Antwort Does HSBC charge abroad? Weitere Antworten – Can I use my HSBC account in another country

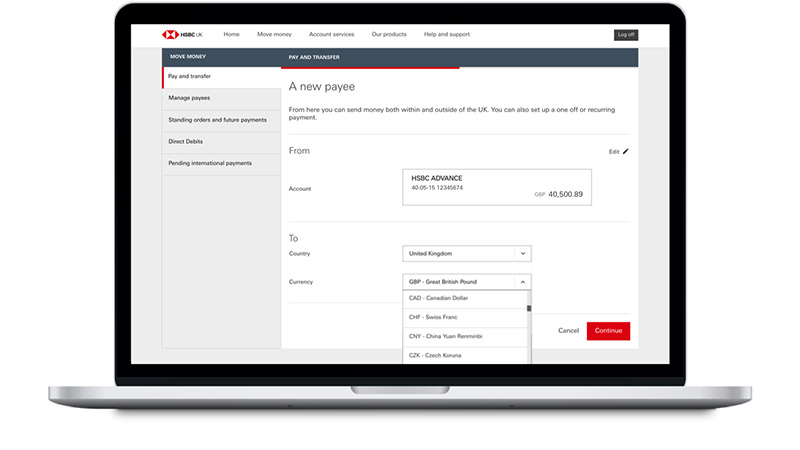

With an overseas account you can manage your accounts and bank seamlessly internationally: Open an account for free with no annual account fees and free instant Global Transfers. View all of your HSBC accounts together in one place. Maintain a minimum account balance in just one home country/region.If you're transferring money online to another one of your HSBC accounts, there is no limit to how much you can move. If you're paying bills or making payments to friends and family – there is a daily limit for online bank transfers of £25,000.When your overseas trading partners pay by cheque, you can pay them into your account and access your money quickly using one of our processing services.

Are there HSBC ATMs in Italy : +39 02 724371. HSBC regrets to inform that it does not offer personal banking services in Italy and therefore cannot provide any cash facilities or ATMs.

How much does HSBC charge for foreign transactions

Overseas usage fees

| Credit card | HSBC Credit Card Find out moreFind out more link to HSBC credit card page |

|---|---|

| Purchases | Non-sterling transaction fee 2.99% |

| Withdrawals | Cash fee 2.99% (minimum GBP 3.00) Non-sterling transaction fee 2.99% |

How much does HSBC charge for using a debit card abroad : 2.75%Fees and exchange rates – how much it costs to use your HSBC debit card abroad

| HSBC account | Fee for debit card payments in foreign currency | Fee for ATM withdrawals in foreign currency |

|---|---|---|

| Global Money Account | 0% | 0% |

| HSBC Premier Account | 2.75% | 2.75% |

| All other HSBC accounts | 2.75% | 2.75% + 2% (max.£5) |

28. 6. 2023

Global View and Global Transfers are available in Australia, Bahrain, Bermuda, Channel Islands, Mainland China, Egypt, Hong Kong SAR, India, Indonesia, Isle of Man, Philippines, Jersey (HSBC Expat), Malaysia, Malta, Mexico, Qatar, Singapore, Sri Lanka, Taiwan, UAE, UK, US and Vietnam.

$10,000 USD

Any international money transfer exceeding $10,000 USD must be reported to the US government on a Foreign Bank Account Report per the Bank Secrecy Act. Many people wonder, “Do large bank transfers take longer than online services” Typically, the answer is yes.

How do I tell HSBC I am going abroad

There's no need to inform us before you travel. You can let us know it's you using your card abroad by making a chip and PIN payment when you arrive. Please make sure your contact details are up to date so we can get in touch if there are any problems.No ATM or transaction fees to access the local currency in Australia or anywhere in the world – some ATM providers and merchants may charge a separate fee. Withdraw your money in the local currency via thousands of HSBC ATMs globally.You can use your HSBC Global Private Banking Mastercard® Debit Card / HSBC Jade Mastercard® Debit Card to withdraw cash overseas at any HSBC Group ATM, or at ATMs carrying the Mastercard or Cirrus logo, for free and at the HSBC preferential rate.

For cash withdrawals on your debit card outside the UK in a foreign currency, we will charge you a 2.75% fee (which will show on your statement as 'non-sterling transaction fee'). Please be aware that some cash machine operators may also apply a direct charge for withdrawals from their cash machines.

Which HSBC card has no foreign transaction fee : The HSBC World Elite Mastercard was much beloved as a travel card due to its many keystone features: no foreign transaction fees, flexible points, a $100 annual travel enhancement credit, World Elite Mastercard benefits, strong insurance, and more.

Is there a fee for HSBC to HSBC international transfer : Most HSBC to HSBC transfers are fee-free, but some intermediary banks may charge fees. You can see an estimate of the applicable fees when you review your transfer. The actual amount is subject to the intermediary bank and will be debited after you've confirmed your transfer.

Is HSBC Global Transfer free

Free of charge

HSBC Global Private Banking, HSBC Premier Elite, HSBC Premier and HSBC One customers can exclusively enjoy fee-free Global Transfers round the clock for eligible countries/regions and currencies.

If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.Generally speaking, senders and recipients will need to provide documents confirming at least some of the following details:

- Payment purpose.

- Relationship between sender and recipient.

- Date of birth.

- Address.

- Occupation and business.

- Nationality and place of residence.

- Bank details.

- Source of funds for remittance.

Do HSBC charge for using debit card abroad : If you use your debit card to make a payment or buy something in a foreign currency, we will charge you a 2.75% fee (which will show on your statement as 'non-sterling transaction fee'). If you buy something in GBP sterling whilst outside of the UK, we will not charge this fee.