Antwort How can I send money without fees? Weitere Antworten – How do I avoid sending money fees

You can send money without a fee by using P2P payment apps such as Cash App, Google Pay, PayPal, Venmo and Zelle. Note that you may have to pay a fee if you fund your transfer with a credit card, and the recipient may have to pay a fee if they choose to receive the money instantly in their bank account or debit card.Zelle. Best for: People with compatible bank accounts who don't want to download another app or pay fees. Zelle is a great option to quickly pay back your friends and family. It's free to use, your money moves within minutes and you may not even need to download another mobile app.

- Your Bank. A bank can assist with many types of transfers.

- PayPal and Venmo. PayPal can be an economical method for transferring money.

- Western Union or MoneyGram.

- Physical Cash.

- Personal Checks.

- Bank Drafts, Money Orders, and Cashier's Checks.

- Email Money Transfers.

How can I transfer money between banks without fees : Use your bank's mobile app or a no-fee P2P mobile app to avoid paying for a cashier's check or a wire transfer. If you can wait to receive your funds, don't pay for a same-day transfer.

Do PayPal charge fees

It's free to use PayPal to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.

Is PayPal free to use : It's free for consumers to donate money, pay for a purchase, and send money domestically using PayPal. But the platform does charge fees for consumers who send money internationally or from credit cards, as well as those buying crypto.

It's free to use PayPal to donate or to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.

PayPal lets you send personal transactions fee-free if the money comes from your PayPal balance or bank account, but if you use a credit card or debit card, you'll pay a 2.90% fee plus an additional fixed fee based on the currency.

Which money transfer has lowest fees

Lowest fee money transfer options and the pros and cons of each

- Venmo. Venmo doesn't charge fees to send or receive personal funds via a Venmo balance, connected bank account, or debit card, but they do charge 3% to send money via credit card.

- Cash app.

- Zelle.

- Bank transfers or wire transfers.

- Cenoa Super Wallet.

There's no fee for sending money domestically to friends and family from your PayPal balance or bank account. However, if you want to use a credit card to send money, you'll have to pay 2.9% of the transaction plus a fixed fee of $0.30.NEFT is available round the clock i.e., 24×7 and 365 days. Safe and secure fund transfer. There are no charges levied by RBI from banks.

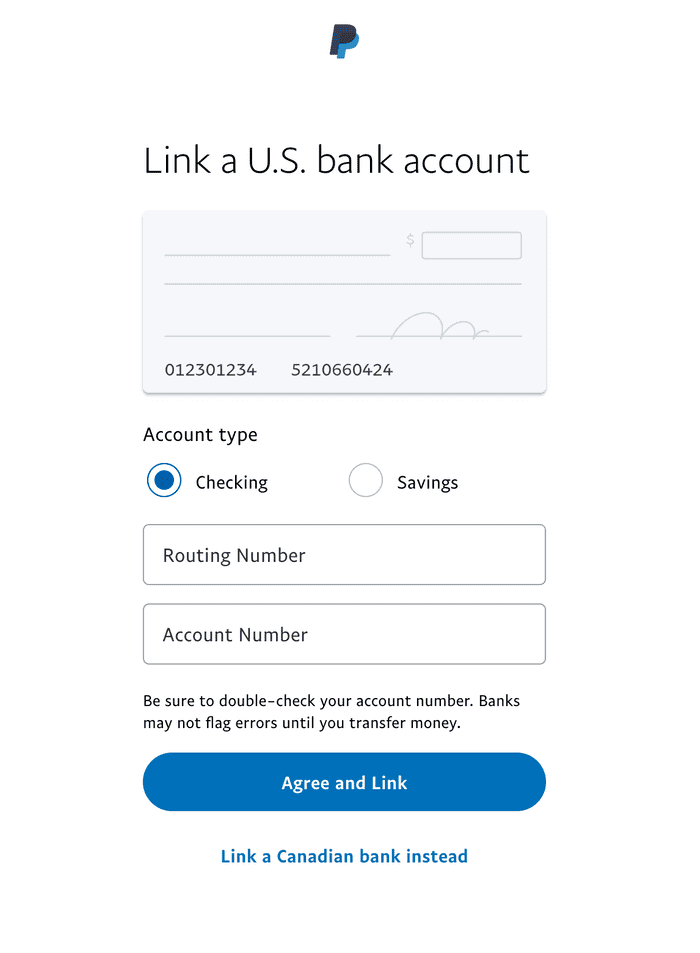

Online transfers are generally free, though some banks do charge, and transfers usually take up to three business days to complete. Check with your institution when setting up a transfer to know when to expect funds to arrive and whether there are fees. Link the two accounts. Provide external account information.

How to avoid PayPal fees : How to avoid PayPal fees

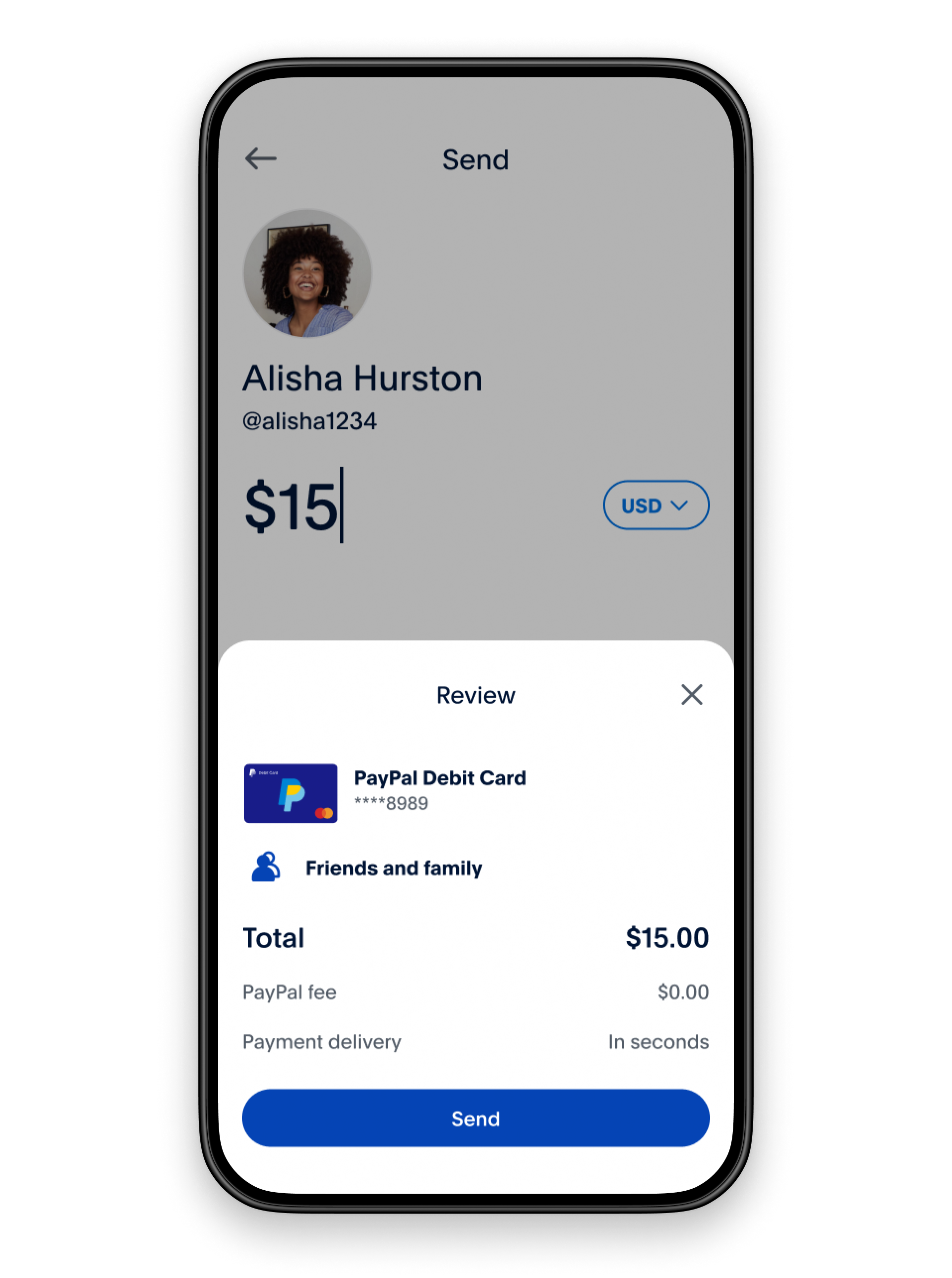

- Use the "Friends and Family" option. When sending money through PayPal, you have the option to use the 'Friends and Family' category instead of 'Goods and Services'.

- Receive payments in the same currency.

- Offer local pickup or delivery options.

- Use other payment methods if possible.

How much is the PayPal fee for $100 : $3.98

How much is the PayPal fee for $100 For the most common PayPal fee of 3.49% + $0.49, the fee for a $100 transaction will be $3.98, making the total money received after fees $96.02. Example 1: You send an invoice to a client for $500 to be paid via PayPal Checkout or Guest Checkout.

How do I avoid PayPal fees

How to avoid PayPal fees

- Use the "Friends and Family" option. When sending money through PayPal, you have the option to use the 'Friends and Family' category instead of 'Goods and Services'.

- Receive payments in the same currency.

- Offer local pickup or delivery options.

- Use other payment methods if possible.

The PayPal transaction fee is waived if you send money from your online PayPal account, a linked bank account, or from the PayPal Cash app. But you'll be hit with a 2.9% fee and a 30-cent fixed transaction fee if you make a payment with your PayPal credit, debit, or credit card.Fees for Swift payments

Your bank will likely charge a fee to make a Swift transfer to Wise. When the money is in transit, correspondent banks in between may also deduct their handling fees.

Is International bank transfer free : Some banks may charge for incoming international transfers. Your payees will need to check with their banks on these charges as they vary and will be debited from the payee's account.