Antwort Are bank lockers insured? Weitere Antworten – How safe are bank lockers

The banks offer enhanced security measures, like 24×7 surveillance cameras, restricted areas, alarms and more to reduce the risk of damage and theft. Nevertheless, you can use bank lockers for legitimate purposes only. You must follow certain rules set by the Reserve Bank of India (RBI) about bank lockers.Did you know that the contents of your safe deposit box are not insured by any bank or the Federal Deposit Insurance Corporation (FDIC) While a safe deposit box is the best solution for storing your most valuable items, they're not immune to disasters like hurricanes, tornadoes, flood events—and even theft.A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes.

)

Is bank safe insured : The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC bank, per ownership category. So each depositor is insured to at least $250,000 per FDIC-insured bank.

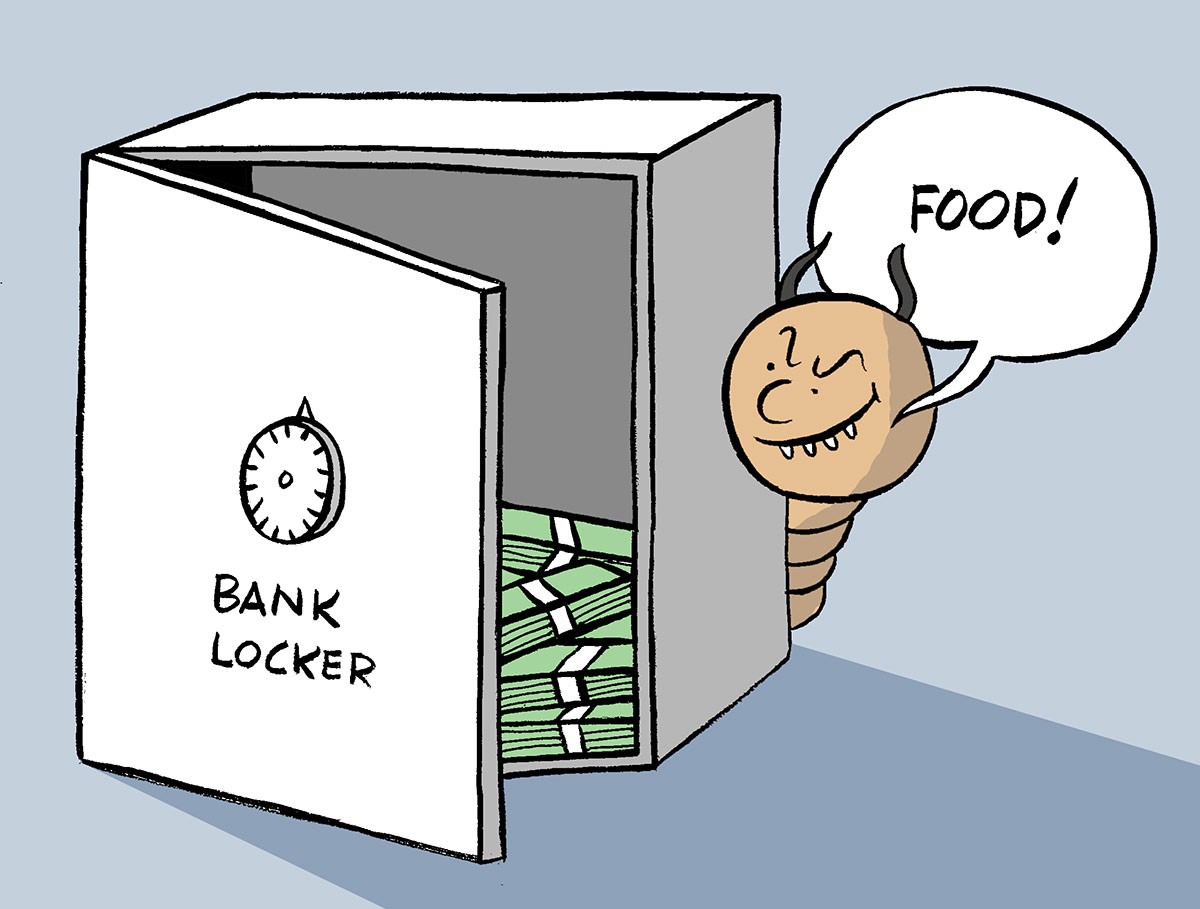

What happens if a bank locker is robbed

Incase of incidents such as fire, theft/ burglary/ robbery, dacoity, building collapse the banks' are liable to pay for an amount equivalent to one hundred times the prevailing annual rent of the safe deposit locker.

What is the disadvantage of a bank locker : Disadvantages. Banks can open your locker without your permission. The bank is NOT liable for the loss of valuables in your locker. You can claim for a loss in extreme eventuality but not 100% compensation.

Incase of incidents such as fire, theft/ burglary/ robbery, dacoity, building collapse the banks' are liable to pay for an amount equivalent to one hundred times the prevailing annual rent of the safe deposit locker.

The locker area in a bank is highly secure, and no one can enter it without prior permission. Therefore, keeping gold in bank lockers is a highly safe choice. But you won't earn any interest on gold kept in bank lockers. Instead, customers have to bear charges for keeping gold in bank lockers.

What are the disadvantages of a safe deposit box

Pros and Cons

- Unlike bank accounts, the contents are not insured.

- Safes can only be accessed during the bank's business hours.

- Contents can still be lost due to fire, flood, or other disasters.

An account that contains more than $250,000 at one bank, or multiple accounts with the same owner or owners, is insured only up to $250,000. The protection does not come from taxes or congressional funding. Instead, banks pay into the insurance system, and the insurance provides their customers with protection.Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

Do banks reimburse stolen money Banks often reimburse stolen money, but there are some exceptions. Transactions not made by you or anyone authorized to use your account are fraudulent, and federal law protects your money.

Is your gold safe in a bank locker : The locker area in a bank is highly secure, and no one can enter it without prior permission. Therefore, keeping gold in bank lockers is a highly safe choice. But you won't earn any interest on gold kept in bank lockers. Instead, customers have to bear charges for keeping gold in bank lockers.

How to insure jewellery in bank locker : Needs a self-declaration up to a specified limit. The claim process is smooth and hassle-free requiring basic documents. The policy can be sold both as a retail and a group policy for banks. A standalone policy for complete coverage of valuables in your bank locker.

Why are safe deposit boxes not as popular as they used to be

If bank boxes are much more expensive than, say, a home safe or a home security system, customers will opt for the latter. Safe deposit also came with a handful of legal headaches. Banking industry executives fretted over hypothetical scenarios about when they would let a customer in to see their valuables.

Here are four ways you may be able to insure more than $250,000 in deposits:

- Open accounts at more than one institution. This strategy works as long as the two institutions are distinct.

- Open accounts in different ownership categories.

- Use a network.

- Open a brokerage deposit account.

Millionaires can insure their money by depositing funds in FDIC-insured accounts, NCUA-insured accounts, through IntraFi Network Deposits, or through cash management accounts. They may also allocate some of their cash to low-risk investments, such as Treasury securities or government bonds.

Can I deposit 1 million cash in a bank : Generally, there is no limit on deposits. However, there are limitations on the amount of funds the Federal Deposit Insurance Corporation (FDIC) will insure. Please refer to the Understanding Deposit Insurance section of the FDIC's website for more information on FDIC deposit insurance.