Antwort Do banks have a GPI code? Weitere Antworten – What is the gpi code in banking

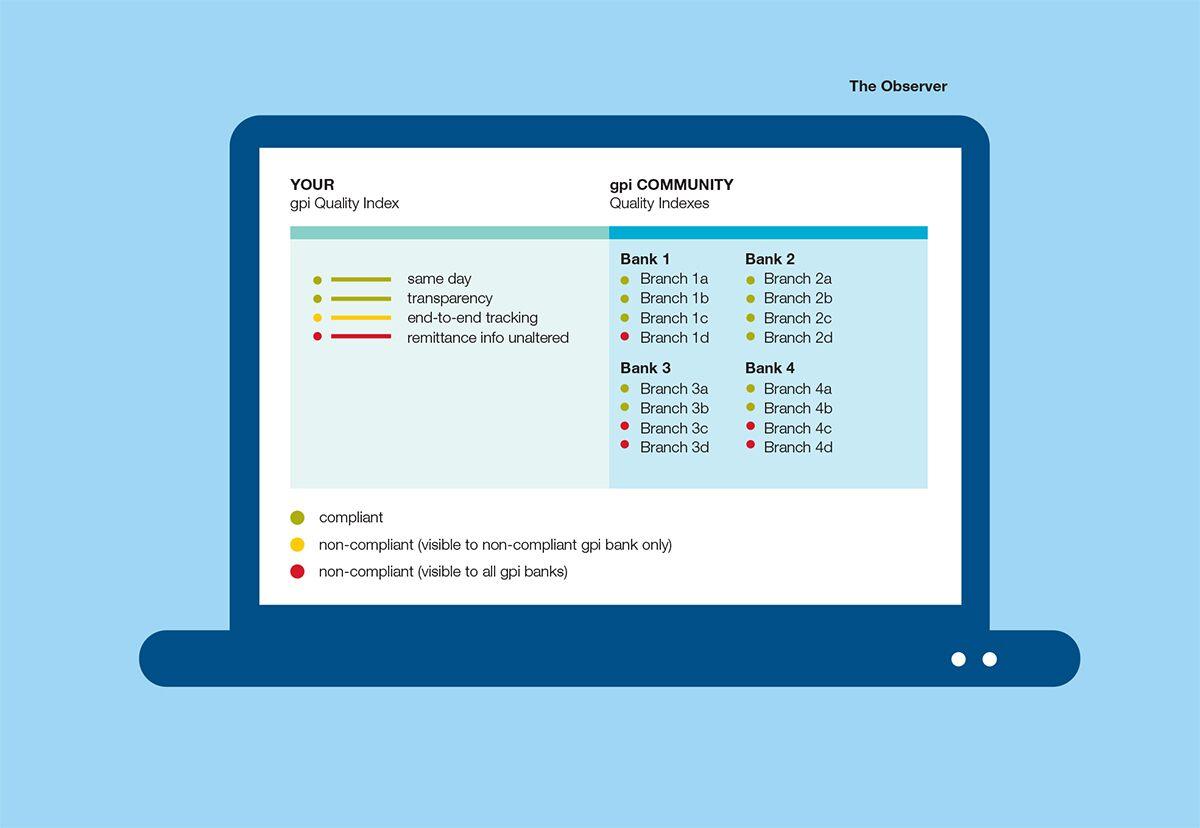

What is SWIFT gpi SWIFT gpi (gpi stands for Global Payments Innovation) is a new initiative from SWIFT and was developed to improve the experience of making a payment via the SWIFT network for both customers and banks. SWIFT gpi combines the traditional SWIFT messaging and banking system with a new set of rules.ABN AMRO, Bank of China, BBVA, Citi, Danske Bank, DBS Bank, Industrial and Commercial Bank of China, ING Bank, Intesa Sanpaolo, Nordea Bank, Standard Chartered Bank and UniCredit are live with SWIFT gpi, exchanging gpi payments across 60 country corridors.SWIFT gpi combines domestic real-time payment networks to deliver cross border payments almost instantly and without the restrictions of bank operating hours. Each transaction is assigned a Unique End-to-End Transaction Reference (UETR) that payment providers can use to trace the transfer from start to finish.

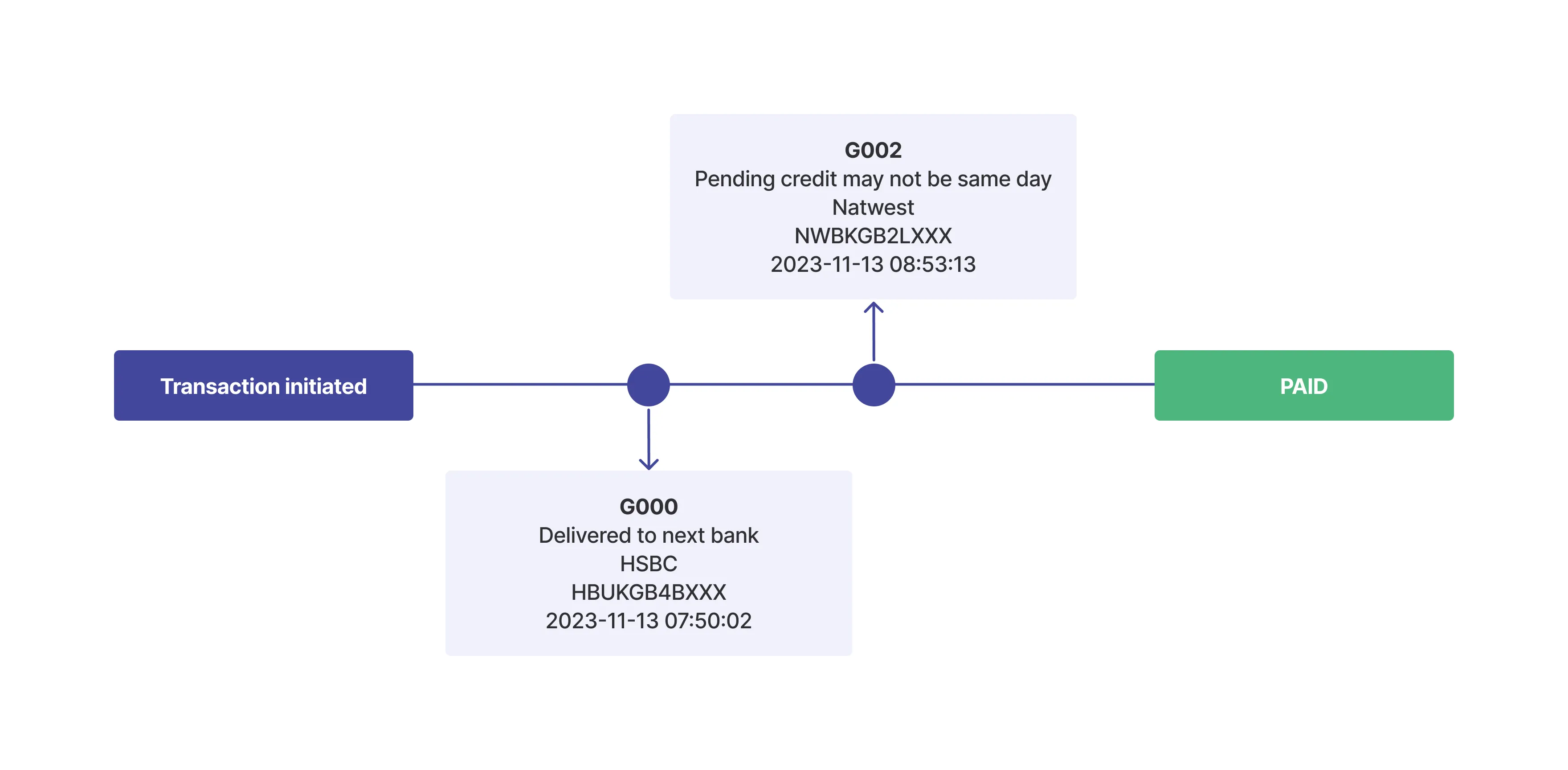

How do I receive my SWIFT GPI payment : How It Works

- The sender initiates.

- The sender Sends payment. The sender's bank then sends the payment to the SWIFT network, along with a unique tracking number called a UETR (Unique End-to-End Transaction Reference).

- The funds are delivered to receiving bank.

- The recipient receives Funds.

Is SWIFT gpi mandatory

SWIFT gpi is an optional service on SWIFT network and operates on the basis of business rules and technical specifications captured in rulebooks between gpi customers (i.e. financial institutions who are SWIFT users and signed up for the gpi service).

Which countries use SWIFT GPI : Societe Generale today launched SWIFT gpi in nine new countries: Germany, Belgium, Spain, Italy, Netherlands, United Kingdom and Switzerland in Europe, as well as Hong Kong and Singapore in Asia.

As of now, 100 banks in the APAC region, delivering 90 percent of traffic are gpi-enabled or in the process of enabling while globally 3500 banks have committed to adoption of gpi, SWIFT said. In 2018, the payments platform handled over $40 trillion worth of transactions globally.

Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

What is the difference between SWIFT go and SWIFT GPI

At a high level, Swift GPI is intended to increase the speed and transparency of high-value payments, with or without foreign exchange. Swift Go is intended to support low-value and cross-border payments by guaranteeing that the principal amount is not adjusted throughout its lifecycle.No, all financial institutions, especially some small banks and credit unions, don't have SWIFT codes. Instead, these institutions contact banks that do have BIC/ SWIFT codes, and ask them to serve as intermediaries for wiring money.MT103 DIRECT CASH TRANSFER GPI SUPPORT (SERVER TO BANK) The transaction is between the sender bank's server to the receiving IP REST (HOST SERVER) which is. connected to the common account of the branch (not the treasury of the bank).

How can I find out my bank's SWIFT code Most banks include their SWIFT code in customer account details and on their mobile apps, websites and statements. Otherwise, you can request it at your branch. You can find the bank's SWIFT/BIC code or an IBAN on some websites.

Are IBAN and SWIFT code the same : How does an IBAN differ from a SWIFT code Whilst a SWIFT code is used to determine a particular bank, your IBAN identifies the individual bank account you're using for international bank transfers.

Is SWIFT GPI mandatory : SWIFT gpi is an optional service on SWIFT network and operates on the basis of business rules and technical specifications captured in rulebooks between gpi customers (i.e. financial institutions who are SWIFT users and signed up for the gpi service).

Do all banks have a SWIFT code

Whilst most banks have a BIC / SWIFT code assigned to them, there are some financial institutions that do not use them. A number of smaller banks and credit unions in the United States do not connect to the SWIFT network, which means that they do not use international routing codes.

Not all banks and financial institutions use SWIFT codes. If yours doesn't, ask what number should be used in its place for sending or receiving international money transfers.BIC (SWIFT code)

A Bank Identifier Code (BIC) is a standard format used to help identify banks worldwide. You'll need a BIC for someone to send you an international payment, such as a SWIFT payment. This is why a BIC is sometimes called a SWIFT code.

Why doesn’t my bank have a SWIFT code : Do all banks have a BIC/SWIFT code for international transactions No — some U.S. credit unions and small banks are not part of the SWIFT system. But if you work with a small bank for your business, this isn't a be-all-end-all: They might still be able to receive and send money internationally.