Antwort How does tap and pay work? Weitere Antworten – How do I pay with tap and pay

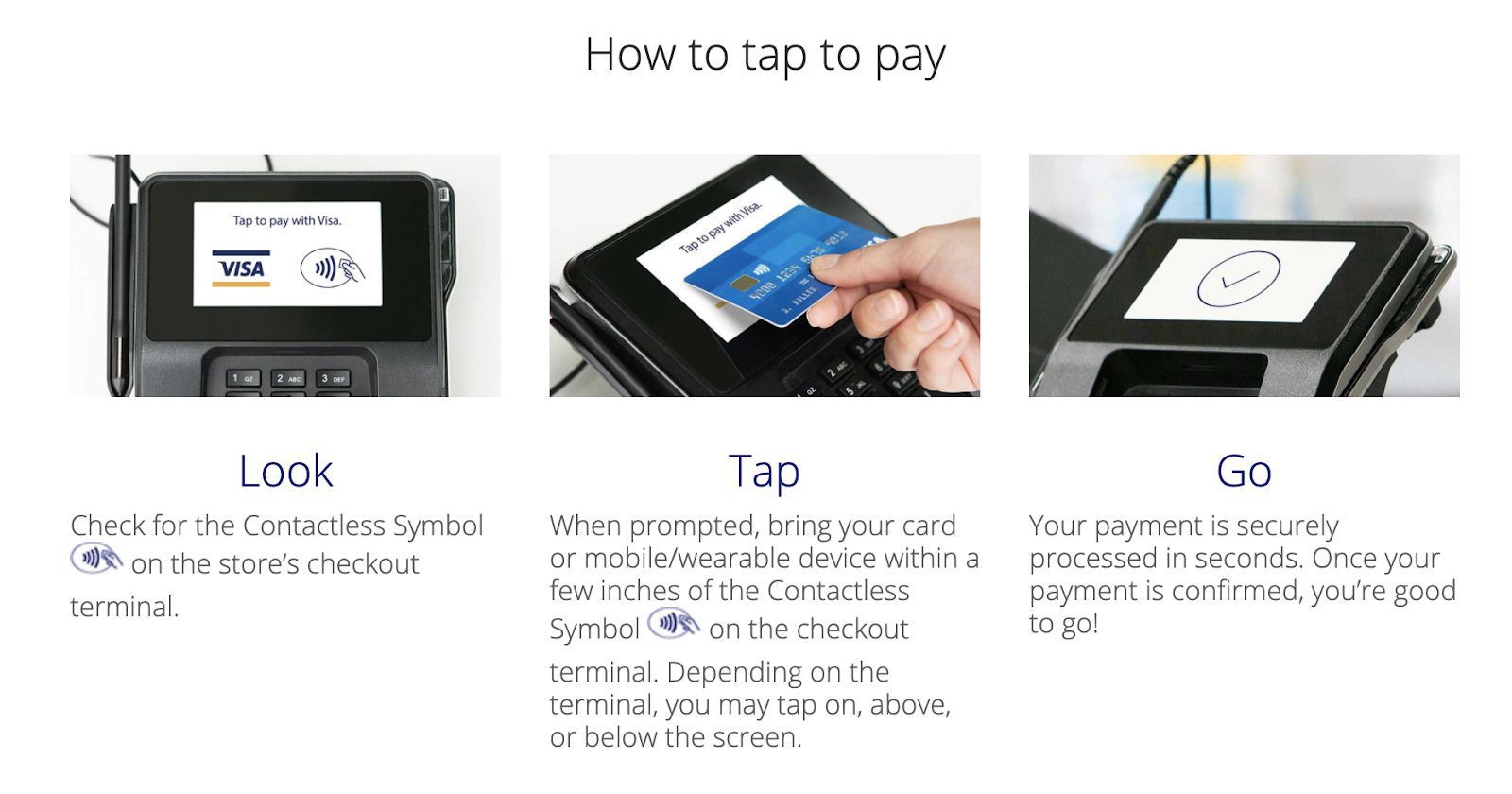

Pay with a tap at stores worldwide

Hold your Android device near the card reader and wait for the checkmark. Pay with your default card or select another. Google Pay will handle the rest. Order free stickers for your business to let customers know you accept Google Pay.Tap to Pay operates through Near Field Communication (NFC) technology, a short-range wireless communication system that allows data exchange between devices in close proximity. The customer's payment information is securely stored in the NFC chip and transmitted to the merchant's terminal for authorization.Are there any hidden charges to tap and go Waving the card next to a terminal instead of inserting generally won't cost you anything extra. However that's only what you see as a customer. On the other end, choosing to tap-and-go can result in different costs for the retailer.

How does paying by phone work : The customer holds their device close to the NFC-enabled POS terminal, approximately within two inches and this initiates the transaction. Both devices use RFID technology (NFC is a subset of this technology) to pass encrypted information back and forth to process the payment, which happens within a matter of seconds.

Is tap and pay safe

Safer transactions

Tap-to-pay technology is more reliable and secure than other forms of payment. The chip technology protects you against any fraudulent purchases through encryption and dynamic data technologies.

What are the disadvantages of contactless payment : Because contactless payments require neither PIN nor signature authorisation, lost or stolen contactless cards can be used to make fraudulent transactions.

Are contactless cards safer than chip cards Contactless credit cards can also be EMV chip cards. However, contactless payments tend to be safer since the credit or debit card itself never makes contact with the payment terminal.

Because contactless payments require neither PIN nor signature authorisation, lost or stolen contactless cards can be used to make fraudulent transactions.

Is tap to pay risky

The transmission is secure, and since contactless cards are also typically EMV cards, they share the same encryption technology, making it difficult for a thief to create a counterfeit card.Making them hard to spot. But. If you're using a tap to pay method PayPal. Says your card or phone doesn't come into contact with those hidden devices.Phone payment apps use the same security technology as contactless credit cards (the kind you tap instead of swipe), and pay-with-phone transactions use tokenization to mask your actual credit card number during the transaction and protect your card information from being stolen.

Benefits of Contactless Credit Cards

In comparison, tapping to pay using a contactless chip can take only seconds. Contactless payments are much faster than inserting a credit card and safer than paying with cash or by means of magnetic stripe swipe.

What are the risks of tap to pay : What are the dangers of contactless cards Contactless cards carry potential risks, including unauthorized payments, card skimming, data interception, and a lack of spending monitoring. Understanding these dangers is important to protect your financial well-being.

Is tapping safer than swiping : Is tapping to pay safer than swiping Contactless payment technology is typically considered the safest since some of the methods thieves use to hack into your card become virtually impossible to facilitate.

Is NFC the same as tap to pay

NFC, meanwhile, stands for “Near Field Communication,” and it allows for communication over a very short range — in this case, between the terminal and the payment card or payment device. More commonly known as contactless pay or tap-to-pay, NFC is a newer method of payment authentication than EMV.

Benefits of Contactless Credit Cards

In comparison, tapping to pay using a contactless chip can take only seconds. Contactless payments are much faster than inserting a credit card and safer than paying with cash or by means of magnetic stripe swipe.Benefits of Contactless Credit Cards

In comparison, tapping to pay using a contactless chip can take only seconds. Contactless payments are much faster than inserting a credit card and safer than paying with cash or by means of magnetic stripe swipe.

Is tap to pay safer than inserting a card : Tap-to-pay is less vulnerable to credit card skimming and other types of fraud since the card itself never touches the payment terminal for a transaction. “Skimming” involves using a hidden device to read and translate credit card data when a credit card is swiped to make a purchase.