Antwort Can a bank transfer take 3 days? Weitere Antworten – Why do bank transfers take 3 days

This is because the funds are staying within the same financial organization. Bank transfers between banks will take longer, up to three business days for some transactions, because they have to go through intermediary banks that help facilitate the transfer.Bank to bank transfer times can vary across financial institutions depending on the type of transfer you make. If you're making a traditional inter-bank transfer it will take 1-3 business days.Your specific bank transfer time will vary depending on a range of factors, including fraud prevention, different currencies, different time zones, and bank holidays/weekends. In general, the bank transfer time will be around one to five working days.

How long does it take to receive money from the Czech Republic : Once Wise receives and converts your money, it usually takes 1 working day to arrive in your recipient's bank account. Conversion can take up to 2 working days.

How long does an IBAN transfer take

one to five working days

Generally speaking, international bank transfers will arrive within one to five working days. Let's explore what this looks like. To send an international payment, you simply need to gather all the necessary information (IBAN number, BIC/SWIFT number, recipient's banking details, etc.)

What happens if money is transferred but not received : If the bank initiated the transfer, notify the bank immediately so that it can investigate your claim. If you first contact the bank by phone, it is a good practice to follow up in writing. If you wired the funds through a third party (e.g., Western Union), contact that party to find out what their procedures are.

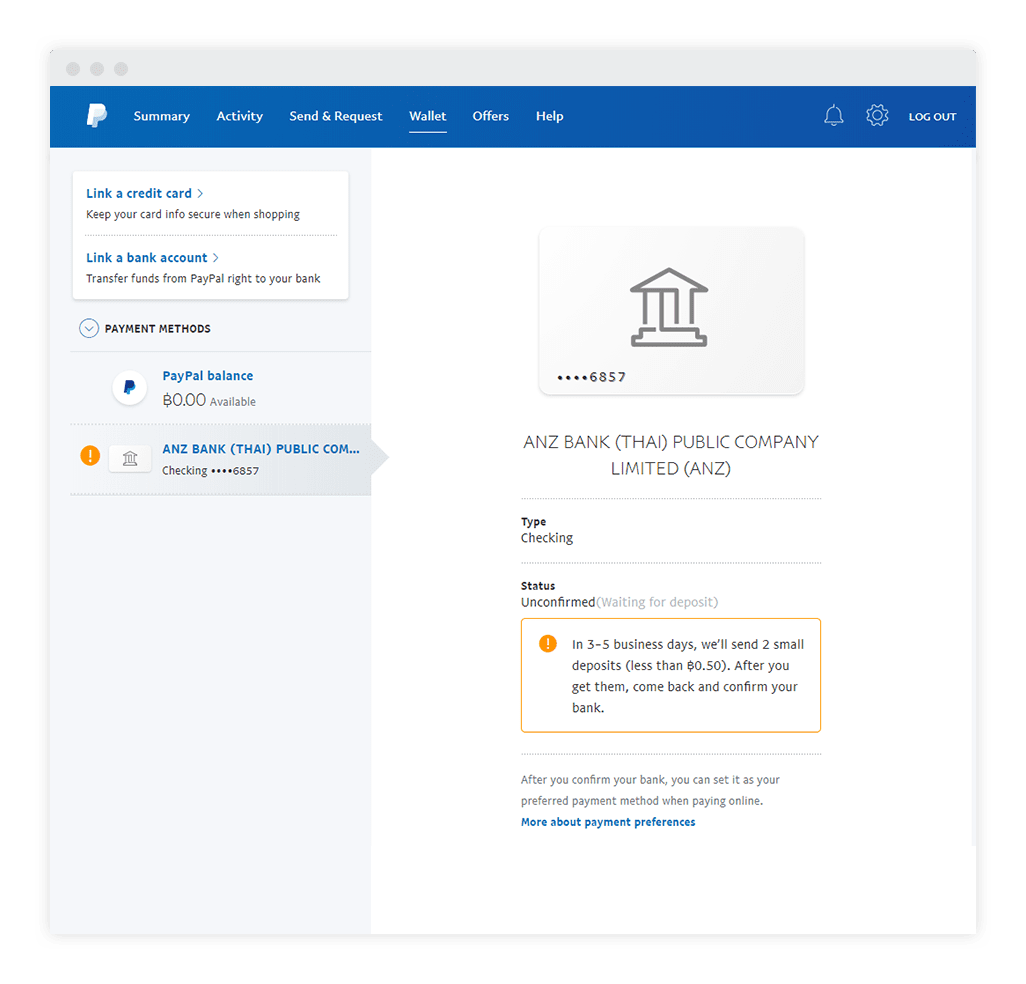

The online banking industry has a “three-day good funds model” policy; where transfers will typically take between two and four days. The banks want to be sure the money is really there and available before it lets the receiver use the money – this is why they don't make the funds available immediately.

:max_bytes(150000):strip_icc()/how-long-does-it-take-check-clear.asp-v2-ae6ff904ef464b8f937280165cf0b4ee.png)

How long do international payments take International bank transfers usually take one or two days but can take as long as five depending on the currency. For example, US dollars and euros are normally quicker than weaker currencies.

Why is my international transfer taking so long

One of the main reasons for delays to international wire transfers are the fraud prevention processes and procedures put in place by banks. The SWIFT network requires transfers to pass through up to three correspondent banks before arriving at their destination.The time it takes for a bank transfer to be successful depends on a number of factors, and some of these factors could cause a delay. These factors include the timing of the transfer, where the transfer is being made, the currencies involved, security checks, bank holidays, and the reasons for the transaction.International bank transfers usually take one or two days but can take as long as five depending on the currency. For example, US dollars and euros are normally quicker than weaker currencies.

Depending on the country of the bank account for which the transfer is intended: National and international transfers in Euros. Since the entry into force of the Single Euro Payment Area (SEPA), for both national and international transfers made in the European currency, the maximum execution time is one working day.

Can international wire transfers take longer than 5 days : And that's why, in part, once you send an international wire transfer, it can take up to 5 business days, or in some cases even longer, for the funds to be available in the recipient's account. Once an international wire transfer is initiated, funds are deducted from the sender's account.

How long does it take to receive an IBAN transfer : one to five working days

Generally speaking, international bank transfers will arrive within one to five working days. Let's explore what this looks like. To send an international payment, you simply need to gather all the necessary information (IBAN number, BIC/SWIFT number, recipient's banking details, etc.)

Can SWIFT take more than 5 days

Once the transfer is initiated, a SWIFT payment can take anywhere between 1 to 5 working days to complete. One of the main reasons for the slow transfer of funds via SWIFT are the fraud prevention and anti money laundering (AML) procedures in place by the banks involved in the transaction.

Time zones: Transferring between banks in different time zones can add delays. Dates and timing: Weekends and public holidays in either the sending or receiving country can cause delays in processing international transfers, as can carrying out the transaction at the end of the business day.Typically, international bank transfers can take up to 2 business days to complete. However, there are times where it can take much longer, up to 10 business days or more due to delays.

How long do IBAN transfers take : one to five working days

Generally speaking, international bank transfers will arrive within one to five working days. Let's explore what this looks like. To send an international payment, you simply need to gather all the necessary information (IBAN number, BIC/SWIFT number, recipient's banking details, etc.)

:max_bytes(150000):strip_icc()/wiretransfer-FINAL-8fb2c62ec7e7410792ebb33a8c82ddb9.jpg)