Antwort Can you do a 15 year mortgage? Weitere Antworten – Can I get a 15-year fixed-rate mortgage

However, there are a few lenders that offer fixed rate mortgages for 15 years, so it is worth shopping around to find the best deal if you feel that a 15-year fixed-rate mortgage is what you need.A 15-year mortgage is a loan for buying a home whereby the interest rate and monthly payment are fixed throughout the life of the loan, which is 15 years. Some borrowers opt for the 15-year vs. a 30-year mortgage (a more conventional choice) since it can save them a significant amount of money in the long term.Buying a new home is not the only time to consider a 15-year mortgage loan. You can also refinance to a 15-year mortgage to leverage the benefits of a shorter loan term. If you started with a 30-year mortgage and interest rates have dropped since then, it might be a good idea to consider refinancing.

Can you get a 15-year home loan : Financially Stable Borrowers: If you have a stable income and can comfortably afford higher monthly repayments, a 15-year fixed rate home loan can be a smart option. The shorter loan term allows you to build equity in your home faster and pay off the loan sooner.

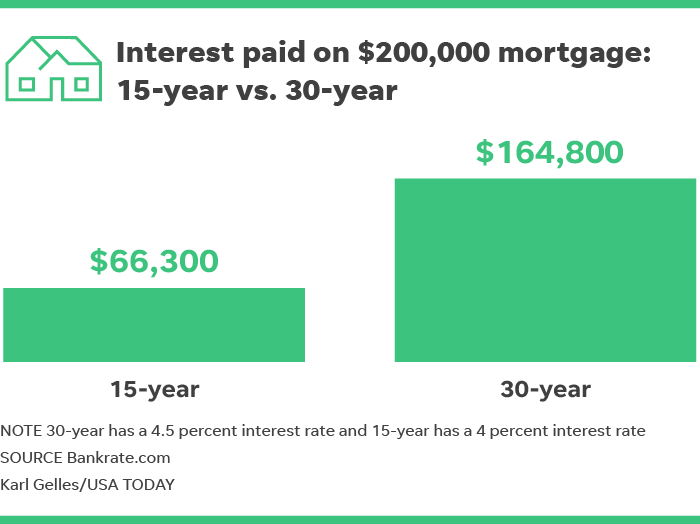

Which is better, a 15 or 30-year mortgage

If your aim is to pay off the mortgage sooner and you can afford higher monthly payments, a 15-year loan might be a better choice. The lower monthly payment of a 30-year loan, on the other hand, may allow you to buy more house or free up funds for other financial goals. Freddie Mac. "Finding the Right Loan."

Can I change my 30-year mortgage to a 15-year : If you're a homeowner looking to pay off your home sooner, refinancing can even allow you to change your loan term from a 30-year loan to a 15-year loan.

The BECU 12-year mortgage lets you:

Refinance your existing mortgage without additional BECU fees. Enjoy significant savings in interest. Get a loan amount of up to $726,200.

A 15-year mortgage means larger monthly payments, but a lower rate and substantial savings on interest. A 30-year mortgage gives you a more affordable monthly payment, but expect higher borrowing costs overall. You can also take out an interest-only mortgage or pay your loan off early to maximize interest savings.

Can I change my 30-year mortgage to a 15 year

If you're a homeowner looking to pay off your home sooner, refinancing can even allow you to change your loan term from a 30-year loan to a 15-year loan.A 20-year fixed mortgage may be a good option for you if you find the monthly payment on a 30-year mortgage low but the monthly payment on a 15-year mortgage too high. Visit our fixed-rate loan calculator to estimate your 20-year fixed mortgage monthly payment.If you're a homeowner looking to pay off your home sooner, refinancing can even allow you to change your loan term from a 30-year loan to a 15-year loan.

A 15-year mortgage means larger monthly payments, but a lower rate and substantial savings on interest. A 30-year mortgage gives you a more affordable monthly payment, but expect higher borrowing costs overall. You can also take out an interest-only mortgage or pay your loan off early to maximize interest savings.

How to knock 15 years off mortgage : Make extra house payments.

Let's crunch the numbers. We'll say you have a $240,000, 30-year mortgage with a 7% interest rate and a monthly payment of $1,597 for your principal and interest. If you made an extra payment just once every quarter, you'd pay off your house nearly 15 years early!

Can you change 30-year mortgage to 15 : If you're a homeowner looking to pay off your home sooner, refinancing can even allow you to change your loan term from a 30-year loan to a 15-year loan.

Which is better 15 or 20 year mortgage

With a 20-year mortgage, it may take longer to build up equity in your home and pay off your loan, but your monthly payments are significantly lower than they'd be with a 15-year term. While some people like the idea of getting rid of debt faster, others believe it's better to have more financial flexibility.

Disadvantages of a 15-Year Mortgage

- Higher monthly payment.

- May require a smaller house or a home in a less ideal location.

- Less cash available to invest monthly.

If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.

Can I change my 30 year mortgage to a 15 year : If you're a homeowner looking to pay off your home sooner, refinancing can even allow you to change your loan term from a 30-year loan to a 15-year loan.

:max_bytes(150000):strip_icc()/find-and-compare-best-mortgage-rates-4148342_FINAL-d90ea8095a49474f90bee793bf4c5918.png)