Antwort How does currency swap between countries work? Weitere Antworten – How do currency swaps work

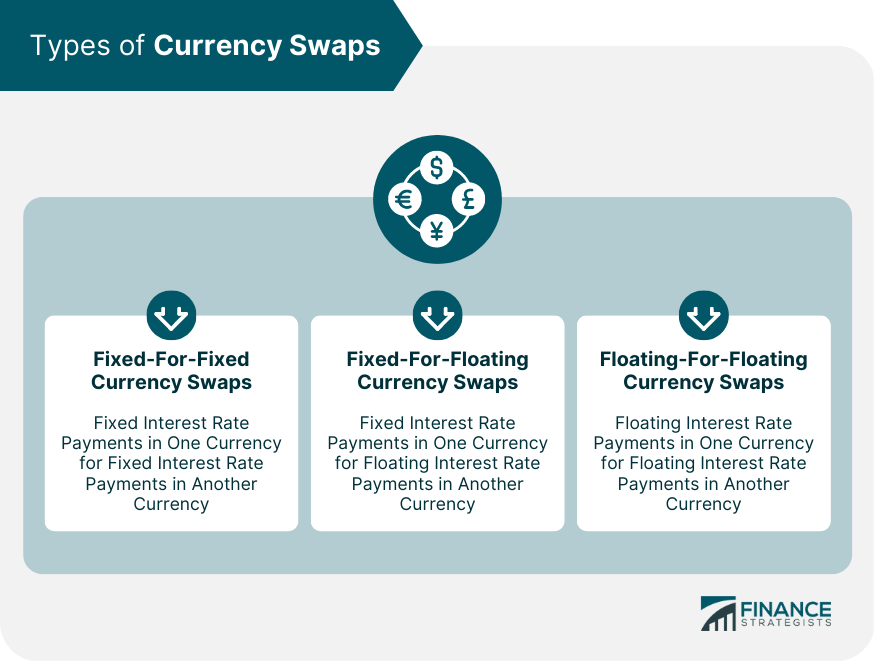

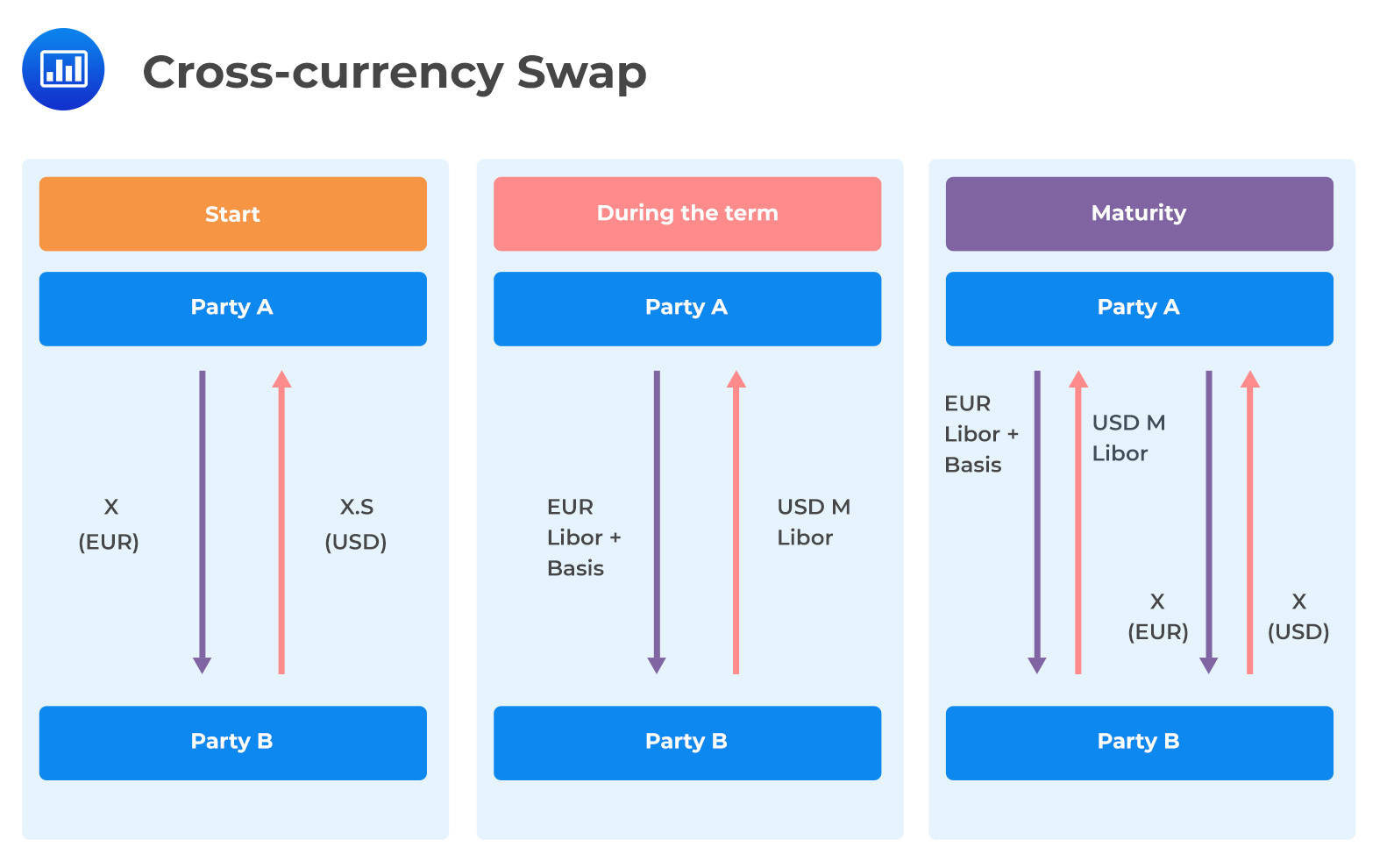

A currency swap is an agreement in which two parties exchange the principal amount of a loan and the interest in one currency for the principal and interest in another currency. At the inception of the swap, the equivalent principal amounts are exchanged at the spot rate.What Is a Currency Swap A currency swap is a transaction in which two parties exchange an equivalent amount of money with each other but in different currencies. The parties are essentially loaning each other money and will repay the amounts at a specified date and exchange rate.In a cross-currency swap, interest payments and principal in one currency are exchanged for principal and interest payments in a different currency. Interest payments are exchanged at fixed intervals during the life of the agreement.

What are the stages of a currency swap : There are three stages that form part of the currency swap. It includes spot exchange of the principal, Continuing exchange of the payment of the interest during the swap terms, and Re-exchange of the principal amount on the date of maturity.

Are currency swaps risky

There is a risk of making a loss on a currency swap, which means that you will have to be careful when you are making the agreement so that you do not lose your money. Do not forget that you can reduce your risk by using leverage and other financial products.

How do swaps make money : A swap is an agreement for a financial exchange in which one of the two parties promises to make, with an established frequency, a series of payments, in exchange for receiving another set of payments from the other party. These flows normally respond to interest payments based on the nominal amount of the swap.

A swaption (also known as a swap option) is an option contract that grants its holder the right but not the obligation to enter into a predetermined swap contract. In return for the right, the holder of the swaption must pay a premium to the issuer of the contract.

When a foreign central bank draws on its swap line with the Federal Reserve, the foreign central bank sells a specified amount of its currency to the Federal Reserve in exchange for dollars at the prevailing market exchange rate. The Federal Reserve holds the foreign currency in an account at the foreign central bank.

How does currency exchange work

Foreign currency exchange converts one currency into another, but it's not usually at a 1:1 ratio. Exchange rates change regularly based on fluctuations in global trade markets. When an international money transfer is made between currencies, the rate calculates the difference based on the markets at that exact time.A foreign exchange swap (also known as an FX swap) is an agreement to simultaneously borrow one currency and lend another at an initial date, then exchanging the amounts at maturity. It is useful for risk-free lending, as the swapped amounts are used as collateral for repayment.Hedging Currency Risk

Currency swaps allow businesses and investors to hedge their exposure to fluctuations in currency exchange rates, reducing the risk of adverse currency movements affecting their financial position.

The disadvantages of swaps are:

- Early termination of swap before maturity may incur a breakage cost.

- Lack of liquidity.

- It is subject to default risk.

What is the risk of swaption : It is important to note that trading in swaptions may involve substantial risk. When selling swaptions: When you sell a swaption, there is a risk that the option will be exercised into an interest rate swap that for you will be of negative value. The loss may exceed the option premium you receive.

Are currency swaps legal : In finance, a currency swap, also known as cross-currency swap, is a legal contract between two parties to exchange two currencies at a later date, but at a predetermined exchange rate.

How does changing currency work

When sending money abroad or overseas, foreign currency exchange swaps one local currency into another. An international money transfer via a bank or transfer services allows a customer to convert their existing currency into the desired foreign currency, using exchange rates based on the global trade markets.

Money changers would assess a foreign coin for its type, wear and tear, and validity, then accept it as deposit, recording its value in local currency. The merchant could then withdraw the money in local currency to conduct trade or, more likely, keep it deposited: the money changer would act as a clearing facility.A universal currency converter is an app or web tool that allows for the quick conversion of any currency into any other currency. Universal converters typically use the most recent market prices in the foreign exchange market.

What are the risks of currency swaps : There Is A Risk Of Rate Changes

A currency swap is an agreement that is based on the interest rate, which means that there is a risk of rate changes. If there is a rate change, then your profitability and ROI will also end up being affected.

:max_bytes(150000):strip_icc()/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)