Antwort How do I transfer a large amount HSBC? Weitere Antworten – How do I transfer large amounts of money HSBC

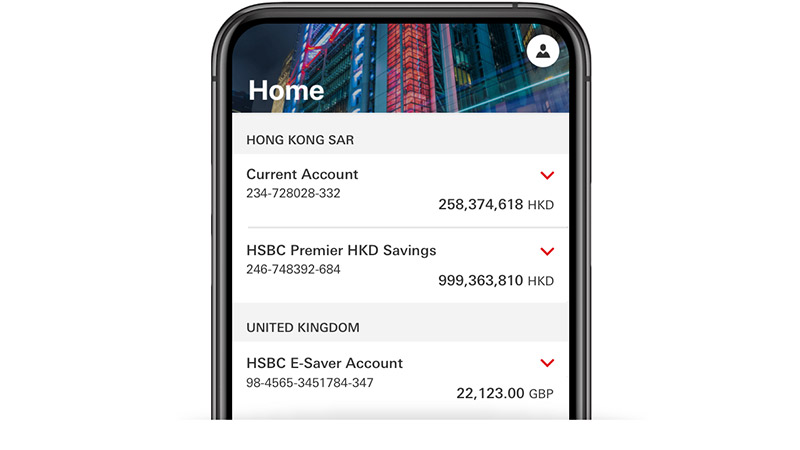

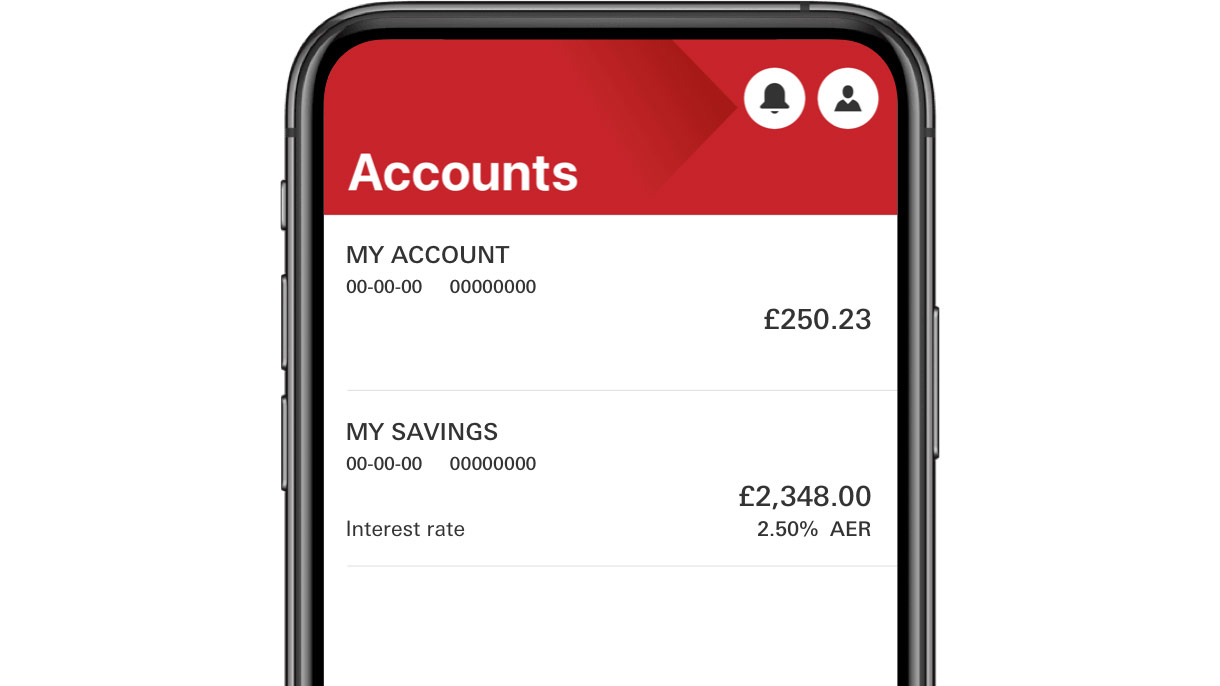

If you're an HSBC customer, you can send a CHAPS payment in branch or by post. If you hold an HSBC Premier account, you can also do this over the phone. To make a CHAPS payment in branch, you'll need to bring valid ID and the details of the person you want to pay. There is no payment limit with a CHAPS transfer.How much money can I transfer between banks If you're transferring money online to another one of your HSBC accounts, there is no limit to how much you can move. If you're paying bills or making payments to friends and family – there is a daily limit for online bank transfers of £25,000.*The maximum daily transfer limit is SGD250,000 (or its equivalent in foreign currency), or up to the maximum daily limit you've set for third-party account transfers, whichever is lower. If you're sending money to accounts in Hong Kong via 'Send like a local', the maximum daily limit is HKD1,000,000.

What is the wire transfer limit for HSBC : $200,000 per transaction

The maximum outbound and inbound Global Transfers limit for U.S. HSBC accounts is $200,000 per transaction and per day. Other countries may have local limit restrictions. Check with your destination country for limit information.

What is the daily limit of HSBC transaction

Is there a payment limit for HSBC mobile banking The daily maximum that can be transferred to third parties is Rs. 30 lakh. You can learn more about your current maximum third party transfer limits by logging into Personal Internet Banking.

How to transfer a large sum of money : If you're sending a large amount of money, you may want to use a wire transfer at your bank. You'll need the recipient's account and routing numbers. You and the recipient will likely incur fees. Wire transfers take place in less than 24 hours but do not occur on weekends or on bank holidays.

Online banking. Step 1 select change internet banking limit step 2 click on edit and adjust your daily limit according to your preference. Step 3 click update to proceed.

In summary, wire transfers over $10,000 are subject to reporting requirements under the Bank Secrecy Act. Financial institutions must file a Currency Transaction Report for any transaction over $10,000, and failure to comply with these requirements can result in significant penalties.

How do I transfer $100,000 from one bank to another

Yes, you can transfer money from one bank to another. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. There are pros and cons to each method, and some come with transfer fees.If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.You can change the transfer limit anytime with your Security Device/Mobile Security Key by selecting 'Pay & transfer' from the top menu > 'Settings' > 'Daily payment and transfer limits'.

Steps for Transferring Money Between Banks

- Log into your bank's website or connect via the bank's app.

- Click on the transfer feature and choose transfer to another bank.

- Enter the routing and account numbers for the account at the other bank.

- Make the transfer.

Can I transfer 20k from one bank to another : Yes, you can transfer money from one bank to another. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. There are pros and cons to each method, and some come with transfer fees.

How to transfer $50,000 to another bank : Steps for Transferring Money Between Banks

- Log into your bank's website or connect via the bank's app.

- Click on the transfer feature and choose transfer to another bank.

- Enter the routing and account numbers for the account at the other bank.

- Make the transfer.

Can I transfer 100000 at a time

As per the National Payments Corporation of India (NPCI), an individual can transfer up to Rs 1 lakh via UPI in a single day.

Set up a wire transfer

For sending a large amount of money, wire transfers can be a solution. To make a wire transfer, you'll need the recipient's name and address and their bank account and routing numbers. Call, visit or go online with your bank or a trusted wire-transfer company.To update your daily limits, log on to HSBC Online Banking, select > 'Move Money' > 'Online banking limits' > 'Manage your daily limits' > 'Edit'. Then enter your new limits and select 'Continue'.

What is the safest way to transfer $100000 : Wire transfers at a bank are ideal for securely sending large amounts domestically or internationally.