Antwort How do you calculate 30 year fixed? Weitere Antworten – What is the formula for a fixed payment

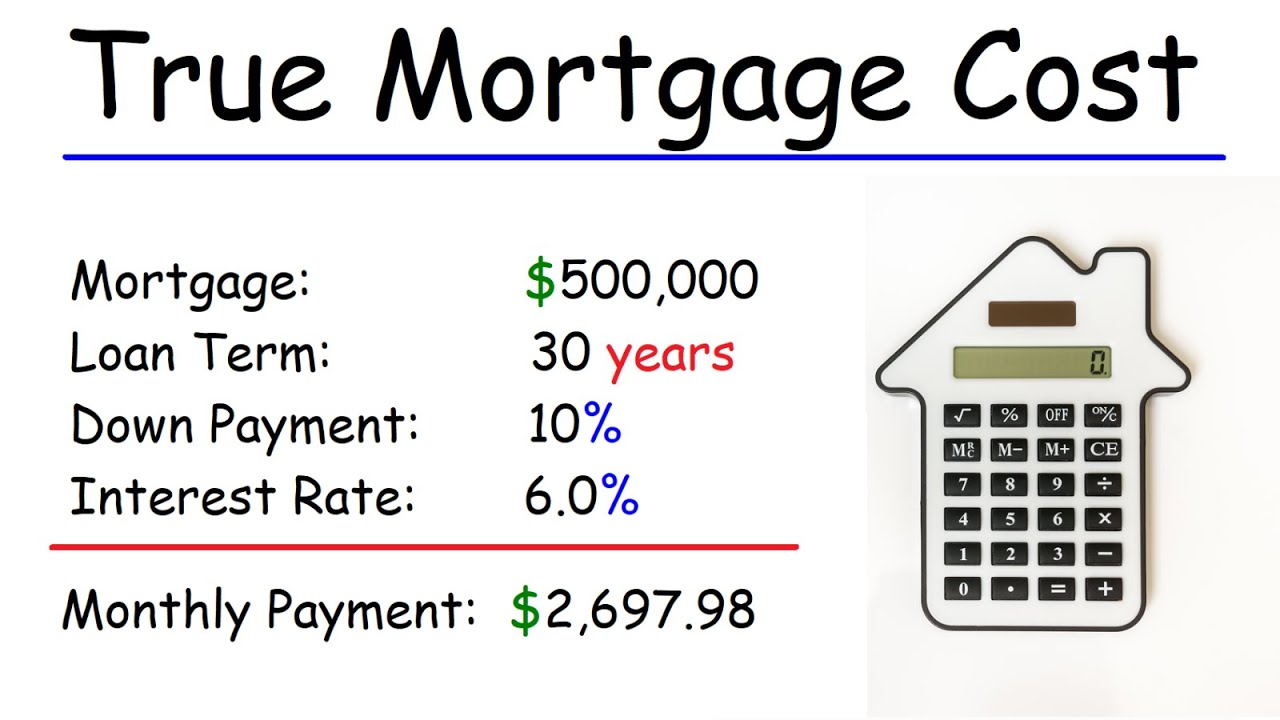

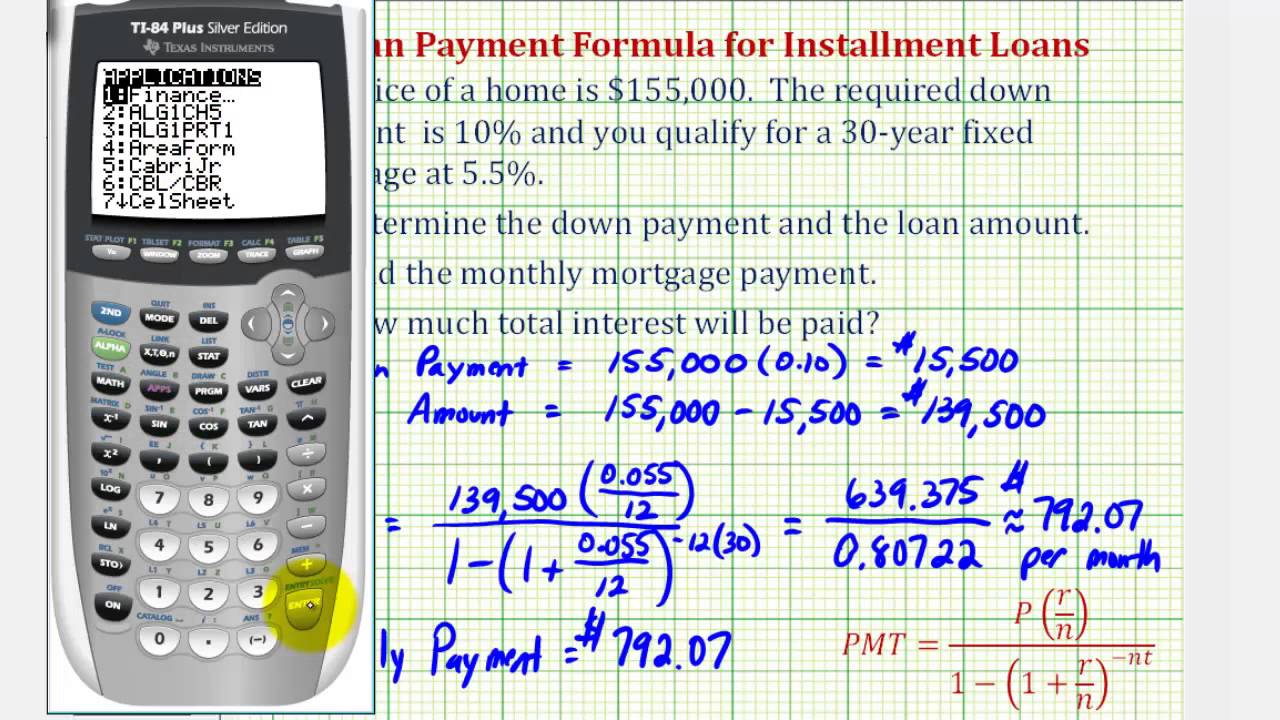

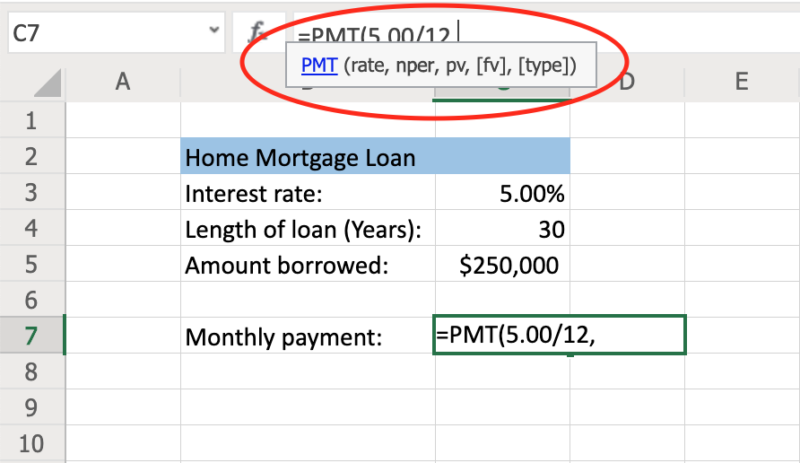

The fixed loan payment formula is P = r ∗ P V / ( 1 − ( 1 + r ) − n ) , where P is the monthly payment, r is the annual interest rate, P V is the loan's maturity value, and n is the number of months until the maturity date.A 30-year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan. When you decide to take out a 30-year home loan with a fixed rate, the payment you owe each month is the same until you've finished paying the loan.You can calculate your total interest by using this formula: Principal loan amount x interest rate x loan term = interest.

How is a fixed-rate mortgage calculated : This derivation illustrates three key components of fixed-rate loans: (1) the fixed monthly payment depends upon the amount borrowed, the interest rate, and the length of time over which the loan is repaid; (2) the amount owed every month equals the amount owed from the previous month plus interest on that amount, …

How do I calculate monthly fixed interest

How to find monthly interest rate

- Convert percentage to a decimal. The first step is to take the annual rate percentage and convert it into a decimal by dividing the number by 100.

- Divide by 12. Next, divide the translated percentage by 12.

- Multiply by the value of the asset.

What is fixed cost and how do you calculate it : Take your total cost of production and subtract the variable cost of each unit multiplied by the number of units you produced. This will give you your total fixed cost.

A 30-year fixed-rate loan is predictable, and gives you the “sleep well advantage.” Knowing your payment will remain consistent makes things a little less stressful, and makes it easier to make other financial plans.

A 15-year mortgage means larger monthly payments, but a lower rate and substantial savings on interest. A 30-year mortgage gives you a more affordable monthly payment, but expect higher borrowing costs overall. You can also take out an interest-only mortgage or pay your loan off early to maximize interest savings.

What is 6% interest on a $30,000 loan

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.A $150,000 30-year mortgage with a 6% interest rate comes with about an $899 monthly payment. The exact costs will depend on your loan's term and other details.Fixed interest rates remain constant throughout the lifetime of the debt. This means they aren't susceptible to changes in the economy. So if you have a mortgage with a fixed rate of 6%, it will never change until you pay off the debt.

To calculate interest rates, use the formula: Interest = Principal × Rate × Tenure. This equation helps determine the interest rate on investments or loans. What are the advantages of using a loan interest rate calculator A loan interest rate calculator offers several benefits.

How to calculate annual fixed interest : How to calculate fixed interest rates

- (Interest Rate / Number of Payments) x Loan Principle = Interest.

- (0.05 / 12) x 40,000 = £166.66.

- Principle – (Repayment – Interest) = New Balance.

- 40,000 – (5,000 – 5%) = £35,250.

What is fixed cost with an example : Fixed costs tend to be costs that are based on time rather than the quantity produced or sold by your business. Examples of fixed costs are rent and lease costs, salaries, utility bills, insurance, and loan repayments. Some kinds of taxes, like business licenses, are also fixed costs.

How do you explain total fixed cost

Total fixed cost (TFC) is that cost which does not change with a change in the level of output. Total variable cost (TVC) is that cost which changes as the level of output changes. Total cost (TC) is the sum of total fixed cost and total variable fixed cost.

Current mortgage and refinance interest rates

| Product | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed Rate | 7.12% | 7.16% |

| 20-Year Fixed Rate | 6.83% | 6.89% |

| 15-Year Fixed Rate | 6.57% | 6.64% |

| 10-Year Fixed Rate | 6.40% | 6.48% |

A 10-year fixed-rate mortgage would suit someone who likes to know their monthly budget. It's also a good idea if you know you can't afford any more than the amount you've set aside for your mortgage.

What are the disadvantages of a 30-year mortgage : Disadvantages of a 30-Year Mortgage

- Higher interest rate.

- Loan balance remains higher for longer.

- Spend more in interest over the life of the loan.

- Home equity is slow to build.

- Making monthly payments over a long period of time.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)