Antwort Does N26 use Wise? Weitere Antworten – Is TransferWise a partnership with N26

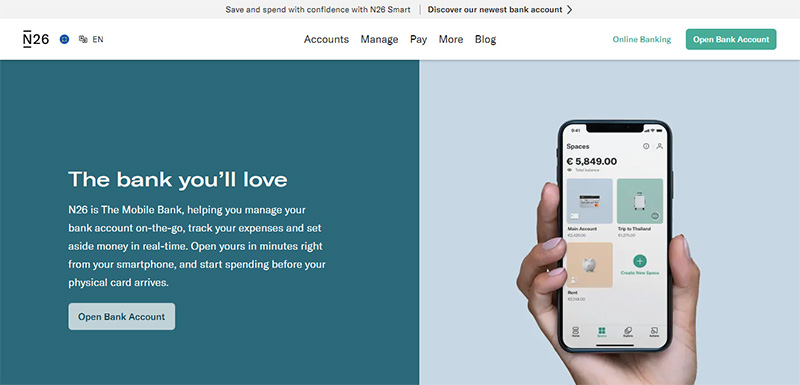

Today, we're excited to announce that N26, the Berlin based mobile bank, has joined the TransferWise revolution. This, our second partnership in 2016, means that N26 users will be able to take advantage of TransferWise's fast, fair overseas transfers – from within the N26 experience.Wise may be more attractive to users who frequently send money internationally or need multi-currency accounts, while N26 may be a better fit for users looking for low-cost banking services with additional features and benefits for frequent travelers.You don't need a Wise login to send payments internationally, as N26 has partnered with Wise to power payments directly through the N26 app.

Which bank does Wise use : How our US entity, Wise US Inc. protects customer funds

| Type | Institution |

|---|---|

| Cash Deposit | GOLDMAN SACHS BANK USA |

| Cash Deposit | JPMORGAN CHASE BANK, N.A. |

| Secure Liquid Assets | US Government Bonds |

Should I use Revolut or Wise

Revolut offers premium accounts with a monthly fee that offer higher limits for fee-free transactions. While Wise can facilitate foreign exchange transactions in 40 currencies and operates in 160 countries, Revolut can send money in 70 currencies to 160 countries, according to their respective websites.

Which bank owns N26 : N26

| Formerly | Number 26 (2013–2016) |

|---|---|

| Key people | Valentin Stalf (co-CEO) Maximilian Tayenthal (co-CEO) |

| Services | Direct bank |

| Revenue | 120,375,000 Euro (2021) |

| Owner | N26 AG |

IndusInd Bank

IndusInd Bank partners with Wise on multi-partner Indus Fast Remit platform to offer low-cost and seamless online inward remittance to India.

Customer ratings. Both money transfer companies are regarded highly by their users. Wise gets 4.3 out of 5 on Trustpilot from more than 218,000 reviews. Revolut has a rating of 4.2 out of 5 from 152,000 reviews.

Is Revolut better than N26

They both have good features. N26 is cheaper but offers more features. And the premium options of N26 are more expensive than the premium options of Revolut.No, you cannot use Wise as a bank account, because Wise is not a bank, it's a Money Services Business. However, with the Wise Account you'll get some features which are similar to those available from bank accounts, such as the option to hold a balance, send and receive payments, and spend with a linked card.N26's 500,000 American customers will no longer be able to use its app from Jan. 11, 2022, the company said in a statement Thursday. The Berlin-based fintech, which was valued at $9 billion in a recent funding round, said it wanted to shift focus to its core European business.

As of 2023, Wise partners with BlackRock for its interest bearing accounts.

Who owns Wise : Who owns Wise Wise started over 10 years ago, and in that time, we've raised money to help us grow. Today, Wise is owned by a number of venture capital firms that invested in us, our co-founders Kristo and Taavet, and over 4,000 current and former Wisers (employees).

Is Revolut better or Wise : Both money transfer companies are regarded highly by their users. Wise gets 4.3 out of 5 on Trustpilot from more than 218,000 reviews. Revolut has a rating of 4.2 out of 5 from 152,000 reviews.

What are the disadvantages of N26

Disadvantages of N26

No Physical Checks: N26 does not offer the option to write physical checks, which may be a drawback for some customers. Limited Customer Support: N26 offers limited customer support, with the only option being email or through its in-app support center.

The standard N26 bank account is free and doesn't charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 You bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month. To open an N26 account, no deposit or minimum income is required.Wise Payments Malaysia Sdn. Bhd. is regulated under the laws of Malaysia by the Bank Negara Malaysia as a licensed remittance, money-changing and e-money issuance business.

Why is Revolut better than N26 : Similarly, when it comes to taking out cash abroad N26 will offer you a charge of 1.7% on all transactions, while Revolut offers free transactions up to €200 a month with a 2% charge added after this limit. This is far better than the current 3-4% offered by most Irish banks.