Antwort Can a bank close your account without giving you your money? Weitere Antworten – Can a bank close your account with no money in it

Even if your bank doesn't insist on a minimum balance, they could shut down your account if you don't pay off your negative balance and fees. Suspicion of fraudulent activity: If your bank suspects fraudulent transactions on your account, they may close it to prevent further illegal activity.If the bank closed your account and there is money still in it, you're due a refund. The bank will typically send you a check, but if it suspects criminal activity on your part, it may be allowed to freeze your assets.A bank can shut a person's account at any time, with limited notice, for a long list of reasons and are generally not legally required to say why. This can cause confusion and financial problems for many people, especially when they believe they haven't done anything wrong.

Will my account close if I have no money : Generally, the bank will not close a checking account that is in an overdraft status. Such an account will be kept open until it is brought current. Then, the account can be closed. Review your deposit account agreement […]

Why would a bank suddenly close an account

For example, the bank might freeze your account if they believe that someone is attempting to use your information to make unauthorized purchases or withdrawals. Banks can also close accounts if they believe the account owner is engaging in fraud or criminal activity, such as money laundering.

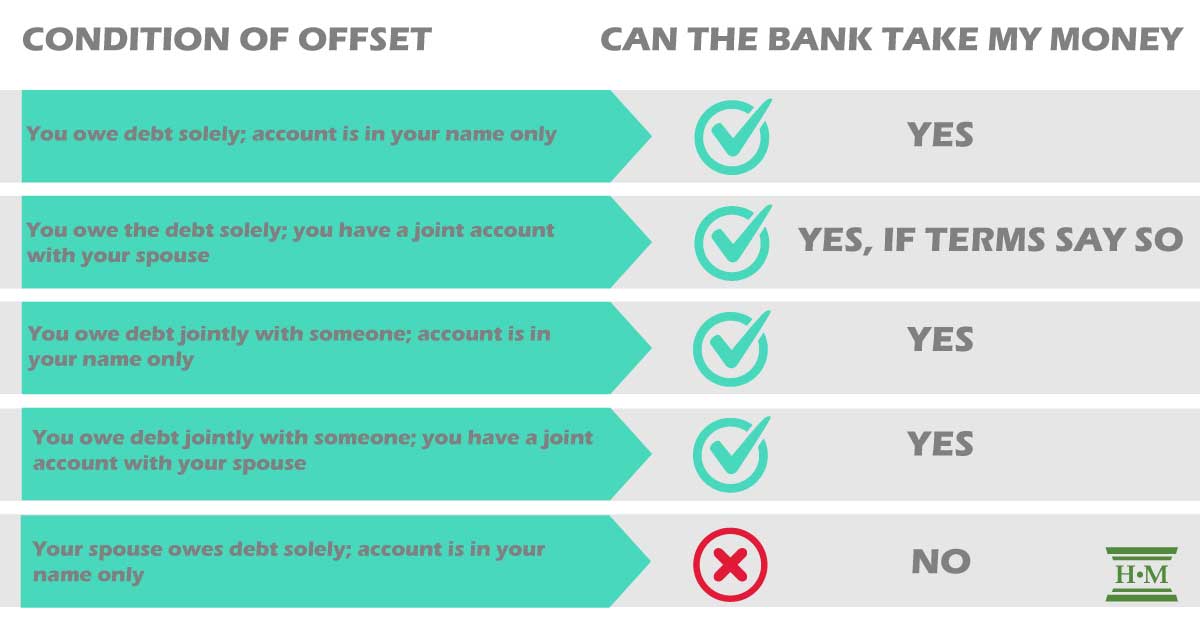

Can a bank take your money : Generally, a bank may take money from your deposit account to make a payment on a separate debt that you owe to the bank, such as a car loan, if you are not paying that loan on time and the terms of your contract(s) with the bank allow it. This is called the right of offset.

Generally, a bank may take money from your deposit account to make a payment on a separate debt that you owe to the bank, such as a car loan, if you are not paying that loan on time and the terms of your contract(s) with the bank allow it. This is called the right of offset.

Can the bank freeze the account Yes. The bank may temporarily freeze your account to ensure that no funds are withdrawn before the error is corrected, as long as the amount of funds frozen does not exceed the amount of the deposit. Or the bank may simply place a hold on the deposit amount.

What are some reasons a bank might close your account without telling you

There are many reasons banks can close your account without notice. The most common reasons include suspicious account activity, too many overdraft fees and account policy violations.Nothing will happen if you don't make any transactions in a bank account for a few weeks. And usually, nothing will come of it if you ignore your bank account for a few months. But if you don't touch your bank account for years, there's a good chance it will be closed — whether you want that to happen or not.Opening a bank account with no opening deposit, and with no need to maintain a balance, is possible. Think carefully about which bank is the best for you to open an account with. Weigh your options based on your financial goals, what you'll use your account for, and if there are any bank fees.

Yes. Generally, banks may close accounts, for any reason and without notice. Some reasons could include inactivity or low usage. Review your deposit account agreement for policies specific to your bank and your account.

Can bank refuse to give me my money : Yes. Your bank may hold the funds according to its funds availability policy. Or it may have placed an exception hold on the deposit.

Can a bank close your account without your permission : Yes. Generally, banks may close accounts, for any reason and without notice. Some reasons could include inactivity or low usage. Review your deposit account agreement for policies specific to your bank and your account.

Can my bank refuse to give me my money

Yes. Your bank may hold the funds according to its funds availability policy.

A "reasonable" period of time can range from two business days to up to six business days. A hold can also be placed if a bank has reasonable cause to doubt the collectability of the check.A bank account freeze means you can't take or transfer money out of the account. Bank accounts are typically frozen for suspected illegal activity, a creditor seeking payment, or by government request. A frozen account may also be a sign that you've been a victim of identity theft.

What’s the longest a bank can freeze your account : The duration of a bank account freeze depends on the circumstances. Simple misunderstandings may be resolved in 7-10 days, while more complex scenarios could take 30 days or longer. In cases where the freeze is due to tax obligations or legal disputes, there's no set time limit.