Antwort How do you calculate labor cost per hour? Weitere Antworten – What is the formula for cost per hour

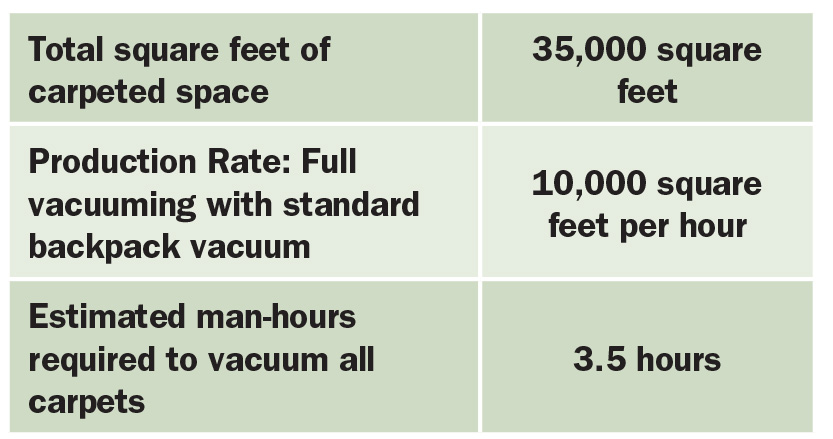

Cost-per-hour is determined by taking fully-loaded-cost in a time period and dividing it by the total number of hours available in that same time period. For example, $100k annual cost / 2080 annual hours = $48 cost per hour.In summary, add together the employee's gross annual pay, annual payroll taxes, and total additional annual expenses to get the total annual employee cost. You can further divide this by months or hours to determine the employee's total monthly or hourly cost.Calculate an employee's labor cost per hour by adding their gross wages to the total cost of related expenses (including annual payroll taxes and annual overhead), then dividing by the number of hours the employee works each year. This will help determine how much an employee costs their employer per hour.

How to work out the true cost of an employee in the UK : Take each employee's gross salary (total before taxes and deductions), including any additional benefits such as car allowance or bonus payments. Add the employers' National Insurance contributions (NIC) and pension contributions. This gives you their total salary cost.

How to calculate per hour rate in Excel

Step-by-Step:

1. Set Up Your Dataset: Arrange your data with columns for Date, Employee Name/ID, Total Hours Worked, and Total Pay for the day. 2. Daily Hourly Rate Formula: Use a formula to divide the Total Pay by the Total Hours Worked to get the hourly rate for each day.

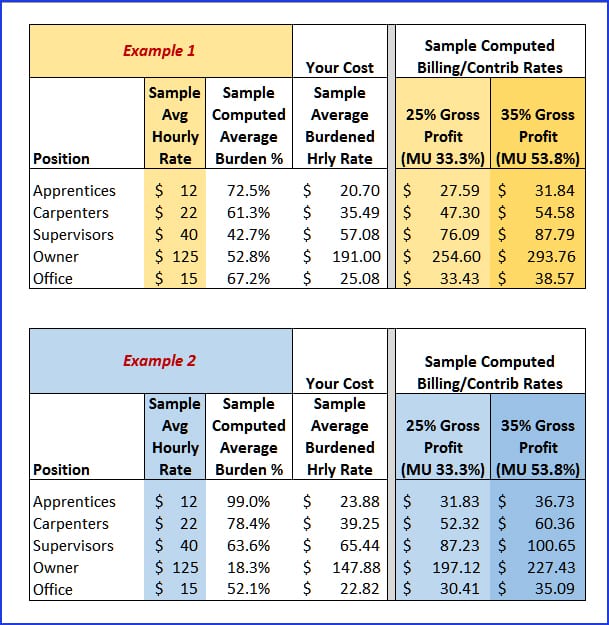

How to charge for labor : The labor rate pricing is determined by adding the hourly rates of the employees who will be working on a single project. That number should then get multiplied by the labor burden and markup. Always round up to the next dollar in these scenarios. Using a nice, round number always makes it easier.

HR functions spend $2,524 per employee annually on average. The top spending areas are recruiting ($425 per employee), total rewards ($213 per employee) and learning and development ($188 per employee). However, the #1 area HR is planning to increase investments in is HR technology.

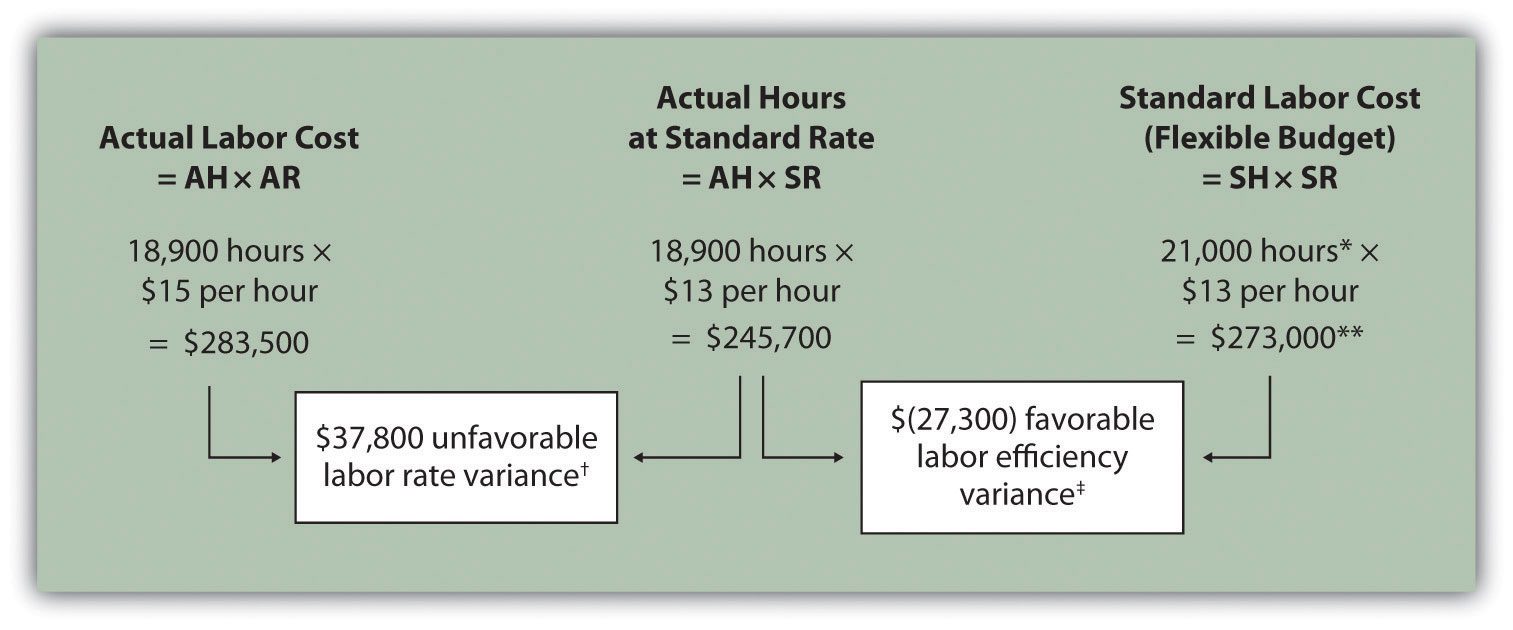

How do you calculate direct labor per hour The direct labor cost is simply pay rate times project time. In order to find the calculation per hour, divide the direct labor cost by the total number of hours spent on the project.

Is there an app to calculate labor costs

The Sling app makes that simple with a built-in time clock and powerful reporting features. Sling automatically imports hours worked after your employees clock in and out and allows you to calculate and track labor costs over any period of time you choose.You do this by dividing the minutes worked by 60. You then have the hours and minutes in numerical form, which you can multiply by the wage rate. For example, if your employee works 38 hours and 27 minutes this week, you divide 27 by 60. This gives you 0.45, for a total of 38.45 hours.Desired profit amount + desired salary + operating costs / number of income producing hours = your hourly rate. For example: Desired profit of $16,500 + desired personal pre-tax salary of $83,500 + operating costs of $30,000/1040 income generating hours = $125 per hour.

Companies split labor costs into four categories: direct labor costs, indirect labor costs, fixed labor costs, and variable labor costs. Each serves its purpose. Direct labor costs refer to supply chain employees such as delivery drivers and manufacturers. It covers expenses like their salaries, benefits, and sick pay.

How to charge for HR services : There are several ways an independent HR consultant can charge for services: An hourly rate/fee. Some consultants may stipulate a minimum number of hours (ranging from two to five) when using this option. A daily or half-day rate/fee depending upon the nature of the assignment.

What are HR overhead costs : This measure calculates the percentage of the total cost to perform the HR function that comes from overhead cost. Overhead costs refer to those that an organization cannot identify as direct costs of performing a process; these include occupancy, facilities, utilities, and maintenance, etc.

What is the direct Labour hour rate method

Direct Labour Hour Rate Method: Under this method, overhead absorption rate is calculated by dividing the overhead with the number of direct labour hours. For example, the budgeted overhead of production centre is Rs . 2 ,00,000 and the budgeted direct labour hours for the period is 40,000.

Definition: Cost of labor is the amount paid by an employer to cover an employee's wages and benefits, plus related payroll taxes and benefits. Labor cost is an important value that finance and accounting professionals calculate to determine the direct and indirect price that a company pays for labor.Labourers will usually price a job on an hourly rate for smaller jobs that will take less than a day. A labourer's hourly rate is usually around £14 – £45. Some labourers may charge a minimum call-out fee in the UK.

How do you make labor costs : Annual Labor Cost = Gross Pay + Annual Costs

The first three categories under annual costs are taxes, benefits, and insurance. Typically the gross pay only accounts for two-thirds of the actual cost of an employee. The majority of the other third lies in these three categories.