Antwort Are BIC and SWIFT the same? Weitere Antworten – Can I use SWIFT code instead of BIC

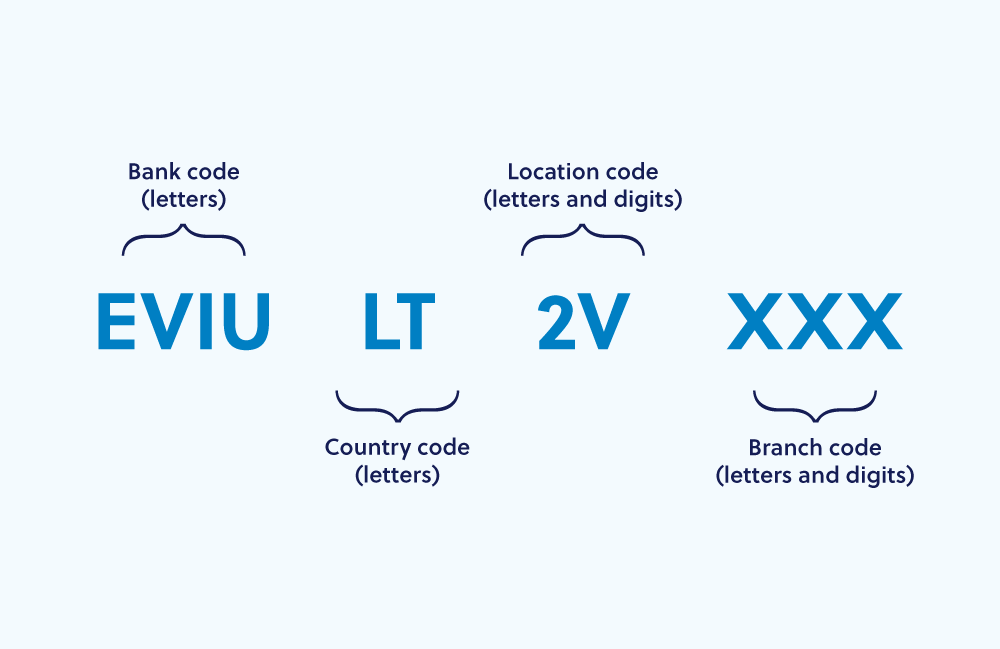

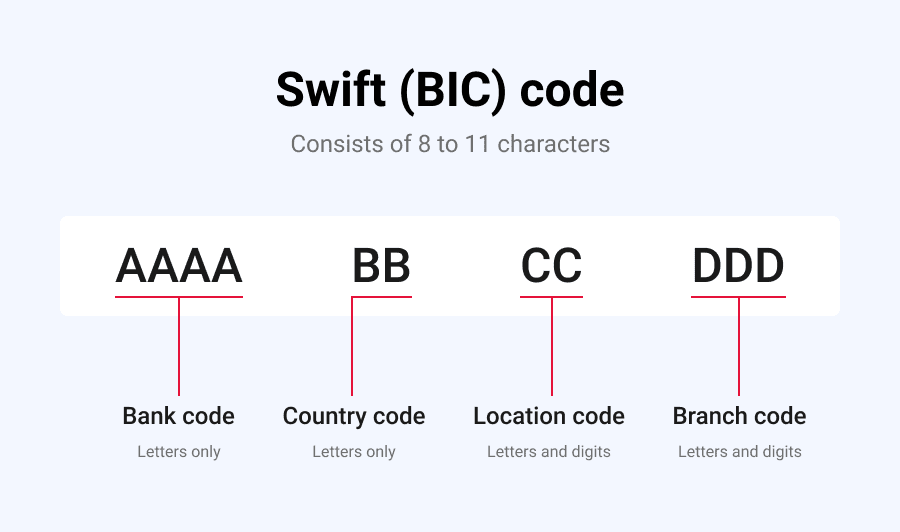

The term Business Identifier Code (BIC) is used interchangeably with SWIFT code and means the same thing. These codes facilitate money transfers between banks and are needed for international wires and SEPA payments. To make an international money transfer from the United States, you'll need a SWIFT/BIC code.In short, SWIFT is the name of the overall messaging system, and BIC is the code used for the system—or the 'Bank Identifier Code'. Both terms are used interchangeably to describe the code, or even the system. This means that if you request your SWIFT or BIC code, you'll receive the exact same 8-11 digit number.Identification. The main difference between an IBAN and SWIFT BIC code lies in what they're used to identify. A SWIFT code refers to a bank, while an IBAN will identify a specific bank account. Basically, a SWIFT number tells you where to pay, and an IBAN tells you who to pay.

How do I find my swift BIC code : How can I find my BIC or SWIFT code

- the account you need the BIC/SWIFT for.

- statements.

- select the statement you need.

- this will download the PDF document displaying the full statement.

- your Branch Identifier Code (BIC) is shown on your statement just below your account summary.

Can I get BIC from IBAN

Additionally, you can also retrieve BIC from an IBAN with our IBAN Validation tool. Integrate our automated BIC Validation Service into your own service or software.

Can I get a SWIFT code from an IBAN : How do I find my SWIFT code You will typically be able to find your SWIFT code on bank statements and on your online or app banking. Most often it will be in the same place as your IBAN number.

IBAN numbers can only be used to send or receive money between accounts, not for withdrawing money or transferring account ownership.

IBAN is your International Bank Account Number. BIC is the Bank Identifier Code (also known as a SWIFT code). You need these to receive payments from some countries. They're used instead of your account number and sort code.

Can I use IBAN instead of SWIFT

Bank Requirements

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.You will typically be able to find your SWIFT code on bank statements and on your online or app banking. Most often it will be in the same place as your IBAN number.Whilst most banks have a BIC / SWIFT code assigned to them, there are some financial institutions that do not use them. A number of smaller banks and credit unions in the United States do not connect to the SWIFT network, which means that they do not use international routing codes.

You will typically be able to find your SWIFT code on bank statements and on your online or app banking. Most often it will be in the same place as your IBAN number.

Is IBAN and SWIFT code enough : Use in international practice

This requirement applies to all payments and applies to individuals and legal entities. That is, when transferring between banks, it is necessary to indicate IBAN and BIC (SWIFT). And an account number in IBAN format is sufficient for individuals.

How do I find my SWIFT code : The SWIFT code can be found on a bank's website, on your bank statement, or through an online search. Make sure you copy down the correct characters when recording a SWIFT code, and check that it has 8 or 11 characters. The first 4 characters stand for the bank to which money is being transferred.

Do you need both SWIFT and IBAN for international transfer

Do I need IBAN if I have SWIFT You might be asked to provide both an IBAN and SWIFT to help a bank identify exactly where the money needs to be sent to. Not all countries support the IBAN system, so if you're sending money to a country that doesn't you'll just need the SWIFT code for the overseas transfer.

IBANs are more secure than SWIFT codes because they are unique identifiers for bank accounts in specific countries. SWIFT codes only identify the bank that will receive a payment, but they do not identify the specific bank account. This means that there is a greater risk of errors and fraud when using SWIFT codes.Not all banks and financial institutions use SWIFT codes. If yours doesn't, ask what number should be used in its place for sending or receiving international money transfers.

Why doesn’t my bank have a SWIFT code : Do all banks have a BIC/SWIFT code for international transactions No — some U.S. credit unions and small banks are not part of the SWIFT system. But if you work with a small bank for your business, this isn't a be-all-end-all: They might still be able to receive and send money internationally.