Antwort Does wise use Swift system? Weitere Antworten – Does Wise use a SWIFT code

Wise can send or receive certain currencies via Swift payment.How our US entity, Wise US Inc. protects customer funds

| Type | Institution |

|---|---|

| Cash Deposit | GOLDMAN SACHS BANK USA |

| Cash Deposit | JPMORGAN CHASE BANK, N.A. |

| Secure Liquid Assets | US Government Bonds |

In short, SWIFT is the name of the overall messaging system, and BIC is the code used for the system—or the 'Bank Identifier Code'. Both terms are used interchangeably to describe the code, or even the system. This means that if you request your SWIFT or BIC code, you'll receive the exact same 8-11 digit number.

What is the SWIFT code for Wise BIC : TRWIGB2BXXX

WISE PAYMENTS LIMITED

| SWIFT code | TRWIGB2BXXX |

|---|---|

| Swift code (8 characters) | TRWIGB2B |

| Branch name | WISE PAYMENTS LIMITED |

| Branch address | FLOOR 6, TEA BUILDING, 56 SHOREDITCH HIGH STREET |

| Branch code | XXX |

Is Wise a real bank

No, you cannot use Wise as a bank account, because Wise is not a bank, it's a Money Services Business. However, with the Wise Account you'll get some features which are similar to those available from bank accounts, such as the option to hold a balance, send and receive payments, and spend with a linked card.

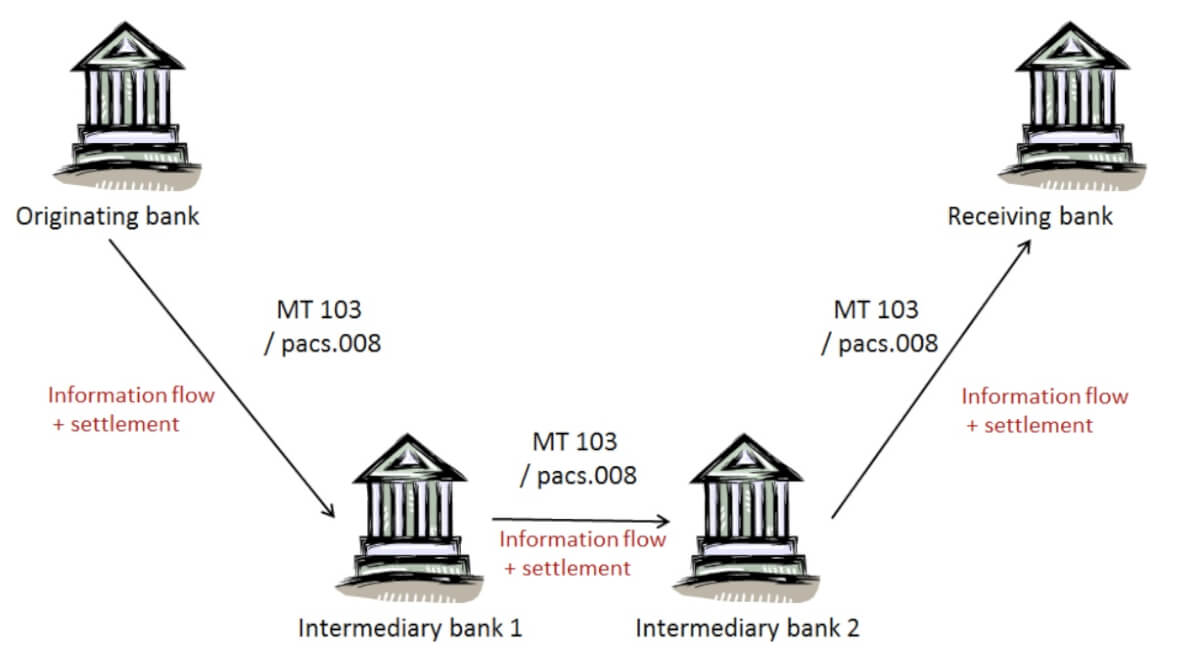

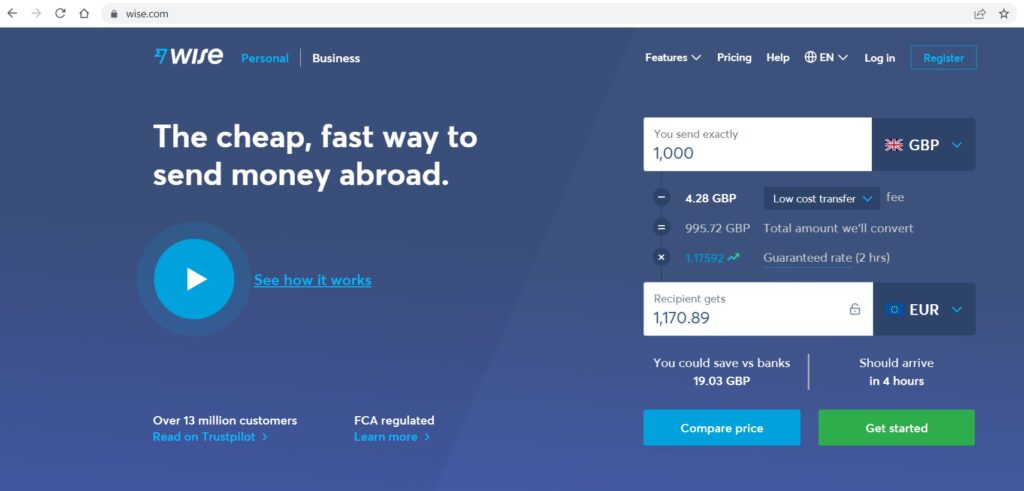

What is the difference between Wise transfer and SWIFT transfer : Opting for swift transfers through Wise is the economical way to transfer money abroad, but it's typically the slowest. It typically takes two days for Wise to receive your funds, followed by an additional two days to transfer the money to your recipient's bank account.

Customer ratings. Both money transfer companies are regarded highly by their users. Wise gets 4.3 out of 5 on Trustpilot from more than 218,000 reviews. Revolut has a rating of 4.2 out of 5 from 152,000 reviews.

Wise isn't a bank, but a money services provider (MSB), so you won't get all the same features you might get from a bank account – but you'll be able to: Hold and exchange 40+ currencies. Exchange between currencies with the mid-market rate and low fees* Order a Wise card for international spending and cash withdrawals.

Do I need both IBAN and SWIFT code

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.You should give your IBAN and BIC to anyone who needs to make payments to you from abroad. Businesses should quote their IBAN and BIC on invoices they issue internationally and look out for IBAN and BIC on invoices received.You can usually find your bank's SWIFT/BIC code in your bank account statements. You also can use our SWIFT/BIC finder to get the right code for your transfer.

Whenever you hold funds in a Wise account your money is safeguarded by being held in top tier banks and assets, separate from Wise's own working capital⁴. This keeps customers' money safe, and also means funds are available whenever they're needed, so you can spend or withdraw your Wise balance whenever you like.

Is Wise better than bank transfer : Is Wise better than a bank Wise isn't a bank and doesn't offer all the same services a regular bank might. But if you want international transfers or a multi-currency account, Wise has a better range and lower costs than many banks.

Can I use Wise as a bank account : No, you cannot use Wise as a bank account, because Wise is not a bank, it's a Money Services Business. However, with the Wise Account you'll get some features which are similar to those available from bank accounts, such as the option to hold a balance, send and receive payments, and spend with a linked card.

Can Revolut transfer money to Wise

Here's how to send money from Revolut to Wise: Log into Revolut and tap Transfer. Tap + New, then Bank Recipient. Enter the Wise account details for the currency you want to receive.

You can get your own free IBAN with Wise.

Wise gives you your own European IBAN, along with bank details for the UK, US, Australia, New Zealand and more.You can get your own free IBAN with Wise.

Wise gives you your own European IBAN, along with bank details for the UK, US, Australia, New Zealand and more.

What is the difference between IBAN and SWIFT Wise : IBANs identify individual bank accounts for domestic and international payments. They're mostly used in Europe, but other countries around the world are starting to adopt the same system. SWIFT codes help to identify bank branches for international payments. They're used all over the world.