = (Pip Value * Swap Rate * Number of Nights) / 10

Note: FxPro calculates swap once for each day of the week that a position is rolled over, however, to account for weekends, a triple charge will take place on Wednesday for FX & metals, and on Friday for other instruments.

The value of a swap at inception is zero (ignoring transaction and counterparty credit costs). On any settlement date, the value of a swap equals the current settlement value plus the present value of all remaining future swap settlements. A swap contract's value changes as time passes and interest rates change.Using the formula:

- Swap rate = (Contract x [Interest rate differential. – Broker's mark-up] /100) x (Price/Number of days. per year)

- Swap Long = (100,000 x [0.75 – 0.25] /100) x. (1.2500/365)

- Swap Long = USD 1.71.

How is the swap rate decided : The “swap rate” is the fixed interest rate that the receiver demands in exchange for the uncertainty of having to pay the short-term LIBOR (floating) rate over time. At any given time, the market's forecast of what LIBOR will be in the future is reflected in the forward LIBOR curve.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)