Antwort Can I transfer my HSBC account to another country? Weitere Antworten – Can I transfer from HSBC account to another country

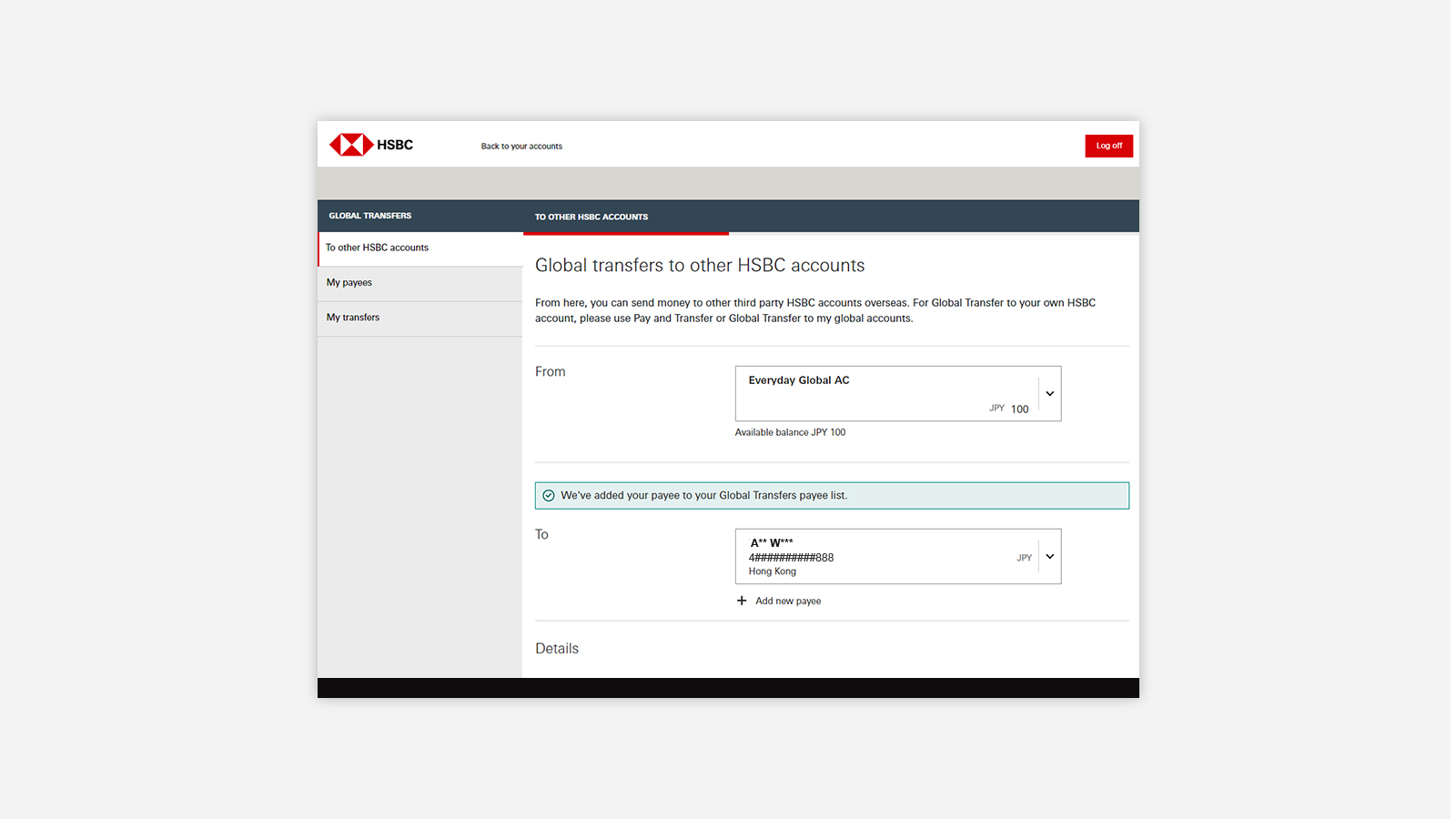

HSBC Global Money Transfers lets you send money overseas faster and fee-free, with just a few taps on the HSBC Mobile Banking app. Other non-HSBC charges may apply.You can rely on HSBC wherever you travel. While traveling internationally, you will have the peace of mind of knowing that the HSBC Group's ATMs and branch locations offer personal financial services in many countries. Emergency financial support is also available worldwide.And accept the terms and conditions. Then you'll be redirected to your selected country's online banking input your logon details used for the selected country. This will be a one-time only login to

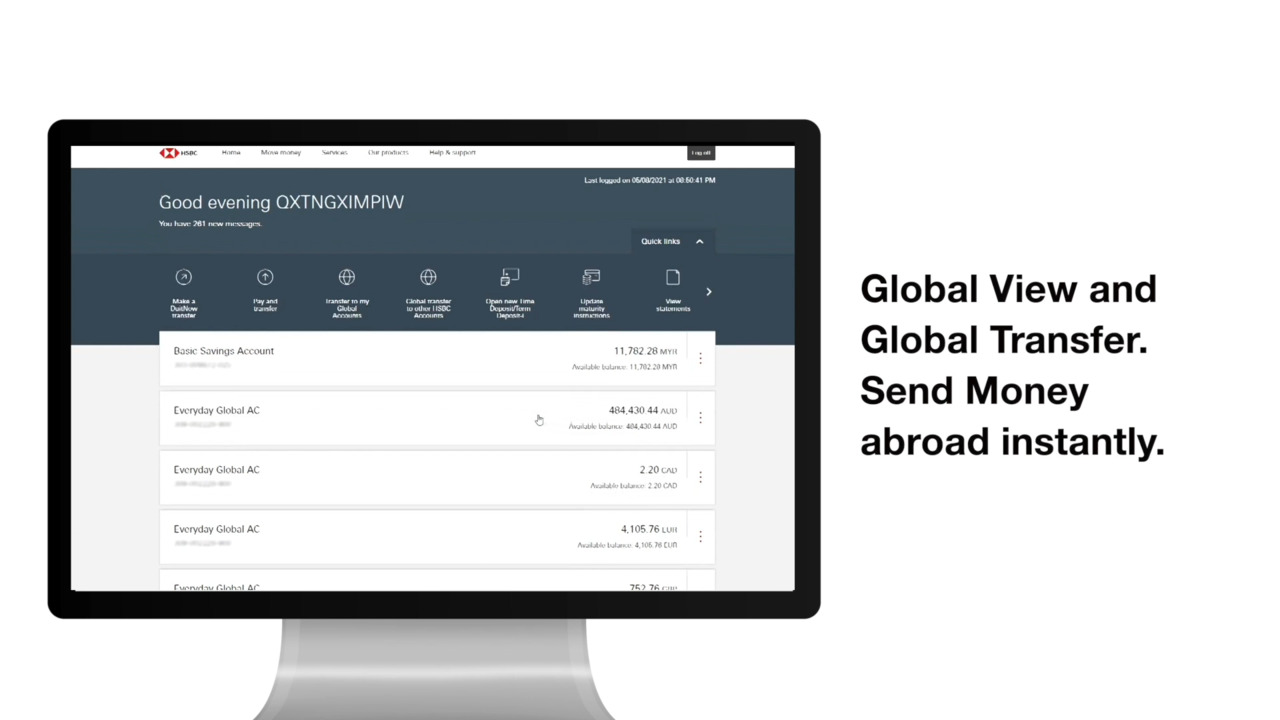

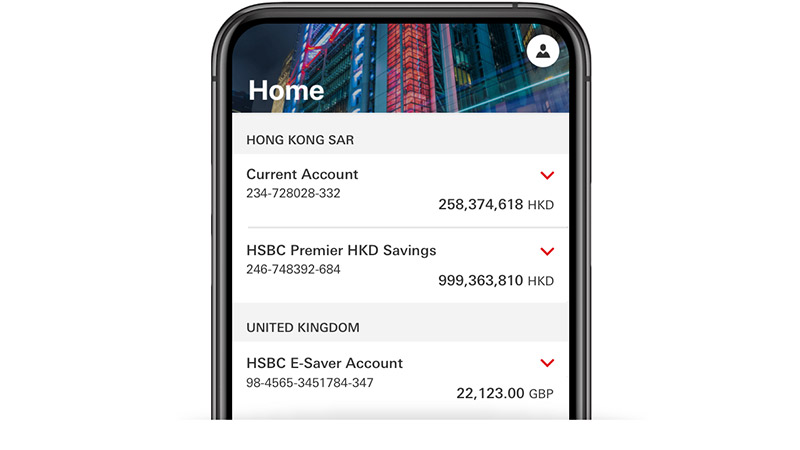

Which countries are covered by HSBC Global Transfer : Global View and Global Transfers are available in Australia, Bahrain, Bermuda, Channel Islands, Mainland China, Egypt, Hong Kong SAR, India, Indonesia, Isle of Man, Philippines, Jersey (HSBC Expat), Malaysia, Malta, Mexico, Qatar, Singapore, Sri Lanka, Taiwan, UAE, UK, US and Vietnam.

Can I keep my UK bank account if I move abroad

Yes, it is a good idea to tell your bank that you're moving. If you don't, you could find that access to services like online banking is restricted once you've moved abroad. The bank could also freeze or close your account. You don't want to risk cutting off access to your money.

Can I have a UK HSBC bank account if I live abroad : You can set up an HSBC UK bank account from many locations abroad. Once you've chosen your preferred account, use the apply button to find out if you might be eligible.

An HSBC Expat Account gives you control of your finances and flexibility when you're living or working abroad. Based in Jersey, Channel Islands – just a short flight from London, an expat account is available in pounds sterling, as well as euros and US dollars, with savings accounts available in many other currencies.

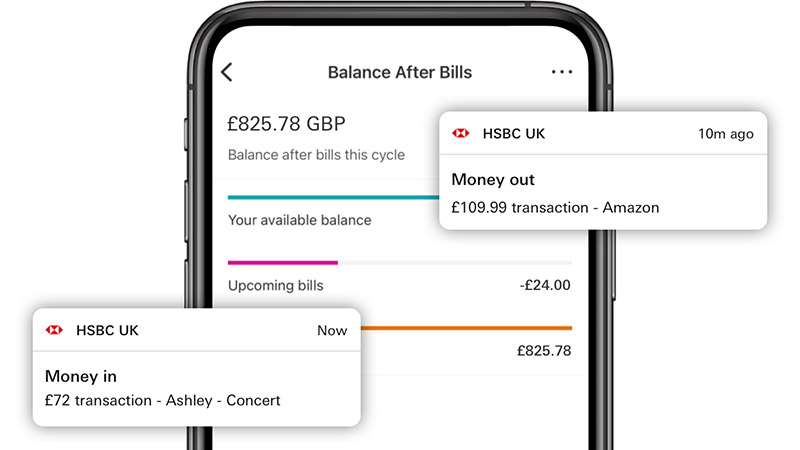

An easy, quick way to send and receive money worldwide

With HSBC you can do it securely via the app or online, at any time and in local currency. Plus, we only use up-to-date exchange rates during market hours.

How can I transfer internationally

International money transfer

- MoneyGram. Send money to overseas from 7,000 branches nationwide.

- Western Union. Send money to over 200 countries and territories with low fees and exchange rates.

- Western Union in-branch. Send money from one of 3,800 participating Post Office branches.

Free of charge

HSBC Global Private Banking, HSBC Premier Elite, HSBC Premier and HSBC One customers can exclusively enjoy fee-free Global Transfers round the clock for eligible countries/regions and currencies.Many major UK banks also have so-called 'international' or 'expat' accounts, like the HSBC expat bank account. These are designed specifically for non-residents, so they're a great option if you don't have the documents to prove your UK address. In fact, you can even apply for an international account online.

Most countries will allow foreign nationals to open a bank account on their shores as long as they can provide proof of legal residence in that country (and other necessary documentation).

Can I keep my UK bank account if I leave the country : Yes, it is a good idea to tell your bank that you're moving. If you don't, you could find that access to services like online banking is restricted once you've moved abroad. The bank could also freeze or close your account.

Can you keep your bank account if you move to another country : Can you keep your US bank account if you move abroad Some banks may let you to keep your US account when you move to another country, but it could be more convenient and beneficial to open up an international account, like our Expat current accountExpat current account This link will open in a new window.

Can an EU resident have a UK bank account

EU Nationals who live in the UK can still apply for an HSBC UK Savings Account.

HSBC credit cards don't charge foreign transaction fees. However, if you use your HSBC Debit Mastercard® card, you may be charged a fee for any purchases abroad. This includes international payments made online.You can transfer money by moving money from your bank account directly into an overseas bank account. This is called a money transfer, a telegraphic transfer (TT), or a wire or SWIFT transfer. Banks can be a more expensive option.

How long does it take for HSBC international transfer : Our standard transfer time for payments made to non-HSBC accounts through the mobile banking app is 1 to 3 days. For selected currencies and destinations, faster payment times are available. Based on the destination and local currency the fastest transfer time will be chosen, and it will be displayed in the app.