Antwort Can I use my HSBC account in another country? Weitere Antworten – Can I access my HSBC account in another country

You can rely on HSBC wherever you travel. While traveling internationally, you will have the peace of mind of knowing that the HSBC Group's ATMs and branch locations offer personal financial services in many countries. Emergency financial support is also available worldwide.Available countries and regions

- Australia.

- HSBC Expat (Offshore banking services)

- China.

- Hong Kong.

- India.

- Singapore.

- UAE.

- USA.

There's no need to inform us before you travel. You can let us know it's you using your card abroad by making a chip and PIN payment when you arrive. Please make sure your contact details are up to date so we can get in touch if there are any problems.

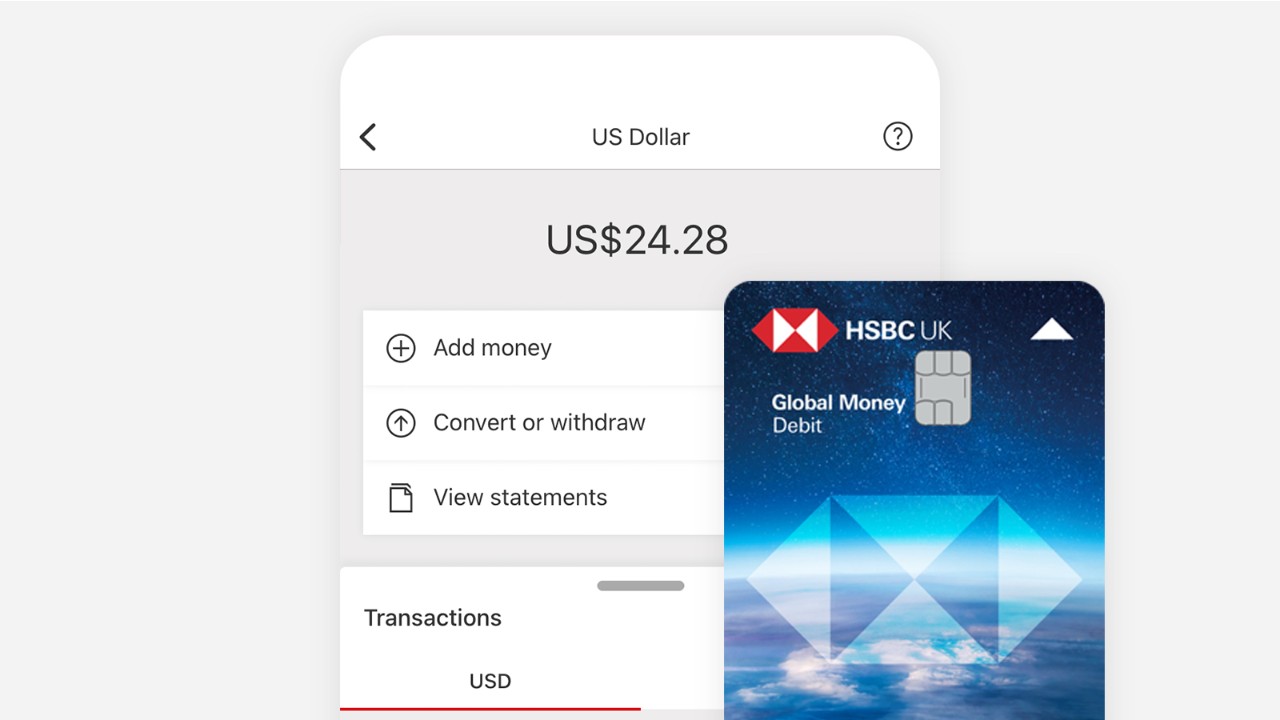

Can HSBC card be used overseas : Yes, simply fund your HSBC Everyday Global Account with the foreign currencies that you intend to spend and transact with your HSBC Everyday Global Debit Card. We will deduct the same transacted amount from your account without any FX fee.

Can I keep a UK bank account if I live abroad

Yes, it is a good idea to tell your bank that you're moving. If you don't, you could find that access to services like online banking is restricted once you've moved abroad. The bank could also freeze or close your account. You don't want to risk cutting off access to your money.

Can I operate my bank account from another country : Offshore banking means you conduct banking services with a financial institution outside your country. To open an account with an offshore bank, you will need to provide proof of your identity and other documents. Banks also may require information on the source of your deposits.

HSBC credit cards don't charge foreign transaction fees. However, if you use your HSBC Debit Mastercard® card, you may be charged a fee for any purchases abroad. This includes international payments made online.

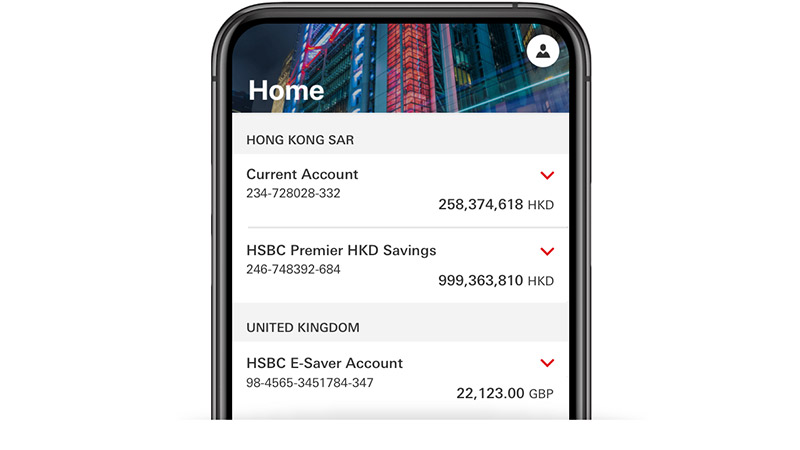

An HSBC Expat Account gives you control of your finances and flexibility when you're living or working abroad. Based in Jersey, Channel Islands – just a short flight from London, an expat account is available in pounds sterling, as well as euros and US dollars, with savings accounts available in many other currencies.

How can I access my bank account while abroad

Using Mobile Banking on your phone or device is an easy way to track what you're spending during your trip. Check the latest transactions and balances, transfer money and even report a lost or stolen card. We recommend connecting to local Wi-Fi hotspots when using Mobile Banking abroad to avoid roaming data charges.HSBC credit cards don't charge foreign transaction fees. However, if you use your HSBC Debit Mastercard® card, you may be charged a fee for any purchases abroad. This includes international payments made online.You can use your credit card abroad to withdraw local currency at cash machines, but you may be charged a non-sterling cash fee, as well as a cash advance fee, on every amount you withdraw. If you need cash, either get travel money before you go, or use your debit card to withdraw.

I'm an EU citizen living in the EU; will I still be able to have an HSBC UK Bank Account after Brexit Yes, you'll still have access to all your existing accounts as you currently do, provided you use them at least once every 12 months.

Can I have an UK bank account if I don’t live in the UK : UK Bank Account for Non-Residents – Documents Needed

To open a bank account, you will need identification. As a non-resident, opening a UK bank account will require a passport and drivers' license, but your bank may also request other documents, particularly one that shows your current address.

Is it good to have a bank account in another country : A foreign savings account provides investment opportunities, access to financial instruments in the country where it is held, and protection against possible economic turbulence in certain countries. Sometimes, banks located outside the U.S. pay higher savings interest rates as well.

How much money can you have in a foreign bank account

$10,000

Who Must File the FBAR A United States person that has a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year.

Call 1800-HSBC NOW (1800-4722 669) or (65) 64722 669 if you are overseas. Select '*', then select '4' for Card Activation and follow the instructions.No ATM or transaction fees to access the local currency in Australia or anywhere in the world – some ATM providers and merchants may charge a separate fee. Withdraw your money in the local currency via thousands of HSBC ATMs globally.

Can I keep my UK bank account if I leave the country : Yes, it is a good idea to tell your bank that you're moving. If you don't, you could find that access to services like online banking is restricted once you've moved abroad. The bank could also freeze or close your account.