Antwort Does swap cost money? Weitere Antworten – How does currency swap work

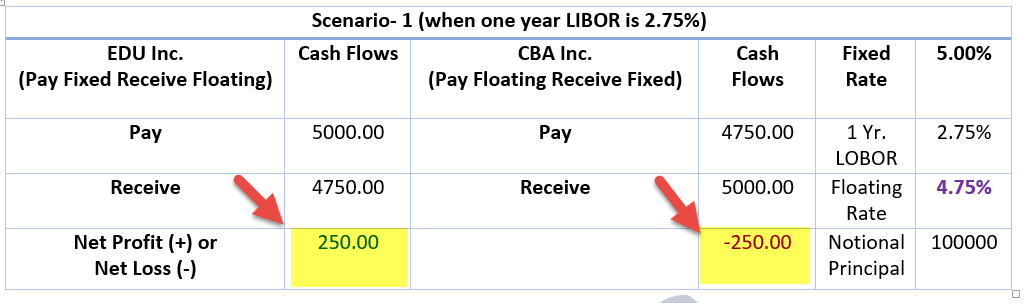

A currency swap is an agreement in which two parties exchange the principal amount of a loan and the interest in one currency for the principal and interest in another currency. At the inception of the swap, the equivalent principal amounts are exchanged at the spot rate.Pricing a currency swap involves solving the appropriate notional amount in one currency, given the notional amount in the other currency, and determining the two fixed interest rates. The currency swap value is zero at the time of initiation.In a currency swap, or FX swap, the counterparties exchange given amounts in the two currencies. For example, one party might receive 100 million British pounds (GBP), while the other receives $125 million. This implies a GBP/USD exchange rate of 1.25.

What is a principal only swap : There are four types of swaps: Principal only swap (POS), A POS is an exchange of principal in two currencies on specific dates with an exchange of fixed interest payments in the two currencies on specific dates.

What is currency swap charge

In online forex trading, a swap is a rollover interest that you earn or pay for holding your positions overnight. The swap charge depends on the underlying interest rates of the currencies involved, and whether you are long or short on the currency pair involved.

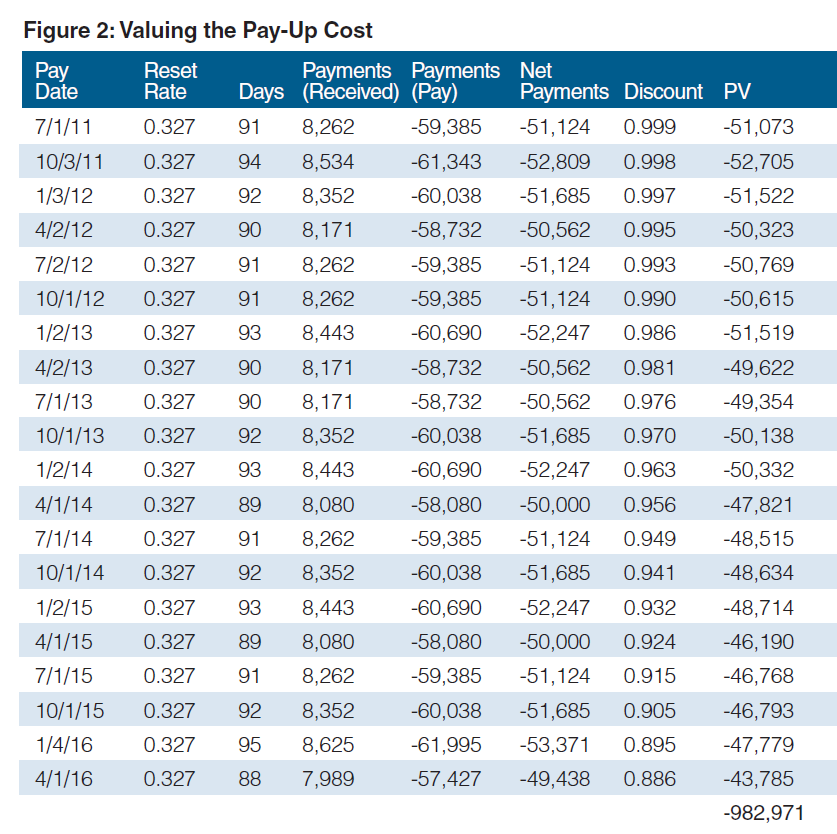

What is FX swap cost : Pricing for FX Swap. – Swap price in FX Swap deal means the difference between the Spot rate and the Forward rate that are applied on Swap deal. In theory, it is determined as per the difference between the two currencies in pursuant to “Interest Rate Parity Theory”.

A swap is priced by solving for the par swap rate, a fixed rate that sets the present value of all future expected floating cash flows equal to the present value of all future fixed cash flows. The value of a swap at inception is zero (ignoring transaction and counterparty credit costs).

A swap fee in Forex, also known as a rollover fee, is interest that traders pay for maintaining a position until the end of the trading day. If traders maintain their positions at the daily rollover point, which occurs at 00:00 server time (or "tomorrow next"), the swap fee will be applied.

What is swap free in forex

Recently, forex swap-free accounts or Islamic accounts have been introduced in the forex market. Traders do not have to pay a commission for using such accounts. In other words, a broker does not debit any money from an Islamic account for an overnight position on any currency pair.Swap fees are charged when trading on leverage. The reason for this being that when you open a leveraged position, you are essentially borrowing funds to place the trade. In the Forex market every time you open a position you are essentially making two trades, buying one currency in the pair and selling the other.Offers an economic benefit – Executing a swap will generate non-interest income for the bank. This fee income is recognized in the period the swap is executed and is NOT amortized over the life of the loan.

Swap rates are charged when trading on leverage. This is because when you open a leveraged position, you are essentially borrowing funds to open the position. For example, every time you open a position in the Forex market, you effectively make two trades, buying οne currency in the pair and selling the οther.

Why is there swap fee : A swap fee in Forex, also known as a rollover fee, is interest that traders pay for maintaining a position until the end of the trading day. If traders maintain their positions at the daily rollover point, which occurs at 00:00 server time (or "tomorrow next"), the swap fee will be applied.

How do you avoid swap fees : How to Avoid Swap Fees. Retail traders can avoid swap charges if they open and close their trades during the same trading session. This is done in high frequency trading and intraday trading. Opening and closing trades during the same trading session also reduces trading risks for the trader.

Is Forex com swap-free

Yes, FOREX.com offers swap-free accounts in certain circumstances. For more information, please contact us.

The ability to quickly buy and sell an asset without having an impact on its price is referred to as liquidity. Because they frequently have a larger user base and a wider variety of trading pairs than crypto swaps, cryptocurrency exchanges frequently have higher liquidity than crypto swaps.A 'swap' is a rollover interest or commission that brokers charge when traders keep their position open for more than a day (overnight). This means that you can trade without incurring any overnight fees. A swap-free trading account does not generate interest, making it ideal for Muslim traders.

Why are swaps risky : What are the risks. Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk.

:max_bytes(150000):strip_icc()/interest-rate-swap-4194467-1-d72db15d28f64e9b801fe940e5999c51.jpg)